Lower-of-Cost-or-Market For the weighted-average method, round calculations to two decimal places. If required, round your final answers to the nearest cent. 1. Calculate the total amount to be assigned to the ending inventory under each of the following periodic inventory methods: a. FIFO b. Weighted-average 2. Assume that the market price per unit (cost to replace) of Stalberg's inventory on December 31, 20--, was $26. Calculate the total amount to be assigned to the ending inventory on December 31 under each of the following methods: a. FIFO lower- of-cost- or- market b. Weighted-average lower-of-cost-or-market 3. What journal entry would be made under lower-of-cost-or-market for parts 2(a) FIFO and 2(b) Weighted-average? If no entry is required, type "No entry required" in the account name box and leave the amount boxes blank or enter "0". Stalberg Company's beginning inventory and purchases during the fiscal year ended December 31, 20--, were as follows: Units Unit Price Total Cost $20 $200 Jan. 1 Beginning inventory 10 Mar. 5 1st purchase 10 22 220 Sept. 9 2nd purchase 10 25 250 3rd purchase Dec. 8 10 30 300 40 $970 There are 10 units of inventory on hand on December 31.

Lower-of-Cost-or-Market For the weighted-average method, round calculations to two decimal places. If required, round your final answers to the nearest cent. 1. Calculate the total amount to be assigned to the ending inventory under each of the following periodic inventory methods: a. FIFO b. Weighted-average 2. Assume that the market price per unit (cost to replace) of Stalberg's inventory on December 31, 20--, was $26. Calculate the total amount to be assigned to the ending inventory on December 31 under each of the following methods: a. FIFO lower- of-cost- or- market b. Weighted-average lower-of-cost-or-market 3. What journal entry would be made under lower-of-cost-or-market for parts 2(a) FIFO and 2(b) Weighted-average? If no entry is required, type "No entry required" in the account name box and leave the amount boxes blank or enter "0". Stalberg Company's beginning inventory and purchases during the fiscal year ended December 31, 20--, were as follows: Units Unit Price Total Cost $20 $200 Jan. 1 Beginning inventory 10 Mar. 5 1st purchase 10 22 220 Sept. 9 2nd purchase 10 25 250 3rd purchase Dec. 8 10 30 300 40 $970 There are 10 units of inventory on hand on December 31.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter13: Accounting For Merchandise Inventory

Section: Chapter Questions

Problem 1MP: Hurst Companys beginning inventory and purchases during the fiscal year ended December 31, 20-2,...

Related questions

Question

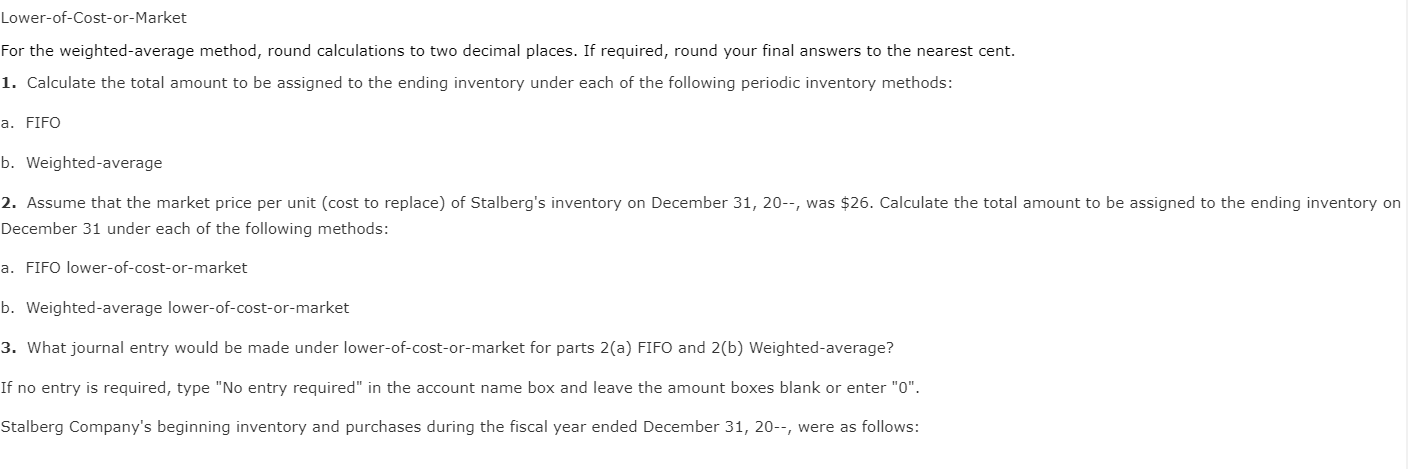

Transcribed Image Text:Lower-of-Cost-or-Market

For the weighted-average method, round calculations to two decimal places. If required, round your final answers to the nearest cent.

1. Calculate the total amount to be assigned to the ending inventory under each of the following periodic inventory methods:

a. FIFO

b. Weighted-average

2. Assume that the market price per unit (cost to replace) of Stalberg's inventory on December 31, 20--, was $26. Calculate the total amount to be assigned to the ending inventory on

December 31 under each of the following methods:

a. FIFO lower- of-cost- or- market

b. Weighted-average lower-of-cost-or-market

3. What journal entry would be made under lower-of-cost-or-market for parts 2(a) FIFO and 2(b) Weighted-average?

If no entry is required, type "No entry required" in the account name box and leave the amount boxes blank or enter "0".

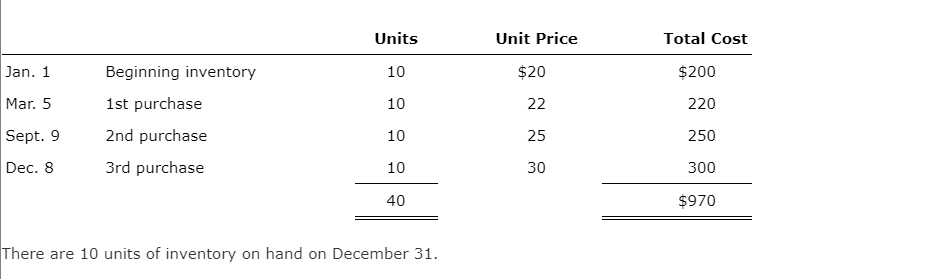

Stalberg Company's beginning inventory and purchases during the fiscal year ended December 31, 20--, were as follows:

Transcribed Image Text:Units

Unit Price

Total Cost

$20

$200

Jan. 1

Beginning inventory

10

Mar. 5

1st purchase

10

22

220

Sept. 9

2nd purchase

10

25

250

3rd purchase

Dec. 8

10

30

300

40

$970

There are 10 units of inventory on hand on December 31.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 5 images

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,