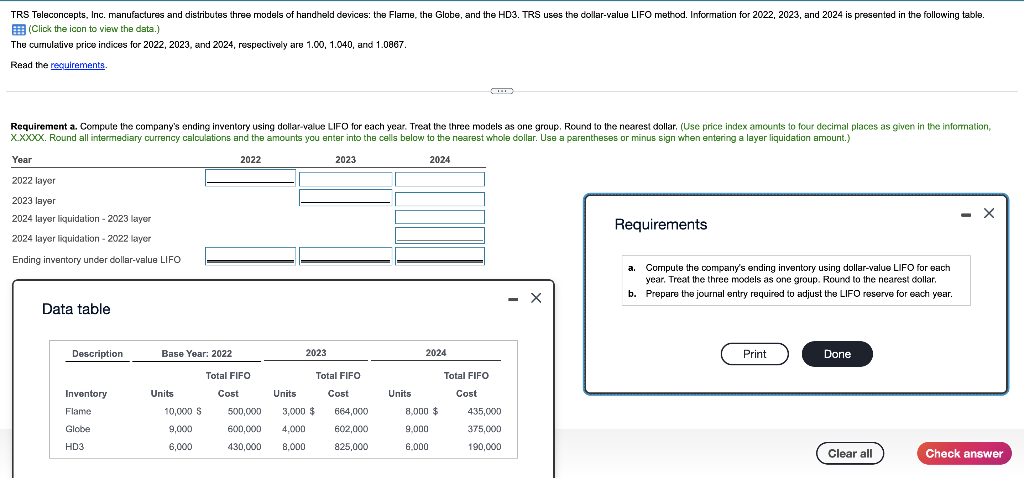

TRS Teleconcepts, Inc. manufactures and distributes three models of handheld devices: the Flame, the Globe, and the HD3. TRS uses the dollar-value LIFO method. Information for 2022, 2023, and 2024 is presented in the following table. (Click the icon to view the data.) The cumulative price indices for 2022, 2023, and 2024, respectively are 1.00, 1.040, and 1.0867. Read the requirements. Requirement a. Compute the company's ending inventory using dollar-value LIFO for each year. Treat the three models as one group. Round to the nearest dollar. (Use price index amounts to four decimal places as given in the information, X.XXXX. Round all intermediary currency calculations and the amounts you enter into the cells below to the nearest whole dollar. Use a parentheses or minus sign when entering a layer liquidation amount.) Year 2022 2023 2024 2022 layer 2023 layer X 2024 layer liquidation - 2023 layer Requirements 2024 layer liquidation - 2022 layer Ending inventory under dollar-value LIFO a. Compute the company's ending inventory using dollar-value LIFO for each year. Treat the three models as one group. Round to the nearest dollar. X b. Prepare the journal entry required to adjust the LIFO reserve for each year. Data table Print Done Description Inventory Flame Globe HD3 Base Year: 2022 Units 10,000 S 9,000 6,000 Total FIFO 2023 Units Total FIFO Cost Cost 500,000 3,000 $ 600,000 4,000 430,000 8,000 664,000 602,000 825,000 Units 2024 8,000 $ 9,000 6,000 Total FIFO Cost 435,000 375,000 190,000 Clear all Check answer

TRS Teleconcepts, Inc. manufactures and distributes three models of handheld devices: the Flame, the Globe, and the HD3. TRS uses the dollar-value LIFO method. Information for 2022, 2023, and 2024 is presented in the following table. (Click the icon to view the data.) The cumulative price indices for 2022, 2023, and 2024, respectively are 1.00, 1.040, and 1.0867. Read the requirements. Requirement a. Compute the company's ending inventory using dollar-value LIFO for each year. Treat the three models as one group. Round to the nearest dollar. (Use price index amounts to four decimal places as given in the information, X.XXXX. Round all intermediary currency calculations and the amounts you enter into the cells below to the nearest whole dollar. Use a parentheses or minus sign when entering a layer liquidation amount.) Year 2022 2023 2024 2022 layer 2023 layer X 2024 layer liquidation - 2023 layer Requirements 2024 layer liquidation - 2022 layer Ending inventory under dollar-value LIFO a. Compute the company's ending inventory using dollar-value LIFO for each year. Treat the three models as one group. Round to the nearest dollar. X b. Prepare the journal entry required to adjust the LIFO reserve for each year. Data table Print Done Description Inventory Flame Globe HD3 Base Year: 2022 Units 10,000 S 9,000 6,000 Total FIFO 2023 Units Total FIFO Cost Cost 500,000 3,000 $ 600,000 4,000 430,000 8,000 664,000 602,000 825,000 Units 2024 8,000 $ 9,000 6,000 Total FIFO Cost 435,000 375,000 190,000 Clear all Check answer

Chapter2: Building Blocks Of Managerial Accounting

Section: Chapter Questions

Problem 9EA: The cost data for Evencoat Paint for the year 2019 is as follows: Using the high-low method, express...

Related questions

Question

Transcribed Image Text:TRS Teleconcepts, Inc. manufactures and distributes three models of handheld devices: the Flame, the Globe, and the HD3. TRS uses the dollar-value LIFO method. Information for 2022, 2023, and 2024 is presented in the following table.

E (Click the icon to view the data.)

The cumulative price indices for 2022, 2023, and 2024, respectively are 1.00, 1.040, and 1.0867.

Read the requirements.

Requirement a. Compute the company's ending inventory using dollar-value LIFO for each year. Treat the three models as one group. Round to the nearest dollar. (Use price index amounts to four decimal places as given in the information,

XXXXX. Round all intermediary currency calculations and the amounts you enter into the cells below to the nearest whole dollar. Use a parentheses or minus sign when entering a layer liquidation amount.)

Year

2022

2023

2024

2022 layer

2023 layer

- X

2024 layer liquidation - 2023 layer

Requirements

2024 layer liquidation - 2022 layer

Ending inventory under dollar-value LIFO

a. Compute the company's ending inventory using dollar-value LIFO for each

year. Treat the three models as one group. Round to the nearest dollar.

b. Prepare the journal entry required to adjust the LIFO reserve for each year.

Data table

Base Year: 2022

Description

2023

2024

Print

Done

Total FIFO

Total FIFO

Total FIFO

Inventory

Units

Cost

Units

Cost

Units

Cost

Flame

10,000 S

500,000

3,000 $

664,000

8,000 $

435,000

Globe

9,000

600,000

4,000

602,000

9,000

375,000

HD3

6,000

430,000

8,000

825,000

6,000

190,000

Clear all

Check answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College