m price ag divis Requirements 1. What is the minimum price at which the airbag division woul 2. Suppose that Watson Motors requires that whenever divisio internally, they must do so at the incremental cost. Evaluate criteria of goal congruence, evaluating division performance preserving division autonomy. 3. If the two divisions were to negotiate a transfer price, what Evaluate this negotiated transfer-pricing policy using the crit

m price ag divis Requirements 1. What is the minimum price at which the airbag division woul 2. Suppose that Watson Motors requires that whenever divisio internally, they must do so at the incremental cost. Evaluate criteria of goal congruence, evaluating division performance preserving division autonomy. 3. If the two divisions were to negotiate a transfer price, what Evaluate this negotiated transfer-pricing policy using the crit

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter10: Decentralization: Responsibility Accounting, Performance Evaluation, And Transfer Pricing

Section: Chapter Questions

Problem 4CE

Related questions

Question

1

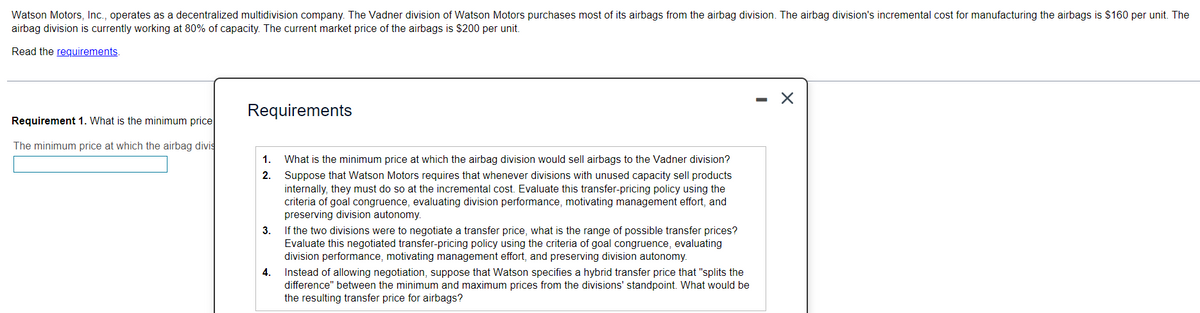

Transcribed Image Text:Watson Motors, Inc., operates as a decentralized multidivision company. The Vadner division of Watson Motors purchases most of its airbags from the airbag division. The airbag division's incremental cost for manufacturing the airbags is $160 per unit. The

airbag division is currently working at 80% of capacity. The current market price of the airbags is $200 per unit.

Read the requirements.

X

Requirements

Requirement 1. What is the minimum price

The minimum price at which the airbag divis

1.

2.

What is the minimum price at which the airbag division would sell airbags to the Vadner division?

Suppose that Watson Motors requires that whenever divisions with unused capacity sell products

internally, they must do so at the incremental cost. Evaluate this transfer-pricing policy using the

criteria of goal congruence, evaluating division performance, motivating management effort, and

preserving division autonomy.

3.

If the two divisions were to negotiate a transfer price, what is the range of possible transfer prices?

Evaluate this negotiated transfer-pricing policy using the criteria of goal congruence, evaluating

division performance, motivating management effort, and preserving division autonomy.

4.

Instead of allowing negotiation, suppose that Watson specifies a hybrid transfer price that "splits the

difference" between the minimum and maximum prices from the divisions' standpoint. What would be

the resulting transfer price for airbags?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning