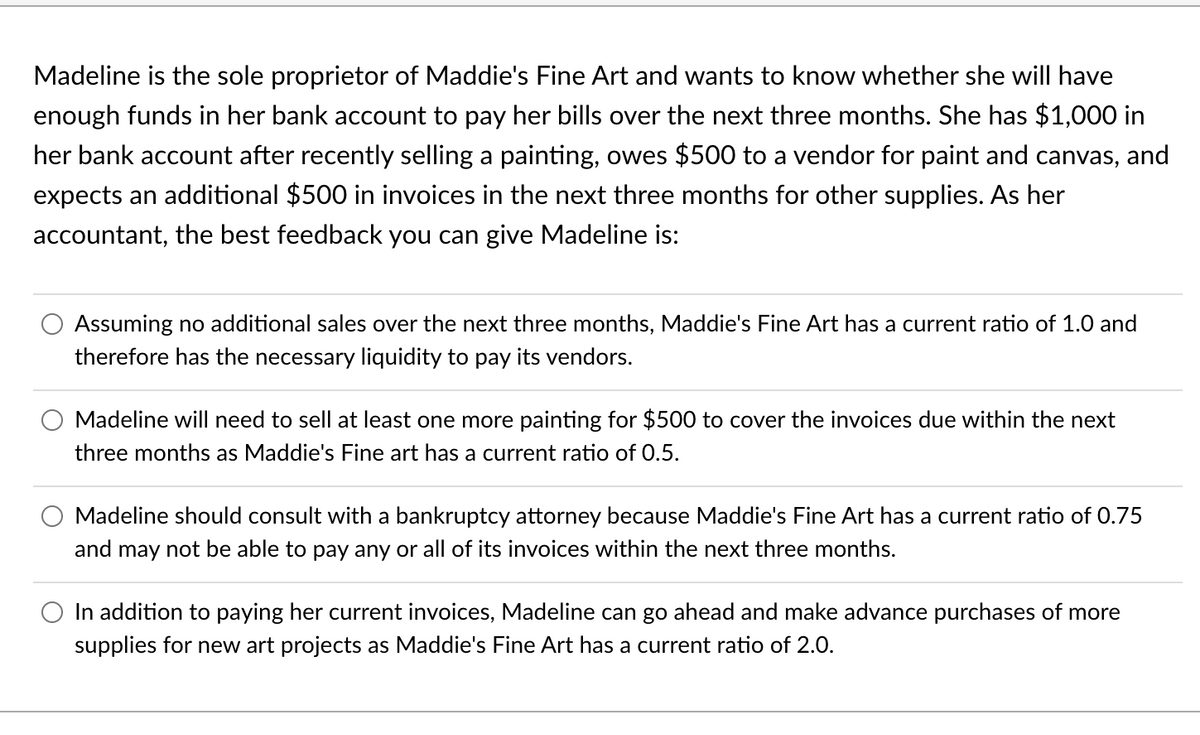

Madeline is the sole proprietor of Maddie's Fine Art and wants to know whether she will have enough funds in her bank account to pay her bills over the next three months. She has $1,000 in her bank account after recently selling a painting, owes $500 to a vendor for paint and canvas, and expects an additional $500 in invoices in the next three months for other supplies. As her accountant, the best feedback you can give Madeline is: Assuming no additional sales over the next three months, Maddie's Fine Art has a current ratio of 1.0 and therefore has the necessary liquidity to pay its vendors. Madeline will need to sell at least one more painting for $500 to cover the invoices due within the next three months as Maddie's Fine art has a current ratio of 0.5. Madeline should consult with a bankruptcy attorney because Maddie's Fine Art has a current ratio of 0.75 and may not be able to pay any or all of its invoices within the next three months. In addition to paying her current invoices, Madeline can go ahead and make advance purchases of more supplies for new art projects as Maddie's Fine Art has a current ratio of 2.0.

Madeline is the sole proprietor of Maddie's Fine Art and wants to know whether she will have enough funds in her bank account to pay her bills over the next three months. She has $1,000 in her bank account after recently selling a painting, owes $500 to a vendor for paint and canvas, and expects an additional $500 in invoices in the next three months for other supplies. As her accountant, the best feedback you can give Madeline is: Assuming no additional sales over the next three months, Maddie's Fine Art has a current ratio of 1.0 and therefore has the necessary liquidity to pay its vendors. Madeline will need to sell at least one more painting for $500 to cover the invoices due within the next three months as Maddie's Fine art has a current ratio of 0.5. Madeline should consult with a bankruptcy attorney because Maddie's Fine Art has a current ratio of 0.75 and may not be able to pay any or all of its invoices within the next three months. In addition to paying her current invoices, Madeline can go ahead and make advance purchases of more supplies for new art projects as Maddie's Fine Art has a current ratio of 2.0.

Chapter6: Business Expenses

Section: Chapter Questions

Problem 68P

Related questions

Question

Transcribed Image Text:Madeline is the sole proprietor of Maddie's Fine Art and wants to know whether she will have

enough funds in her bank account to pay her bills over the next three months. She has $1,000 in

her bank account after recently selling a painting, owes $500 to a vendor for paint and canvas, and

expects an additional $500 in invoices in the next three months for other supplies. As her

accountant, the best feedback you can give Madeline is:

Assuming no additional sales over the next three months, Maddie's Fine Art has a current ratio of 1.0 and

therefore has the necessary liquidity to pay its vendors.

Madeline will need to sell at least one more painting for $500 to cover the invoices due within the next

three months as Maddie's Fine art has a current ratio of 0.5.

Madeline should consult with a bankruptcy attorney because Maddie's Fine Art has a current ratio of 0.75

and may not be able to pay any or all of its invoices within the next three months.

O In addition to paying her current invoices, Madeline can go ahead and make advance purchases of more

supplies for new art projects as Maddie's Fine Art has a current ratio of 2.0.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT