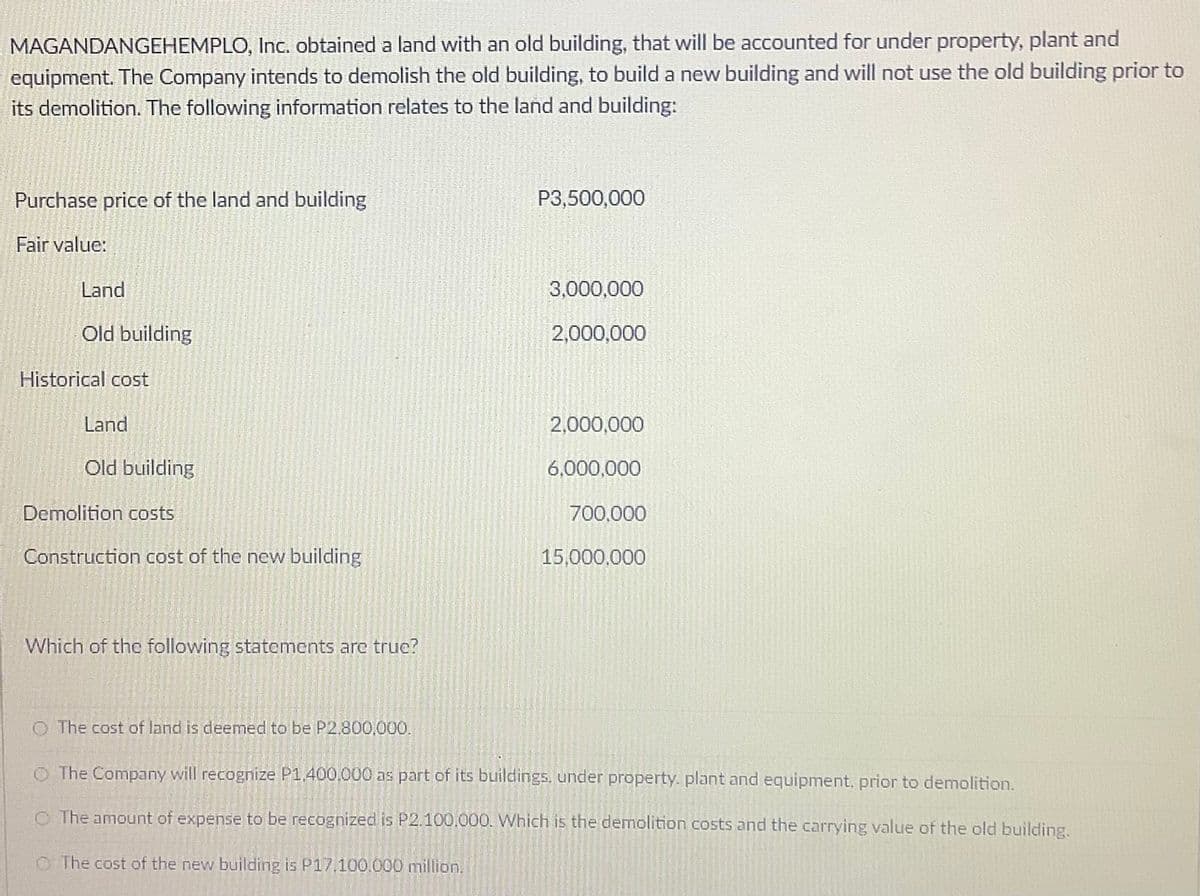

MAGANDANGEHEMPLO, Inc. obtained a land with an old building, that will be accounted for under property, plant and equipment. The Company intends to demolish the old building, to build a new building and will not use the old building prior to its demolition. The following information relates to the land and building: Purchase price of the land and building P3,500,000 Fair value: Land 3,000,000 Old building 2,000,000 Historical cost Land 2,000,000 Old building 6,000,000 Demolition costs 700,000 Construction cost of the new building 15,000,000 Which of the following statements are true? O The cost of land is deemed to be P2.800,000. O The Company will recognize P1,400.000 as part of its buildings, under property. plant and equipment, prior to demolition. O The amount of expense to be recognized is P2.100.000. Which is the demolition costs and the carrying value of the old building. O The cost of the new building is P17,100.000 million.

MAGANDANGEHEMPLO, Inc. obtained a land with an old building, that will be accounted for under property, plant and equipment. The Company intends to demolish the old building, to build a new building and will not use the old building prior to its demolition. The following information relates to the land and building: Purchase price of the land and building P3,500,000 Fair value: Land 3,000,000 Old building 2,000,000 Historical cost Land 2,000,000 Old building 6,000,000 Demolition costs 700,000 Construction cost of the new building 15,000,000 Which of the following statements are true? O The cost of land is deemed to be P2.800,000. O The Company will recognize P1,400.000 as part of its buildings, under property. plant and equipment, prior to demolition. O The amount of expense to be recognized is P2.100.000. Which is the demolition costs and the carrying value of the old building. O The cost of the new building is P17,100.000 million.

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 3PA: During the current year, Alanna Co. had the following transactions pertaining to its new office...

Related questions

Question

100%

Transcribed Image Text:MAGANDANGEHEMPLO, Inc. obtained a land with an old building, that will be accounted for under property, plant and

equipment. The Company intends to demolish the old building, to build a new building and will not use the old building prior to

its demolition. The following information relates to the land and building:

Purchase price of the land and building

P3,500,000

Fair value:

Land

3,000,000

Old building

2,000,000

Historical cost

Land

2,000,000

Old building

6,000,000

Demolition costs

700,000

Construction cost of the new building

15,000,000

Which of the following statements are true?

O The cost of land is deemed to be P2.800,000.

O The Company will recognize P1.400.000 as part of its buildings. under property. plant and equipment, prior to demolition.

O The amount of expense to be recognized is P2.100.000. Which is the demolition costs and the carrying value of the old building.

O The cost of the new building is P17,100.000 million.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College