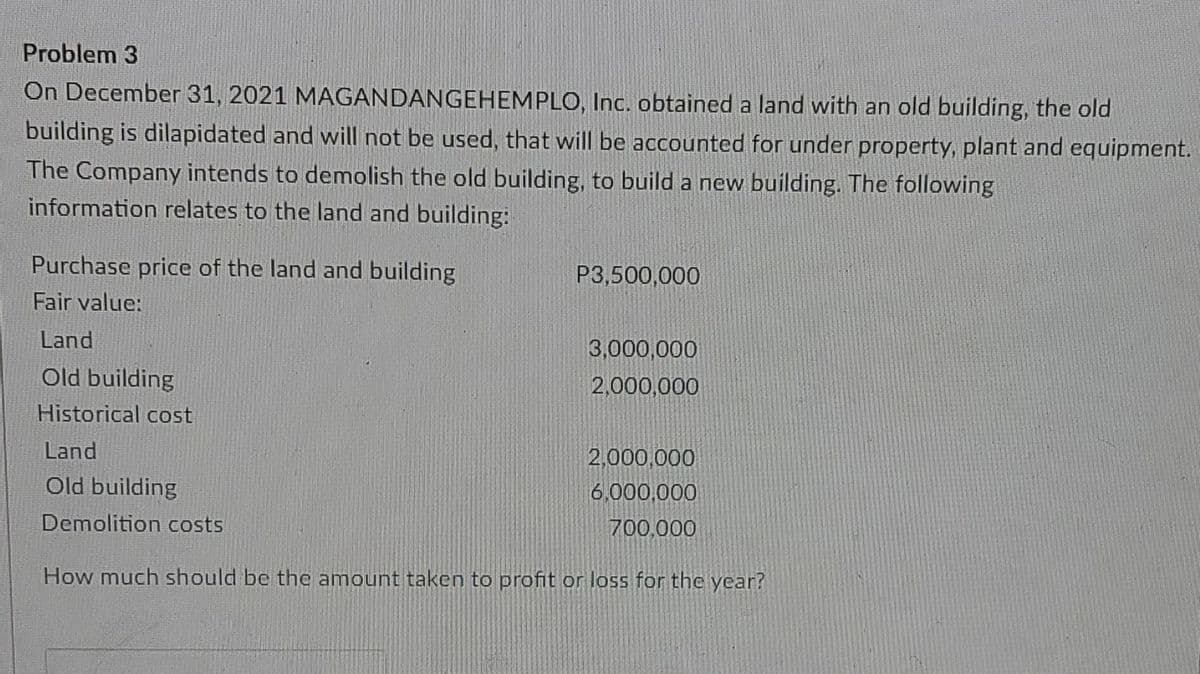

building is dilapidated and will not be used, that will be accounted for under property, plant and equipmer The Company intends to demolish the old building, to build a new building. The following information relates to the land and building: Purchase price of the land and building P3,500,000 Fair value: Land 3,000,000 Old building 2,000,000 Historical cost Land 2,000,000 Old building 6,000,000 Demolition costs 700,000 How much should be the amount taken to profit or loss for the year?

Q: A company made the following expenditures in connection with the construction of a new building:…

A:

Q: Merchant Company purchased property for a building site. The costs associated with the property…

A: Total cost of land = Purchase price + Real estate commission + Legal fees + Expenses of clearing the…

Q: On April 1, 2020 ABC Co. purchased a tract of land as a factory site for P195,500. An existing…

A: Building:- A buildings are considered as the fixed assets account that includes the carrying value…

Q: Torikatsu Company purchased a machine for P 100,000; current accumulated depreciation totals P…

A: Sunk Costs are costs that are have already been incurred (i.e., Historical Cost). These costs does…

Q: On February 1, 20X1, ABC Corporation purchased a parcel of land as a factory site (unusable) for…

A: Property, Plant, and Equipment or PP&E is a classification shown on a balance sheet. It normally…

Q: MABUTINGEHEMPLO, Inc. obtained a land with an old building, that will be accounted for under…

A: Solution: As old building is unusable and same is to be demolished, therefore demolition costs would…

Q: MABUTINGEHEMPLO, Inc. obtained a land with an old building, that will be accounted for under…

A: The following statement is True... The amount of expense to be recognized is P700,000. Which is…

Q: Holly, Incorporated has a building that originally cost $425,000. Holly expects to be able to sell…

A: The residual value is the resale value of the asset after its useful life of assets. It is also…

Q: On April 1, 2020 ABC Co. purchased a tract of land as a factory site for P195,500. An existing…

A: The cost incurred on buying or constructing a building is a capital expenditure. The cost not only…

Q: Roberto Company purchased a P4,000,000 tract of land as an investment property. The entity razed an…

A: Purchase of land: Purchase of land means acquiring the land or any part of land for carrying out the…

Q: 19. MAGANDANGEHEMPLO, Inc. obtained a land with an old building, that will be accounted for under…

A: An old land and building is purchased for construction new building than use it for business purpose…

Q: The Company intends to demolish the old building, to build a new building and will not use the old…

A: In the given case, since the Company intends to demolish the old building, to build a new building…

Q: Bon Company has decided to expand its operations and has purchased land in the city for construction…

A:

Q: The purchase price Re cost of filling the land was RO 15,000. Cost of demolishing an old building on…

A: The answer is stated below:

Q: What is the sound value of this building?

A: Sound value is the replacement cost of property, less accrued depreciation. The replacement cost is…

Q: Old Room Co. purchased land and building for a lump-sum price of ₱48,000,000. The existing building…

A: The allocated cost of land and the new building is calculated as follows:

Q: Amelia Corporation purchased a tract of land for the construction of a new office building. The…

A: Cost of Asset = Purchase price(-) Any trade discount + Non-refundable taxes + Directly attributable…

Q: On September 3, 2016, Ivory Company acquired an apartment building for $1,500,000 (with $300,000…

A: Straight line method is also called fixed installment method, original value method, It is one of…

Q: Gamjatang Inc. acquired a land and an old unusable building for P7,500,000. Gamjatang contracted…

A: Cost of Land = Purchase price + Cost incurred to demolish old building - Proceeds from Scrap…

Q: A building owned and previously occupied by the company was vacated and was being negotiated for…

A: The details of building are given Required At what amount should this asset be measured on the…

Q: Old Room Co. purchased land and building for a lump-sum price of ₱48,000,000. The existing building…

A: In the given question based on the nature of expenditure we need to allocate the capital expenditure…

Q: On January 6, Year 1, Mount Jackson Corporation purchased a tract of land for a factory site for…

A: Land and Building are fixed assets however the treatment of both with regard to depreciation is…

Q: A company purchased a track of land with the intent to use the land to put a new building. However,…

A: Property, Plant, and Equipment or PP&E is a classification shown on a balance sheet. It normally…

Q: Sunland Enterprises incurred several costs related to the acquisition of plant assets. Purchase…

A: But interest can be capitalized upto the date of completion of qualifying assets.

Q: A 2,400 square foot building has an remaining economic life of 55 years. Its current effective age…

A: Depreciation is the amount of expense that is incurred when the value of assets is decreasing with…

Q: Carter vacated an office building and let it out to a third party on 30 June 20X8. The building had…

A: We have the following information: The building had an original cost of $900,000 on 1 January 20X0…

Q: A building owned and previously occupied by the company was vacated and was being negotiated for…

A: As per the provision contain in PFRS 5, it applies to the following non current asset. Property…

Q: Smitty Inc. wishes to use the revaluation model for this property: Before Revaluation • Building…

A: Journal entries are prepared to record the financial and non-financial transactions of the business…

Q: se the following information for the next three questions: Altitude Company purchased a plot of land…

A: Property, plant, and equipment seem to be long-term real or tangible assets which generally have a…

Q: Merchant Company purchased property for a building site. The costs associated with the property…

A: Cost of asset includes all those expenses which are incurred to made the asset ready to use.

Q: Asura Co. purchased land and building for a lump-sum price of P48,000,000. The existing building…

A: Lump-sum purchase: - Lump-sum purchase occurs when different assets or a group of assets are…

Q: Martini Company incurred the following costs in purchasing a land as a factory site: Purchase price…

A: All the expense which are incurred to make or asset ready to put into use are to be added to the…

Q: The Perkins Construction Company bought abuilding for $800,000 to be used as a warehouse.A number of…

A: Hi student Since there are multiple sub parts, we will answer only first three sub parts.

Q: Merchant Company purchased land for a building site. The costs associated with the property were:…

A: The Costs associated with the property were include the all cost related to property to use.

Q: Company x bought a house and lot for $1,500,000. The value of the land was appraised at $900,000 and…

A: The question is related to Property, Plant and Equipment. As per IAS 16 the Cost of Property, Plant…

Q: Fresh Veggies, Inc. (FVI), purchases land and a warehouse for $490,000. In addition to the purchase…

A:

Q: MAGANDANGEHEMPLO, Inc. obtained a land with an old building, that will be accounted for under…

A: Asper PPE , land and building going to list as separate items in PPE basis on their fair value As…

Q: MABUTINGEHEMPLO, Inc. obtained a land with an old building, that will be accounted for under…

A: The demolished cost of land is to be capitalised in the books of accounts and is recognised as…

Q: Good Influence, Inc. obtained a land with an old building, that will be accounted for under…

A: The following statement is True regarding :::: The amount of expense to be recognized is P700,000.…

Q: Teradene Corporation purchased land as a factory site and contracted with Maxtor Construction to…

A: Current asset is a short-term purpose assets which we usually purchased for one year, that is,…

Q: MAGANDANGEHEMPLO, Inc. obtained a land with an old building, that will be accounted for under…

A: Construction cost of the new building P1,50,00,000 Add: Cost of old building (P3500000 * P2000000…

Q: urchased a parcel of land as a factory site (unusable) for P320,000. An old building on the property…

A: Cost of new building Demolition of old building 21000 Architect's fee 31700 Construction…

Q: MAGANDANGEHEMPLO, Inc. obtained a land with an old building, that will be accounted for under…

A: In the given case the company will recognise the construction cost of new building as an asset…

Q: Auto purchased a $500,000 tract of land that is intended to be the site of a new office complex. The…

A: Land is the fixed asset for the company that is recorded in the balance sheet of the company.

Q: MABUTINGEHEMPLO, Inc. obtained a land with an old building, that will be accounted for under…

A: In the given case the demolished cost of the land will be capitalised in the books of accounts is…

Q: MABUTINGEHEMPLO, Inc. obtained a land with an old building, that will be accounted for under…

A: The question is related to IAS 16 Property, Plant and Equipment. As per IAS 16 the cost of PPE…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- (Appendix 11.1) Auburn Company purchased an asset on January 1, Year 1, for 150,000. The asset has a MACRS life of 7 years. The residual value of the asset is 35,000. Calculate the depreciation expense for Year 1 and Year 2 using MACRS.Allocating payments and receipts to fixed asset accounts The following payments and receipts are related to land, land improvements, and buildings acquired for use in a wholesale apparel business. The receipts are identified by an asterisk. A. Fee paid to attorney for title search............................................ 3,600 B. Cost of real estate acquired as a plant site: Land................................ 720,000 Building (to be demolished)........... 60,000 C. Finder's fee paid to real estate agency.......................................... 23,400 D. Delinquent real estate taxes on property, assumed by purchaser................. 15,000 E. Architect's and engineer's fees for plans for new building....................... 75,000 F. Cost of removing building purchased with land in (B)............................ 10,000 G. Proceeds from sale of salvage materials from old building....................... 3,400 H. Cost of filling and grading land................................................ 18,000 1. Premium on one-year insurance policy during construction...................... 8,400 J. Money borrowed to pay building contractor.................................... 800,000 K. Special assessment paid to city for extension of water main to the property....... 13,400 L. Cost of repairing windstorm damage during construction....................... 3,000 M. Cost of repairing vandalism damage during construction........................ 2,000 N. Cost of trees and shrubbery planted........................................... 14,000 0. Cost of paving parking lot to be used by customers............................. 21,600 P. Interest incurred on building loan during construction.......................... 40,000 Q. Proceeds from insurance company for windstorm and vandalism damage........ 4,500 R. Payment to building contractor for new building................................ 800,000 S. Refund of premium on insurance policy (1) canceled after 10 months............. 1,400 Instructions 1. Assign each payment and receipt to Land (unlimited life), Land Improvements (limited life), Building, or Other Accounts. Indicate receipts by an asterisk. Identify each item by letter and list the amounts in columnar form, as follows: Item Land Land Improvements Building Other Accounts 2. Determine the amount debited to Land. Land Improvements, and Building. 3. The costs assigned to the land, which is used as a plant site, will not be depreciated, while the costs assigned to land improvements will be depreciated. Explain this seemingly contradictory application of the concept of depreciation. 4. What would be the effect on the income statement and balance sheet if the cost of paving the parking lot of 21,600 [payment (0)] was incorrectly classified as Land rather than Land Improvements? Assume Land Improvements are depreciated over a 10-year life using the double-declining-balance method.Capstone Consulting Services acquired land 5 years ago for $200,000. Capstone recently signed an agreement to sell the land for $375,000. In accordance with the sales agreenwnt, the buyer transferred $375,000 to Capstone’s bank account on February 20. How would elements of the accounting equation be affected by the sale?

- Allocating payments and receipts to fixed asset accounts The following payments and receipts are related to land, land improvements, and buildings acquired for use in a wholesale ceramic business. The receipts are identified by an asterisk. a. Fee paid to attorney for title search 2,500 b. Cost of real estate acquired as a plant site: Land 285,000 Building (to be demolished) 55,000 c. Delinquent real estate taxes on property, assumed by purchaser 15,500 d. Cost of tearing down and removing building acquired In (b) 5,000 e. Proceeds from sale of salvage materials from old building 4,000 f. Special assessment paid to city for extension of water main to the property 29,000 g. Architects and engineers fees for plans and supervision 60,000 h. Premium on one-year insurance policy during construction 6,000 i. Cost of filling and grading land 12,000 j. Money borrowed to pay building contractor 900,000 k. Cost of repairing windstorm damage during construction 5,500 1. Cost of paving parking lot to be used by customers 32,000 m. Cost of trees and shrubbery planted 11,000 n. Cost of floodlights installed on parking lot 2,000 o. Cost of repairing vandalism damage during construction 2,500 p. Proceeds from insurance company for windstorm and vandalism damage 7,500 q. Payment to building contractor for new building 800,000 r. Interest incurred on building loan during construction 34,500 s. Refund of premium on insurance policy (h) canceled after 11 months 500 Instructions 1.Assign each payment and receipt to Land (unlimited life), Land Improvements (limited life), Building, or Other Accounts. Indicate receipts by an asterisk. Identify each item by letter and list the amounts in columnar form, as follows: Item Land Land improvements Building Other Accounts 2.Determine the amount debited to Land, Land Improvements, and Building. 3.The costs assigned to the land, which is used as a plant site, will not be depreciated, while the costs assigned to land improvements will be depreciated. Explain this seemingly contradictory application of the concept of depreciation. 4.What would be the effect on the current years income statement and balance sheet if the cost of filling and grading land of 12,000 [payment (i)] was incorrectly classified as Land Improvements rather than Land? Assume that Land Improvements are depreciated over a 20-year life using the double-declining-balance method.19 MAGANDANGEHEMPLO, Inc. obtained a land with an old building, that will be accounted for under property, plant and equipment. The Company intends to demolish the old building, to build a new building and will not use the old building prior to its demolition. The following information relates to the land and building: Purchase price of the land and building P3,500,000 Fair value: Land 3,000,000 Old building 2,000,000 Historical cost Land 2,000,000 Old building 6,000,000 Demolition costs 700,000 Construction cost of the new building…19. MAGANDANGEHEMPLO, Inc. obtained a land with an old building, that will be accounted for under property, plant and equipment. The Company intends to demolish the old building, to build a new building and will not use the old building prior to its demolition. The following information relates to the land and building: Purchase price of the land and building P3,500,000 Fair value: Land 3,000,000 Old building 2,000,000 Historical cost Land 2,000,000 Old building 6,000,000 Demolition costs 700,000 Construction cost of the new building…

- 5 Part Question: SportsWorld purchased property for $100,000. The property included a building, parking lot, and land. The building was appraised at $65,000; the land at $40,000; and the parking lot at $10,000. To the nearest dollar, the value of the land to be recorded in the books should be Multiple Choice $34,783 $36,364 $40,000 $48,696 $56,522 SportsWorld paid $140,000 for a property. The property included land appraised at $67,500, land improvements appraised at $25,000, and a building appraised at $55,500. What should be the allocation of costs in the accounting records (round calculations to 3 decimals)? Multiple Choice Land $62,000; land improvements, $23,000; building, $45,000 Land $63,840; land improvements, $23,660; building, $52,500 Land $87,500; land improvements; $35,000; building; $52,500 Land $79,500; land improvements, $32,600; building, $47,700 Land $62,000; land improvements, $23,800; building, $46,200…Can I please get help with this question and a quck explaination of how?(5.7) On January 1, Mitzu Company pays a lump-sum amount of $2,650,000 for land, Building 1, Building 2, and Land Improvements 1. Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $780,000, with a useful life of 20 years and a $75,000 salvage value. Land Improvements 1 is valued at $360,000 and is expected to last another 12 years with no salvage value. The land is valued at $1,860,000. The company also incurs the following additional costs. Cost to demolish Building 1 $ 348,400 Cost of additional land grading 195,400 Cost to construct Building 3, having a useful life of 25 years and a $398,000 salvage value 2,242,000 Cost of new Land Improvements 2, having a 20-year useful life and no salvage value 168,000Q2(no pic): FDN Company acquires a building on April 1, 2021 at a cost of P24,500,000. The building has an estimated useful life of 40 years and an estimated salvage value of P500,000. How much is the depreciation expense for the year ended December 31, 2021?

- Please provide solution 1. On December 31, 20x1, DECAPITATE BEHEAD Co. decided to lease out under operating lease one of its buildings that was previously used as office space. The building has an original cost of ₱12,000,000 and accumulated depreciation of ₱8,000,000 as of January 1, 20x1. Annual depreciation is ₱400,000. DECAPITATE Co. uses the fair value model for investment property. The fair value of the building on December 31, 20x1 is ₱6,000,000. The entry to record the transfer of the building to investment property includes a: a. credit to gain on reclassification for ₱2,000,000. b. credit to revaluation surplus for ₱2,000,000. c. debit to building for ₱12,000,000. d. credit to revaluation surplus for ₱2,400,000.PROBLEM 3 (No. 6 and 7 are based on the following problem) Panganiban Company acquired an equipment on January 1, 2023, costing the company P1,500,000. It was at revalued amount less any accumulated depreciation and accumulated impairment losses and transfers a portion of its revaluation surplus as the asset is used every period On December 31, 2023, the fair value of the asset was P1,687,500 and the company appropriately recorded its revaluation surplus. On December 31, 2025, the recoverable amount of the asset was determined to be P1,010,625 On December 31, 2026, the fair value of the asset was determined to be P1,095,000 5. What amount of revaluation surplus should be credited in equity on December 31, 2023? 6. What amount of impairment loss should be reported by Panganiban Company on December 31, 2025. hlam)QUESTION 3 MacPro Property Bhd acquired an investment property on 1 January 2015 and measured it using the cost model. On 1 January 2018, MacPro Property Bhd changed the accounting policy and used the fair value model to measure investment property. The acquisition cost of the property was RM70 million and the estimated useful life was 35 years. The fair values of the property were measured as below: Date RM (in million) 31/12/2015 72 31/12/2016 74 31/12/2017 78 31/12/2018 83 Profit after depreciation on investment property but before tax for 2017 and 2018 were RM80 million and RM95 million, respectively. Retained earnings brought forward on 1 January 2017 and 2018, were RM150 million and RM210 million, respectively. Assume that tax rate for 2017 and 2018 was 25%. REQUIRED: Discuss the accounting treatment of the above transaction in accordance to MFRS 108 Accounting Policies, Changes in Accounting Estimates and Errors. Prepare the…