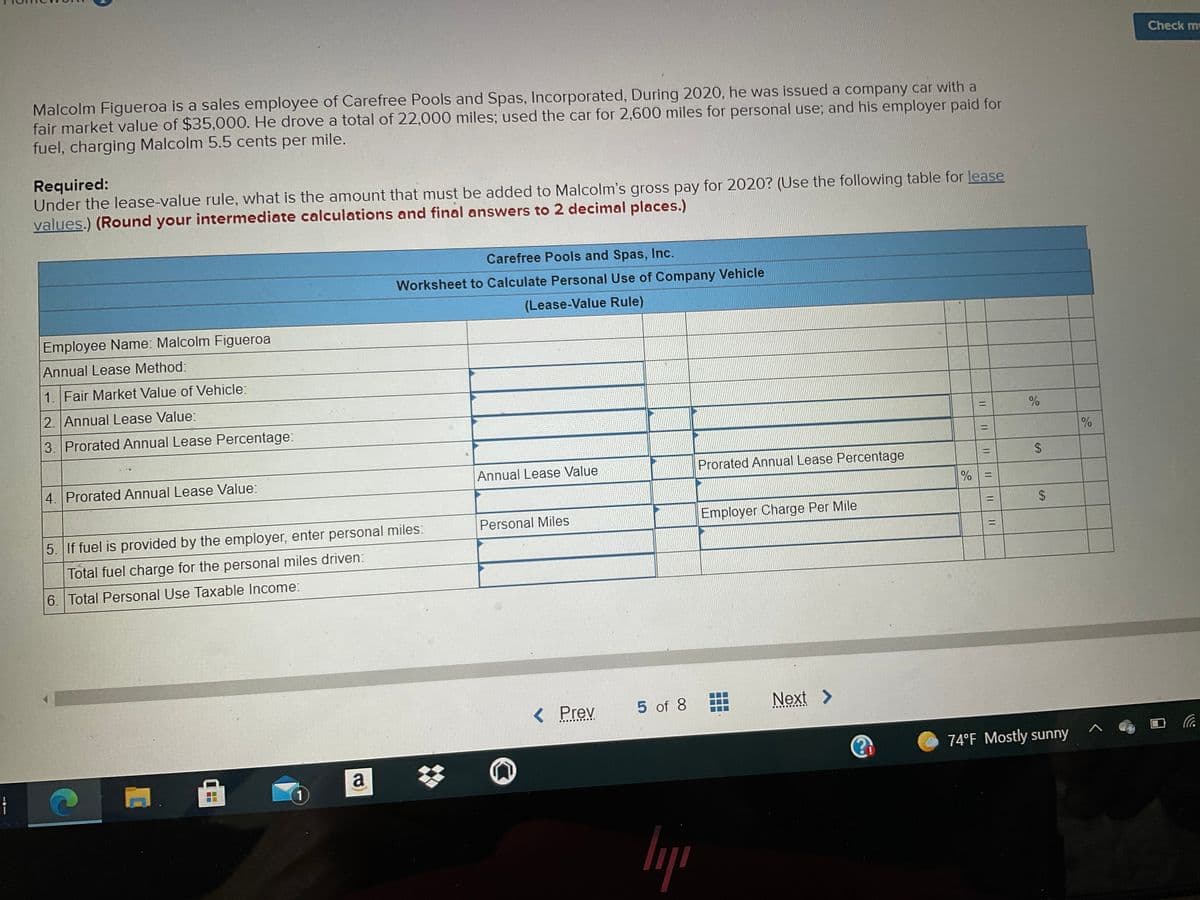

Malcolm Figueroa is a sales employee of Carefree Pools and Spas, Incorporated, During 2020, he was issued a company car with a fair market value of $35,000. He drove a total of 22,000 miles; used the car for 2,600 miles for personal use; and his employer paid for fuel, charging Malcolm 5.5 cents per mile. Required: Under the lease-value rule, what is the amount that must be added to Malcolm's gross pay for 2020? (Use the following table for lease values.) (Round your intermediate calculations and final answers to 2 decimal places.) Carefree Pools and Spas, Inc. Worksheet to Calculate Personal Use of Company Vehicle lalua Rule)

Malcolm Figueroa is a sales employee of Carefree Pools and Spas, Incorporated, During 2020, he was issued a company car with a fair market value of $35,000. He drove a total of 22,000 miles; used the car for 2,600 miles for personal use; and his employer paid for fuel, charging Malcolm 5.5 cents per mile. Required: Under the lease-value rule, what is the amount that must be added to Malcolm's gross pay for 2020? (Use the following table for lease values.) (Round your intermediate calculations and final answers to 2 decimal places.) Carefree Pools and Spas, Inc. Worksheet to Calculate Personal Use of Company Vehicle lalua Rule)

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 50P

Related questions

Question

How would these taxes be figured?

Transcribed Image Text:Check m

Malcolm Figueroa is a sales employee of Carefree Pools and Spas, Incorporated, During 2020, he was issued a company car with a

fair market value of $35,000. He drove a total of 22,000 miles; used the car for 2,600 miles for personal use; and his employer paid for

fuel, charging Malcolm 5.5 cents per mile.

Required:

Under the lease-value rule, what is the amount that must be added to Malcolm's gross pay for 2020? (Use the following table for lease

values.) (Round your intermediate calculations and final answers to 2 decimal places.)

Carefree Pools and Spas, Inc.

Worksheet to Calculate Personal Use of Company Vehicle

(Lease-Value Rule)

Employee Name: Malcolm Figueroa

Annual Lease Method:

1. Fair Market Value of Vehicle:

2. Annual Lease Value:

%3D

3. Prorated Annual Lease Percentage:

%3D

%

Prorated Annual Lease Percentage

%3D

4. Prorated Annual Lease Value:

Annual Lease Value

%D

%3D

Personal Miles

Employer Charge Per Mile

5. If fuel is provided by the employer, enter personal miles:

%3D

Total fuel charge for the personal miles driven:

6. Total Personal Use Taxable Income:

< Prev

5 of 8

Next >

74°F Mostly sunny

a

%23

1

%24

%24

||

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning