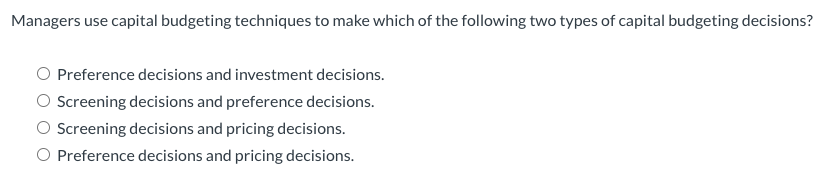

Managers use capital budgeting techniques to make which of the following two types of capital budgeting decisions?

Managers use capital budgeting techniques to make which of the following two types of capital budgeting decisions?

Chapter9: Deductions: Employee And Self- Employed-related Expenses

Section: Chapter Questions

Problem 30P

Related questions

Question

100%

1

Transcribed Image Text:Managers use capital budgeting techniques to make which of the following two types of capital budgeting decisions?

Preference decisions and investment decisions.

O Screening decisions and preference decisions.

Screening decisions and pricing decisions.

O Preference decisions and pricing decisions.

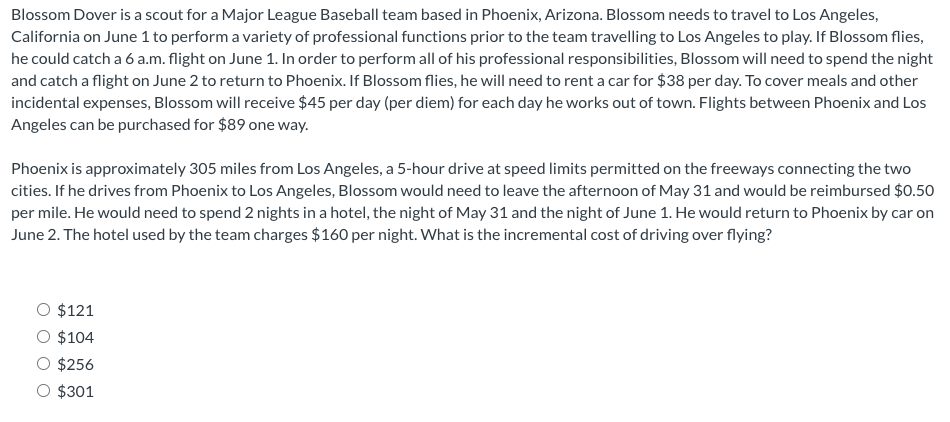

Transcribed Image Text:Blossom Dover is a scout for a Major League Baseball team based in Phoenix, Arizona. Blossom needs to travel to Los Angeles,

California on June 1 to perform a variety of professional functions prior to the team travelling to Los Angeles to play. If Blossom flies,

he could catch a 6 a.m. flight on June 1. In order to perform all of his professional responsibilities, Blossom will need to spend the night

and catch a flight on June 2 to return to Phoenix. If Blossom flies, he will need to rent a car for $38 per day. To cover meals and other

incidental expenses, Blossom will receive $45 per day (per diem) for each day he works out of town. Flights between Phoenix and Los

Angeles can be purchased for $89 one way.

Phoenix is approximately 305 miles from Los Angeles, a 5-hour drive at speed limits permitted on the freeways connecting the two

cities. If he drives from Phoenix to Los Angeles, Blossom would need to leave the afternoon of May 31 and would be reimbursed $0.50

per mile. He would need to spend 2 nights in a hotel, the night of May 31 and the night of June 1. He would return to Phoenix by car on

June 2. The hotel used by the team charges $160 per night. What is the incremental cost of driving over flying?

$121

$104

$256

O $301

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT