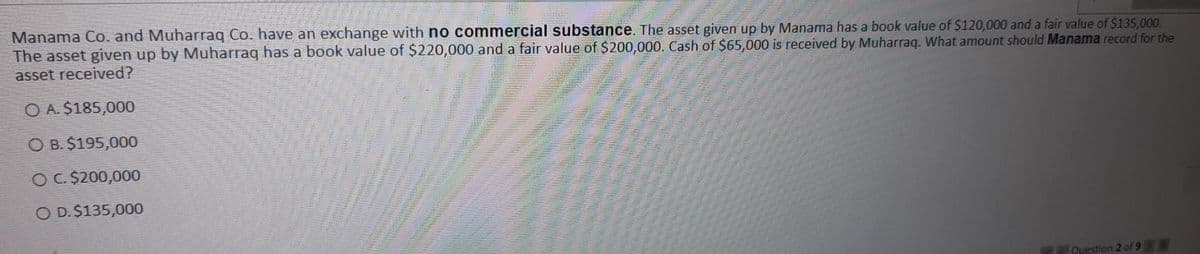

Manama Co, and Muharraq Co. have an exchange with no commercial substance. The asset given up by Manama has a book value of $120,000 and a fair value of $135,000. The asset given up by Muharraq has a book value of $220,000 and a fair value of $200,000. Cash of $65,000 is received by Muharraq. What amount should Manama record for the asset received? O A. $185,000 O B. $195,000 OC. $200,000 O D.$135,000

Manama Co, and Muharraq Co. have an exchange with no commercial substance. The asset given up by Manama has a book value of $120,000 and a fair value of $135,000. The asset given up by Muharraq has a book value of $220,000 and a fair value of $200,000. Cash of $65,000 is received by Muharraq. What amount should Manama record for the asset received? O A. $185,000 O B. $195,000 OC. $200,000 O D.$135,000

Chapter14: Property Transactions: Capital Gains And Losses, § 1231, And Recapture Provisions

Section: Chapter Questions

Problem 37CE

Related questions

Question

intermediate accounting

Plz explain in detail

Transcribed Image Text:Manama Co. and Muharraq Co. have an exchange with no commercial substance. The asset given up by Manama has a book value of $120,000 and a fair value of $135,000.

The asset given up by Muharraq has a book value of $220,000 and a fair value of $200,000. Cash of $65,000 is received by Muharraq. What amount should Manama record for the

asset received?

O A. $185,000

O B. $195,000

OC. $200,000

O D. $135,000

Question 2 of 9

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you