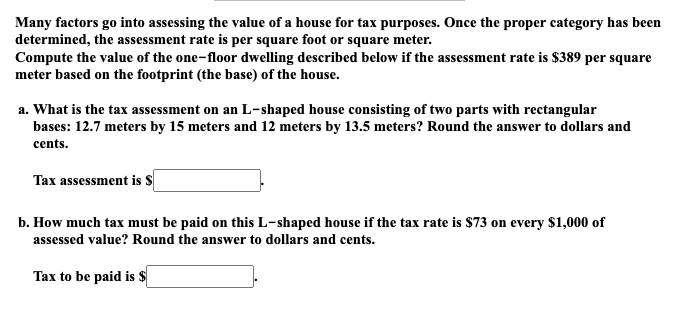

Many factors go into assessing the value of a house for tax purposes. Once the proper category has been determined, the assessment rate is per square foot or square meter. Compute the value of the one-floor dwelling described below if the assessment rate is $389 per square meter based on the footprint (the base) of the house. a. What is the tax assessment on an L-shaped house consisting of two parts with rectangular bases: 12.7 meters by 15 meters and 12 meters by 13.5 meters? Round the answer to dollars and cents. Tax assessment is S b. How much tax must be paid on this L-shaped house if the tax rate is $73 on every $1,000 of assessed value? Round the answer to dollars and cents. Tax to be paid is $

Many factors go into assessing the value of a house for tax purposes. Once the proper category has been determined, the assessment rate is per square foot or square meter. Compute the value of the one-floor dwelling described below if the assessment rate is $389 per square meter based on the footprint (the base) of the house. a. What is the tax assessment on an L-shaped house consisting of two parts with rectangular bases: 12.7 meters by 15 meters and 12 meters by 13.5 meters? Round the answer to dollars and cents. Tax assessment is S b. How much tax must be paid on this L-shaped house if the tax rate is $73 on every $1,000 of assessed value? Round the answer to dollars and cents. Tax to be paid is $

Mathematics For Machine Technology

8th Edition

ISBN:9781337798310

Author:Peterson, John.

Publisher:Peterson, John.

Chapter12: Multiplication Of Decimal Fractions

Section: Chapter Questions

Problem 13A: The length, L, of the point on any standard 118° included angle drill, as shown in Figure 12-5, can...

Related questions

Question

Transcribed Image Text:Many factors go into assessing the value of a house for tax purposes. Once the proper category has been

determined, the assessment rate is per square foot or square meter.

Compute the value of the one-floor dwelling described below if the assessment rate is $389 per square

meter based on the footprint (the base) of the house.

a. What is the tax assessment on an L-shaped house consisting of two parts with rectangular

bases: 12.7 meters by 15 meters and 12 meters by 13.5 meters? Round the answer to dollars and

cents.

Tax assessment is S

b. How much tax must be paid on this L-shaped house if the tax rate is $73 on every $1,000 of

assessed value? Round the answer to dollars and cents.

Tax to be paid is $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Recommended textbooks for you

Mathematics For Machine Technology

Advanced Math

ISBN:

9781337798310

Author:

Peterson, John.

Publisher:

Cengage Learning,

Trigonometry (MindTap Course List)

Trigonometry

ISBN:

9781305652224

Author:

Charles P. McKeague, Mark D. Turner

Publisher:

Cengage Learning

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Mathematics For Machine Technology

Advanced Math

ISBN:

9781337798310

Author:

Peterson, John.

Publisher:

Cengage Learning,

Trigonometry (MindTap Course List)

Trigonometry

ISBN:

9781305652224

Author:

Charles P. McKeague, Mark D. Turner

Publisher:

Cengage Learning

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Algebra: Structure And Method, Book 1

Algebra

ISBN:

9780395977224

Author:

Richard G. Brown, Mary P. Dolciani, Robert H. Sorgenfrey, William L. Cole

Publisher:

McDougal Littell

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill