Mar. 31 Accounts Receivable 700 Service Revenue 700 To accrue service revenue. (b) Mar. 31 Unearned Revenue 100 Service Revenue 100 To record service revenue that was collected in advance. (c) Mar. 31 Supplies Expense 400 Office Supplies 400 To record office supplies used. (d) Mar. 31 Salaries Expense 200 Salaries Payable 200 To accrue salaries expense. (e) Mar. 31 Rent Expense 560 Prepaid Rent 560 To record rent expense. (f) Mar. 31 Depreciation Expense—Equipment 120 Accumulated Depreciation—Equipment 120 To record depreciation on equipment use the following adjustments to make a T-acct for each item, continued instructions found in image

Mar. 31 Accounts Receivable 700 Service Revenue 700 To accrue service revenue. (b) Mar. 31 Unearned Revenue 100 Service Revenue 100 To record service revenue that was collected in advance. (c) Mar. 31 Supplies Expense 400 Office Supplies 400 To record office supplies used. (d) Mar. 31 Salaries Expense 200 Salaries Payable 200 To accrue salaries expense. (e) Mar. 31 Rent Expense 560 Prepaid Rent 560 To record rent expense. (f) Mar. 31 Depreciation Expense—Equipment 120 Accumulated Depreciation—Equipment 120 To record depreciation on equipment use the following adjustments to make a T-acct for each item, continued instructions found in image

Chapter3: Setting Up A New Company

Section: Chapter Questions

Problem 3.6C

Related questions

Question

'

|

a) Mar. 31

|

|

700

|

|

||

|

|

|

|

Service Revenue

|

|

700

|

|

|

|

|

To accrue service revenue.

|

|

|

|

(b) Mar. 31

|

Unearned Revenue

|

100

|

|

||

|

|

|

|

Service Revenue

|

|

100

|

|

|

|

|

To record service revenue that was collected in advance.

|

|

|

|

(c) Mar. 31

|

Supplies Expense

|

400

|

|

||

|

|

|

|

Office Supplies

|

|

400

|

|

|

|

|

To record office supplies used.

|

|

|

|

(d) Mar. 31

|

Salaries Expense

|

200

|

|

||

|

|

|

|

Salaries Payable

|

|

200

|

|

|

|

|

To accrue salaries expense.

|

|

|

|

(e) Mar. 31

|

Rent Expense

|

560

|

|

||

|

|

|

|

Prepaid Rent

|

|

560

|

|

|

|

|

To record rent expense.

|

|

|

|

(f) Mar. 31

|

|

120

|

|

||

|

|

|

|

|

|

120

|

|

|

|

|

To record depreciation on equipment

|

use the following adjustments to make a T-acct for each item, continued instructions found in image

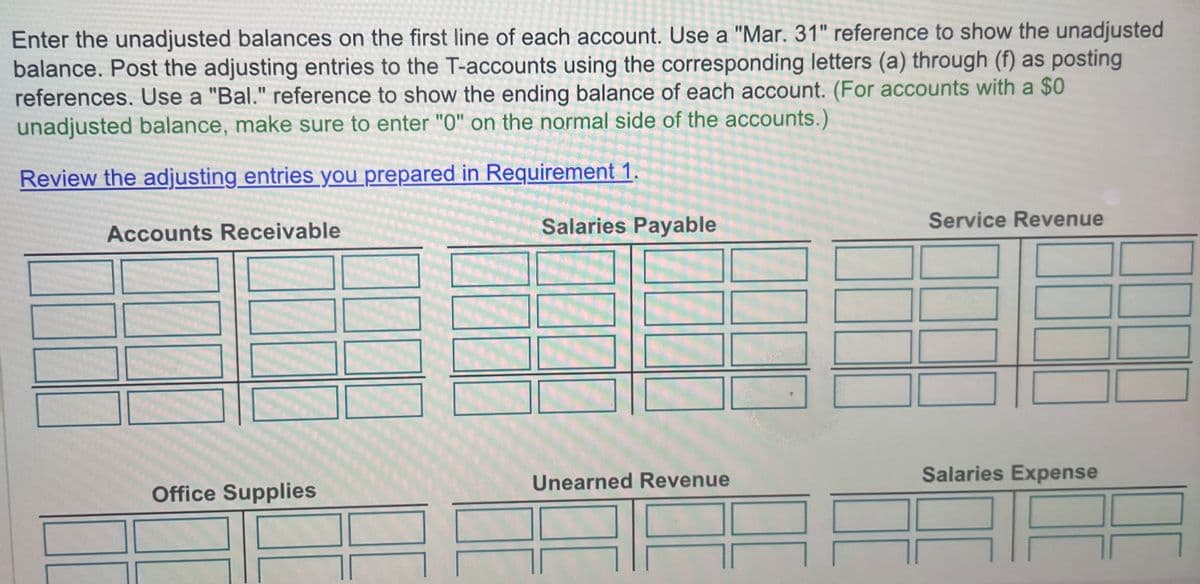

Transcribed Image Text:Enter the unadjusted balances on the first line of each account. Use a "Mar. 31" reference to show the unadjusted

balance. Post the adjusting entries to the T-accounts using the corresponding letters (a) through (f) as posting

references. Use a "Bal." reference to show the ending balance of each account. (For accounts with a $0

unadjusted balance, make sure to enter "0" on the normal side of the accounts.)

Review the adjusting entries you prepared in Requirement 1.

Accounts Receivable

Office Supplies

Salaries Payable

Unearned Revenue

Service Revenue

Salaries Expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College