Marigold Manufacturing has old equipment that cost $57,000. The equipment has accumulated depreciation of $28,400. Marigold has decided to sell the equipment. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) (a) What entry would Marigold make to record the sale of the equipment for $33,000 cash? What entry would Marigold make to record the sale of the equipment for $15,000 cash? (b) Account Titles and Explanation Debit Credit (a) (b)

Marigold Manufacturing has old equipment that cost $57,000. The equipment has accumulated depreciation of $28,400. Marigold has decided to sell the equipment. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) (a) What entry would Marigold make to record the sale of the equipment for $33,000 cash? What entry would Marigold make to record the sale of the equipment for $15,000 cash? (b) Account Titles and Explanation Debit Credit (a) (b)

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter10: Long-lived Tangible And Intangible Assets

Section: Chapter Questions

Problem 28E

Related questions

Question

Please answer question correctly

Transcribed Image Text:NEXT

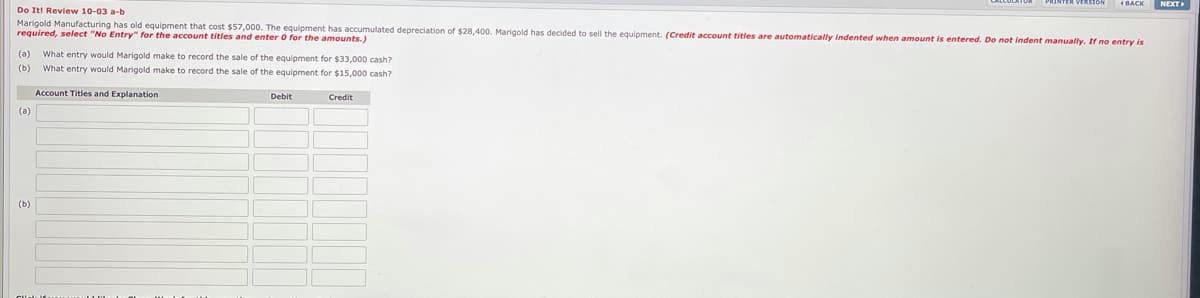

Do Iti Review 10-03 a-b

Marigold Manufacturing has old equipment that cost $57,000. The equipment has accumulated depreciation of $28,400. Marigold has decided to sell the equipment. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is

required, select "No Entry" for the account titles and enter o for the amounts.)

What entry would Marigold make to record the sale of the equipment for $33,000 cash?

(b

What entry would Marigold make to record the sale of the equipment for $15,000 cash?

Account Titles and Explanation

Debit

Credit

(а)

(b)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage