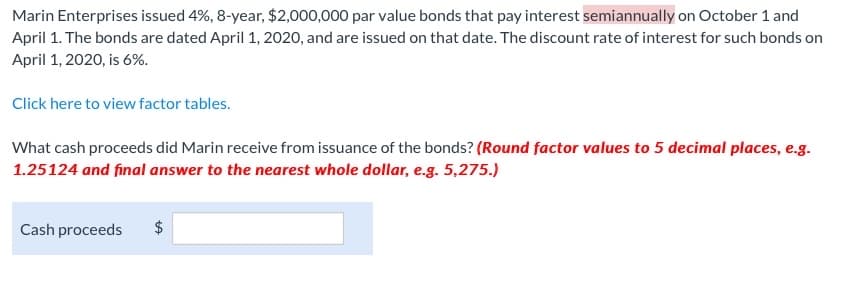

Marin Enterprises issued 4%, 8-year, $2,000,000 par value bonds that pay interest semiannually on October 1 and April 1. The bonds are dated April 1, 2020, and are issued on that date. The discount rate of interest for such bonds on April 1, 2020, is 6%. Click here to view factor tables. What cash proceeds did Marin receive from issuance of the bonds? (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to the nearest whole dollar, e.g. 5,275.) Cash proceeds $

Marin Enterprises issued 4%, 8-year, $2,000,000 par value bonds that pay interest semiannually on October 1 and April 1. The bonds are dated April 1, 2020, and are issued on that date. The discount rate of interest for such bonds on April 1, 2020, is 6%. Click here to view factor tables. What cash proceeds did Marin receive from issuance of the bonds? (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to the nearest whole dollar, e.g. 5,275.) Cash proceeds $

Question

how to calculate this?

please elaborate

Transcribed Image Text:Marin Enterprises issued 4%, 8-year, $2,000,000 par value bonds that pay interest semiannually on October 1 and

April 1. The bonds are dated April 1, 2020, and are issued on that date. The discount rate of interest for such bonds on

April 1, 2020, is 6%.

Click here to view factor tables.

What cash proceeds did Marin receive from issuance of the bonds? (Round factor values to 5 decimal places, e.g.

1.25124 and final answer to the nearest whole dollar, e.g. 5,275.)

Cash proceeds

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.