(Marks: 10 On 31 August 2018, Musk Traders purchased a machine on credit for a cost price of R402 500 (including VAT at 15%). Machinery is depreciated over six years according to the straight-line basis and there is no residual value on this machine, as it is highly specialised. Musk Traders has a 30 June year-end.

(Marks: 10 On 31 August 2018, Musk Traders purchased a machine on credit for a cost price of R402 500 (including VAT at 15%). Machinery is depreciated over six years according to the straight-line basis and there is no residual value on this machine, as it is highly specialised. Musk Traders has a 30 June year-end.

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter7: Inventory Cost Flow Assumptions (fifolifo)

Section: Chapter Questions

Problem 8R: Reset the November 20 purchase to 150 units, including column G. To test your formulas, suppose that...

Related questions

Question

On 31st August 2018

Transcribed Image Text:HELP

Uit Page

157.60%

T

WHighlight

Dit Width

Rotate Left

Actual

FStrikeout

Size AFtVisible Rotate Right

Typewriter Note

Quick

PDF

U Underline

Scan

Sign

Convert Protect

View

Comment

Home Test 2.pdf

Question 2

(Marks: 10)

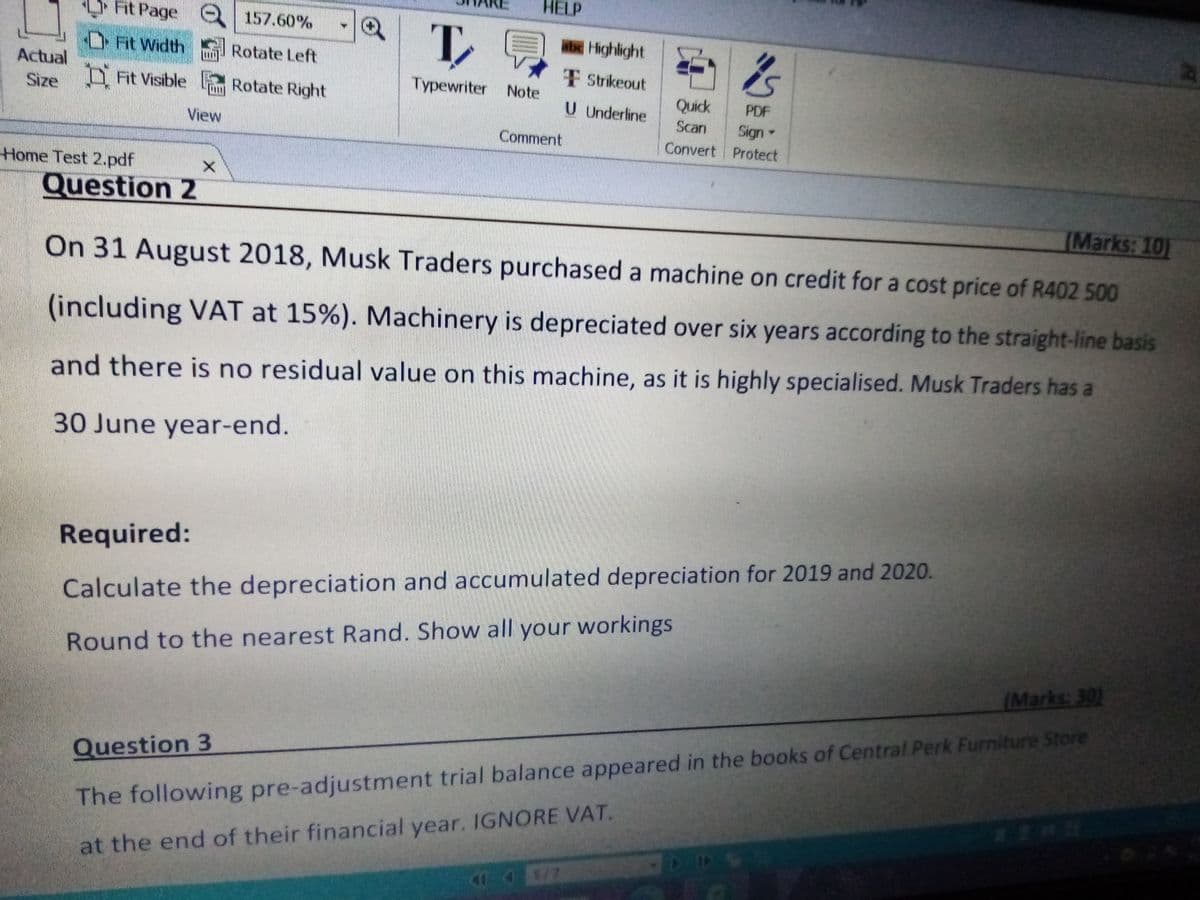

On 31 August 2018, Musk Traders purchased a machine on credit for a cost price of R402 500

(including VAT at 15%). Machinery is depreciated over six years according to the straight-line basis

and there is no residual value on this machine, as it is highly specialised. Musk Traders has a

30 June year-end.

Required:

Calculate the depreciation and accumulated depreciation for 2019 and 2020.

Round to the nearest Rand. Show all your workings

(Marks: 30)

Question 3

The following pre-adjustment trial balance appeared in the books of Central Perk Furniture Store

at the end of their financial year. IGNORE VAT.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning