married on January 1 of last year. Robin has a ous marriage. Joshua works as an audit manage obin is self-employed and runs a food truck sel financial information pertaining to their activit ross income? a $126,000 salary for the year. $8,500 in child support payments from he eived $300 of interest from corporate bond

married on January 1 of last year. Robin has a ous marriage. Joshua works as an audit manage obin is self-employed and runs a food truck sel financial information pertaining to their activit ross income? a $126,000 salary for the year. $8,500 in child support payments from he eived $300 of interest from corporate bond

Chapter13: Tax Credits And Payment Procedures

Section: Chapter Questions

Problem 34P

Related questions

Question

Please help me to solve this question

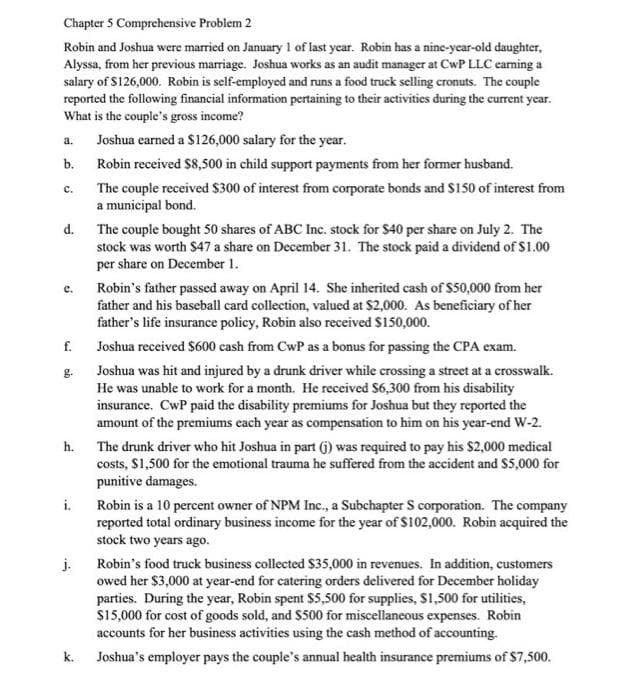

Transcribed Image Text:Chapter 5 Comprehensive Problem 2

Robin and Joshua were married on January 1 of last year. Robin has a nine-year-old daughter,

Alyssa, from her previous marriage. Joshua works as an audit manager at CwP LLC earning a

salary of $126,000. Robin is self-employed and runs a food truck selling cronuts. The couple

reported the following financial information pertaining to their activities during the current year.

What is the couple's gross income?

a.

b.

C.

d.

e.

f.

g.

h.

i.

j.

k.

Joshua earned a $126,000 salary for the year.

Robin received $8,500 in child support payments from her former husband.

The couple received $300 of interest from corporate bonds and $150 of interest from

a municipal bond.

The couple bought 50 shares of ABC Inc. stock for $40 per share on July 2. The

stock was worth $47 a share on December 31. The stock paid a dividend of $1.00

per share on December 1.

Robin's father passed away on April 14. She inherited cash of $50,000 from her

father and his baseball card collection, valued at $2,000. As beneficiary of her

father's life insurance policy, Robin also received $150,000.

Joshua received $600 cash from CwP as a bonus for passing the CPA exam.

Joshua was hit and injured by a drunk driver while crossing a street at a crosswalk.

He was unable to work for a month. He received $6,300 from his disability

insurance. CwP paid the disability premiums for Joshua but they reported the

amount of the premiums each year as compensation to him on his year-end W-2.

The drunk driver who hit Joshua in part (j) was required to pay his $2,000 medical

costs, $1,500 for the emotional trauma he suffered from the accident and $5,000 for

punitive damages.

Robin is a 10 percent owner of NPM Inc., a Subchapter S corporation. The company

reported total ordinary business income for the year of $102,000. Robin acquired the

stock two years ago.

Robin's food truck business collected $35,000 in revenues. In addition, customers

owed her $3,000 at year-end for catering orders delivered for December holiday

parties. During the year, Robin spent $5,500 for supplies, $1,500 for utilities,

$15,000 for cost of goods sold, and $500 for miscellaneous expenses. Robin

accounts for her business activities using the cash method of accounting.

Joshua's employer pays the couple's annual health insurance premiums of $7,500.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning