Mary Matthews made $1,150 during a biweekly pay period only social security (fully taxable) and federal income taxes attach to her pay. Matthews contributes $100 each biweekly pay to her company's 401k. Determine Matthews take home pay if she is married filing jointly. (Use Wage Bracket Method) Round your answer to two decimal place.

Mary Matthews made $1,150 during a biweekly pay period only social security (fully taxable) and federal income taxes attach to her pay. Matthews contributes $100 each biweekly pay to her company's 401k. Determine Matthews take home pay if she is married filing jointly. (Use Wage Bracket Method) Round your answer to two decimal place.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 74APSA: Payroll Accounting Jet Enterprises has the following data available for its April 30, 2019, payroll:...

Related questions

Question

(18) Mary Matthews made $1,150 during a biweekly pay period only social security (fully taxable) and federal income taxes attach to her pay. Matthews contributes $100 each biweekly pay to her company's 401k. Determine Matthews take home pay if she is married filing jointly. (Use Wage Bracket Method) Round your answer to two decimal place.

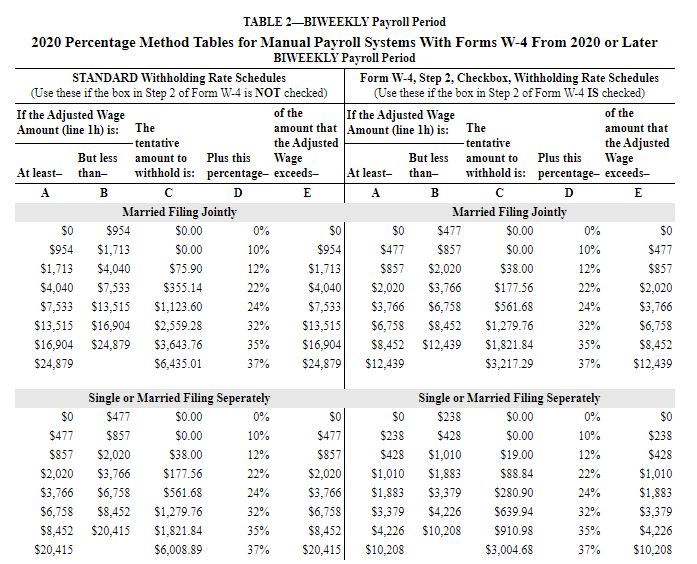

Transcribed Image Text:TABLE 2–BIWEEKLY Payroll Period

2020 Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later

BIWEEKLY Payroll Period

STANDARD Withholding Rate Schedules

(Use these if the box in Step 2 of Form W-4 is NOT checked)

Form W-4, Step 2, Checkbox, Withholding Rate Schedules

(Use these if the box in Step 2 of Form W-4 IS checked)

If the Adjusted Wage

of the

of the

If the Adjusted Wage

Amount (line lh) is: The

- tentative

amount that Amount (line lh) is: The

the Adjusted

Wage

amount that

the Adjusted

Wage

withhold is: percentage- exceeds-

tentative

But less amount to Plus this

But less

amount to

Plus this

At least- than-

withhold is: percentage- exceeds-

At least-

than-

A

в

D

E

A

В

D

E

Married Filing Jointly

Married Filing Jointly

$477

$0

$954

$0.00

0%

$0

$0

$0.00

0%

$0

$954

$1,713

$0.00

10%

$954

$477

$857

$0.00

10%

$477

$1,713

$4,040

$75.90

12%

$1,713

$857

$2,020

$38.00

12%

$857

$4,040

$7,533

$355.14

22%

$4,040

$2,020

$3,766

$177.56

22%

$2,020

$7,533 $13,515

$1,123.60

24%

$7,533

$3,766

$6,758

$561.68

24%

$3,766

$13,515 $16,904

$2,559.28

32%

$13,515

$6,758

$8,452

$1,279.76

32%

$6,758

$16,904 $24,879

$3,643.76

35%

$16,904

$8,452 $12,439

$1,821.84

35%

$8,452

$24,879

$6,435.01

37%

$24,879

$12,439

$3,217.29

37%

$12,439

Single or Married Filing Seperately

Single or Married Filing Seperately

$0

$477

$0.00

0%

$0

sO

$238

$0.00

0%

$0

$477

$857

$0.00

10%

$477

$238

$428

$0.00

10%

$238

$857

$2,020

$38.00

12%

$857

$428

$1,010

$19.00

12%

$428

$2,020

$3,766

$177.56

22%

$2,020

$1,010

$1,883

$88.84

22%

$1,010

$3,766

$6,758

$561.68

24%

$3,766

$1,883

$3,379

$280.90

24%

$1,883

$6,758

$8,452

$1,279.76

32%

$6,758

$3,379

$4,226

$639.94

32%

$3,379

$8,452

$20,415

$1,821.84

35%

$8,452

$4,226 $10,208

$910.98

35%

$4,226

$20,415

$6,008.89

37%

$20,415

$10,208

$3,004.68

37%

$10,208

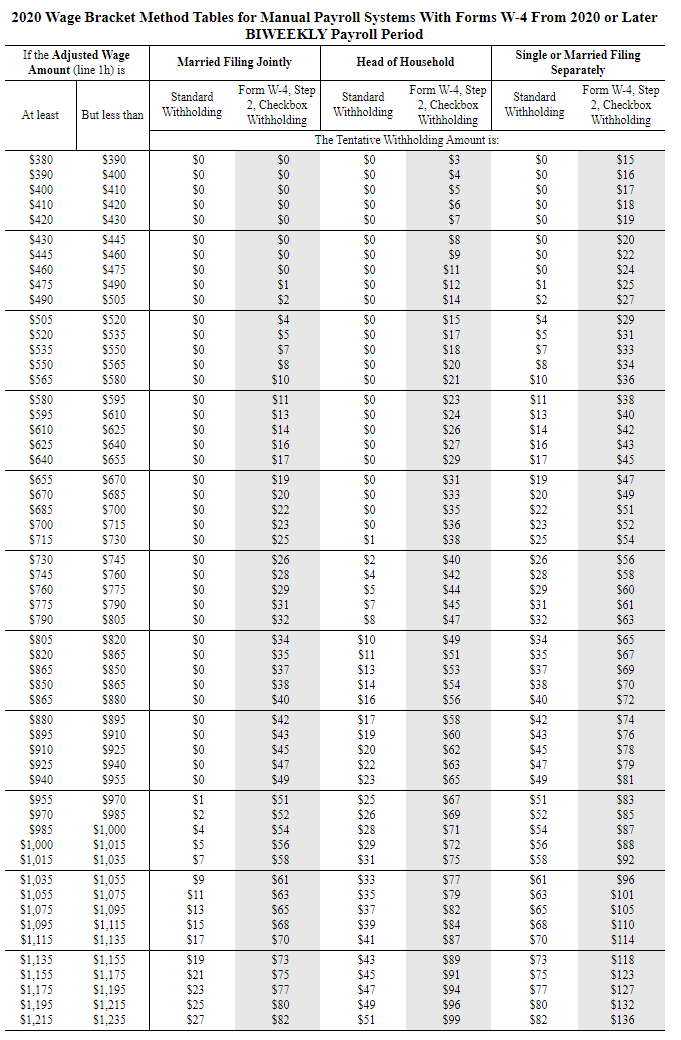

Transcribed Image Text:2020 Wage Bracket Method Tables for Manual Payroll Svstems With Forms W-4 From 2020 or Later

BIWEEKLY Payroll Period

If the Adjusted Wage

Amount (line 1h) is

Single or Married Filing

Married Filing Jointly

Head of Household

Separately

Form W-4, Step

2, Checkbox

Withholding

Form W-4, Step

2, Checkbox

Withholding

Form W-4, Step

2, Checkbox

Withholding

Standard

Standard

Withholding

Standard

At least

But less than

Withholding

Withholding

The Tentative Withholding Amount is:

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$380

$390

$400

$410

$3

$15

$390

$4

$16

$5

$6

$7

$400

$17

$410

$420

$18

$420

$430

$19

$0

$0

$0

$0

$0

$0

$0

$0

$1

$2

$0

$0

$0

$0

$8

$9

$0

$0

$0

$20

$22

$24

$25

$27

$430

$445

$445

$460

$475

$460

$11

$475

$490

$12

$1

$490

$505

$14

$2

$0

$0

$0

$0

$0

$0

$0

$0

$0

SO

$15

$505

$520

$535

$520

$535

$29

$31

$33

$4

$4

$5

$7

$8

$10

$5

$7

$8

$17

$18

$20

$550

$550

$565

$34

$36

$565

$580

$21

$10

SO

$38

$40

$42

$43

$45

$580

$595

$595

$11

$23

$1

$13

$14

$16

$17

$13

$610

$625

$0

$0

$24

$0

$0

$0

$26

$27

$29

$610

$14

$0

$0

$625

$640

$655

$16

$640

$17

$0

$0

$0

$0

$0

$19

$20

$22

$23

$25

$0

$0

$0

$0

$1

$47

$49

$51

$52

$54

$655

$670

$31

$19

$20

$22

$33

$35

$36

$38

$670

$685

$685

$700

$700

$715

$23

$715

$730

$25

$0

$0

$0

$0

$0

$40

$26

$28

$29

$31

$56

$58

$60

$61

$63

$730

$745

$26

$2

$28

$29

$745

$760

ירך>

$4

$42

$5

$7

$8

$760

$775

$44

$45

$47

$775

$790

$31

S790

S805

$32

$32

$805

$0

$0

$0

$0

$34

$35

$37

$38

$10

$11

$13

$34

$35

$37

$38

$65

$67

$69

$70

$72

S820

$49

S820

$865

$51

$865

$850

$53

$850

$865

$14

$54

S865

S880

$0

$40

$16

$56

$40

$0

$0

$0

$0

$17

$58

$60

$62

$63

$65

SS80

S895

$42

$42

$74

$76

$78

$79

$81

S895

$910

$43

$19

$43

$910

$925

$940

$955

$45

$20

$45

$925

$47

$2

$47

$940

$0

so

$49

$23

$49

$1

$51

$67

$51

$52

$83

$85

$87

$8

$92

$955

$970

$25

$970

$985

$2

$52

$26

$985

$1,000

$1,015

$1,000

$1,015

$1,035

$69

$71

$72

$75

$54

$28

$29

$4

$54

$5

$7

$56

$8

$56

$58

$31

$1,035

$1,055

$1,075

$1,095

$1,115

$1,055

$1,075

$1,095

$1,115

$1,135

$9

$61

$33

$77

$79

$82

$61

$63

$96

$1

$63

$65

$68

$70

$35

$37

$39

$101

$13

$65

$105

$15

$4

$87

$68

$110

$17

$41

$70

$114

$73

$1,135

$1,155

$1,175

$1,195

$1,215

$1,155

$1,175

$1,195

$1.215

$1,235

$118

$123

$127

$132

$19

$73

$75

$7

$80

$82

$89

$91

$43

$75

$7

$80

$2

$21

$45

$23

$25

$27

$47

$49

$94

$96

$99

$51

$136

888888888888888888888888

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning