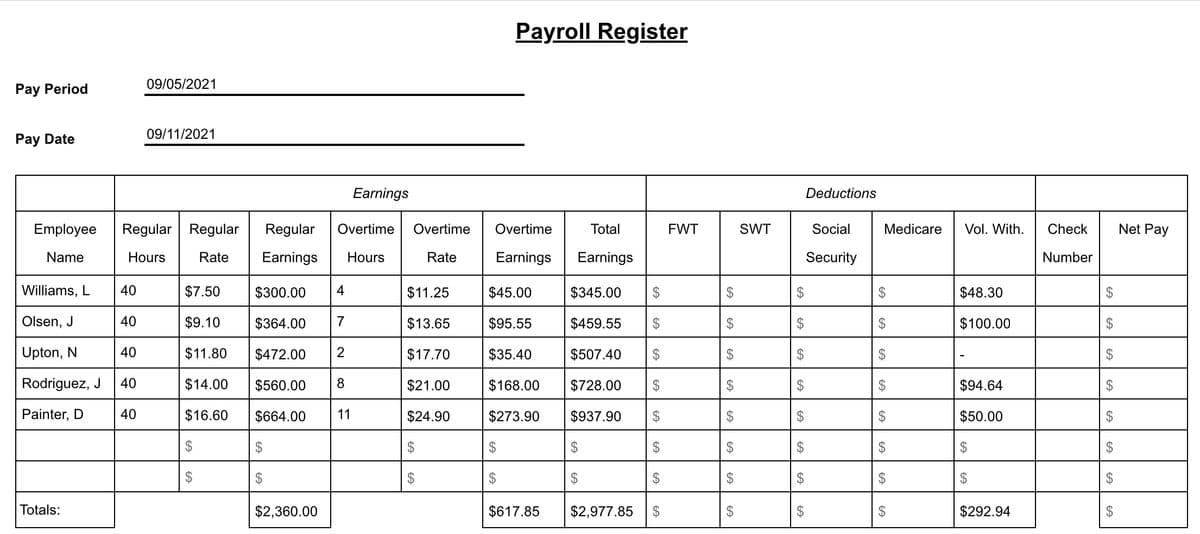

omplete the FWT column (wage-bracket method) and SWT column of the payroll register using the employee data listed below. The associated pay period ends on 09/05/2021 (enter the year using four digits), with paychecks being printed and distributed six days later. Every employee earns hourly overtime wages 1.5 times greater than their regular wage rate. Enter all employees' names in the format Last Name, First Initial (for example: Rick Smith would be written as Smith, R). The state income tax withholding rate is 5.0% of taxable pay, with taxable pay being the same for federal and state income tax withholding. Note that the Voluntary Withholding column, for which partial information is provided below, has been populated based on the partial information shown here. Luisa Williams earns $7.50/hour, and worked 44 hours during the most recent week. She makes a 401(k) retirement plan contribution of 14% of gross pay each period. Luisa Williams is single, and claims one withholding allowance for both federal and state. Jonathan Olsen earns $9.10/hour, and worked 47 hours during the most recent week. He participates in a cafeteria plan, to which he pays $100 each period. Jonathan Olsen is single, claims two federal withholding allowances, and one state withholding allowance. Nathan Upton earns $11.80/hour, and worked 42 hours during the most recent week. He does not make any voluntary deductions each period. Nathan Upton is married, and claims three withholding allowances for both federal and state. Juan Rodriguez earns $14.00/hour, and worked 48 hours during the most recent week. He makes a 403(b) retirement plan contribution of 13% of gross pay each period. Juan Rodriguez is single, and claims one withholding allowance for both federal and state. Drew Painter earns $16.60/hour, and worked 51 hours during the most recent week. He participates in a flexible spending account, to which he contributes $50 each period. Drew Painter is married, claims five federal withholding allowances and four state withholding allowances. Notes: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation.

Complete the FWT column (wage-bracket method) and SWT column of the payroll register using the employee data listed below. The associated pay period ends on 09/05/2021 (enter the year using four digits), with paychecks being printed and distributed six days later. Every employee earns hourly overtime wages 1.5 times greater than their regular wage rate. Enter all employees' names in the format Last Name, First Initial (for example: Rick Smith would be written as Smith, R). The state income tax withholding rate is 5.0% of taxable pay, with taxable pay being the same for federal and state income tax withholding. Note that the Voluntary Withholding column, for which partial information is provided below, has been populated based on the partial information shown here.

- Luisa Williams earns $7.50/hour, and worked 44 hours during the most recent week. She makes a 401(k) retirement plan contribution of 14% of gross pay each period. Luisa Williams is single, and claims one withholding allowance for both federal and state.

- Jonathan Olsen earns $9.10/hour, and worked 47 hours during the most recent week. He participates in a cafeteria plan, to which he pays $100 each period. Jonathan Olsen is single, claims two federal withholding allowances, and one state withholding allowance.

- Nathan Upton earns $11.80/hour, and worked 42 hours during the most recent week. He does not make any voluntary deductions each period. Nathan Upton is married, and claims three withholding allowances for both federal and state.

- Juan Rodriguez earns $14.00/hour, and worked 48 hours during the most recent week. He makes a 403(b) retirement plan contribution of 13% of gross pay each period. Juan Rodriguez is single, and claims one withholding allowance for both federal and state.

- Drew Painter earns $16.60/hour, and worked 51 hours during the most recent week. He participates in a flexible spending account, to which he contributes $50 each period. Drew Painter is married, claims five federal withholding allowances and four state withholding allowances.

Notes:

- For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps