Mary's credit card situation is out of control because she cannot afford to make her monthly payments. She has thr redit cards with the following loan balances and APRS: Card 1, $4,500, 21%; Card 2, $5,700, 25%; and Card 3, 3,100, 19%. Interest compounds monthly on all loan balances. A credit card loan consolidation company has aptured Mary's attention by stating they can save Mary 16% per month on her credit card payments. This compan harges 16.5% APR. Is the company's claim correct? Assume a 10-year repayment period. Mary's current minimum monthly payments are $ (Round to the nearest cent.) Mary's minimum monthly payments after loan consolidation will be $. (Round to the nearest cent.) the company's claim correct? Choose the correct answer below. OA. Yes because Mary's monthly credit card payments will decrease for more than 16%. OB Yes because Mary's monthly credit card payments will increase for less than 16%

Mary's credit card situation is out of control because she cannot afford to make her monthly payments. She has thr redit cards with the following loan balances and APRS: Card 1, $4,500, 21%; Card 2, $5,700, 25%; and Card 3, 3,100, 19%. Interest compounds monthly on all loan balances. A credit card loan consolidation company has aptured Mary's attention by stating they can save Mary 16% per month on her credit card payments. This compan harges 16.5% APR. Is the company's claim correct? Assume a 10-year repayment period. Mary's current minimum monthly payments are $ (Round to the nearest cent.) Mary's minimum monthly payments after loan consolidation will be $. (Round to the nearest cent.) the company's claim correct? Choose the correct answer below. OA. Yes because Mary's monthly credit card payments will decrease for more than 16%. OB Yes because Mary's monthly credit card payments will increase for less than 16%

Chapter6: Business Expenses

Section: Chapter Questions

Problem 89TPC

Related questions

Question

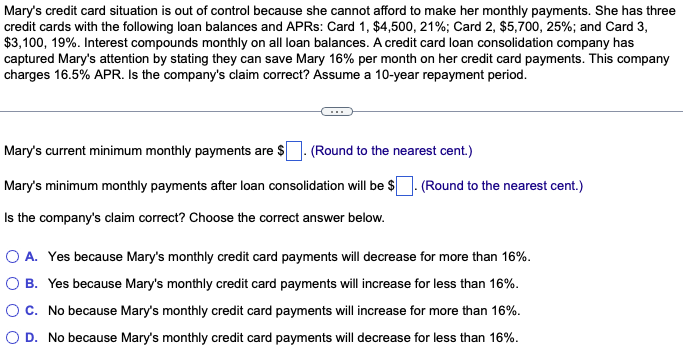

Transcribed Image Text:Mary's credit card situation is out of control because she cannot afford to make her monthly payments. She has three

credit cards with the following loan balances and APRs: Card 1, $4,500, 21%; Card 2, $5,700, 25%; and Card 3,

$3,100, 19%. Interest compounds monthly on all loan balances. A credit card loan consolidation company has

captured Mary's attention by stating they can save Mary 16% per month on her credit card payments. This company

charges 16.5% APR. Is the company's claim correct? Assume a 10-year repayment period.

Mary's current minimum monthly payments are $

(Round to the nearest cent.)

Mary's minimum monthly payments after loan consolidation will be $ . (Round to the nearest cent.)

Is the company's claim correct? Choose the correct answer below.

O A. Yes because Mary's monthly credit card payments will decrease for more than 16%.

O B. Yes because Mary's monthly credit card payments will increase for less than 16%.

C. No because Mary's monthly credit card payments will increase for more than 16%.

O D. No because Mary's monthly credit card payments will decrease for less than 16%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you