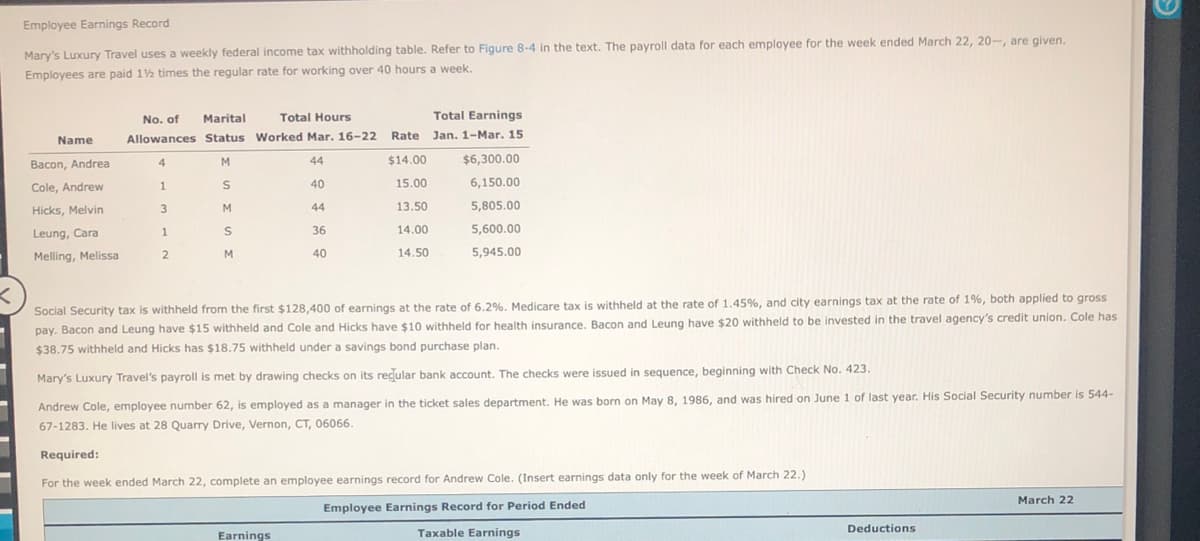

Mary's Luxury Travel uses a weekly federal income tax withholding table. Refer to Figure 8-4 in the text. The payroll data for each employee for the week ended March 22, 20-, are given. Employees are paid 1½ times the regular rate for working over 40 hours a week. Name Bacon, Andrea Cole, Andrew Hicks, Melvin Leung, Cara Melling, Melissa No. of Allowances 4 1 3 1 2 Total Hours Marital Status Worked Mar. 16-22 44 40 44 36 40 M S M S M Rate $14.00 15.00 13.50 14.00 14.50 Total Earnings Jan. 1-Mar. 15 $6,300.00 6,150.00 5,805.00 5,600.00 5,945.00 Social Security tax is withheld from the first $128,400 of earnings at the rate of 6.2%. Medicare tax is withheld at the rate of 1.45%, and city earnings tax at the rate of 1%, both applied to gross pay. Bacon and Leung have $15 withheld and Cole and Hicks have $10 withheld for health insurance. Bacon and Leung have $20 withheld to be invested in the travel agency's credit union. Cole has $38.75 withheld and Hicks has $18.75 withheld under a savings bond purchase plan. Mary's Luxury Travel's payroll is met by drawing checks on its regular bank account. The checks were issued in sequence, beginning with Check No. 423. Andrew Cole, employee number 62, is employed as a manager in the ticket sales department. He was born on May 8, 1986, and was hired on June 1 of last year. His Social Security number is 544- 67-1283. He lives at 28 Quarry Drive, Vernon, CT, 06066.

Mary's Luxury Travel uses a weekly federal income tax withholding table. Refer to Figure 8-4 in the text. The payroll data for each employee for the week ended March 22, 20-, are given. Employees are paid 1½ times the regular rate for working over 40 hours a week. Name Bacon, Andrea Cole, Andrew Hicks, Melvin Leung, Cara Melling, Melissa No. of Allowances 4 1 3 1 2 Total Hours Marital Status Worked Mar. 16-22 44 40 44 36 40 M S M S M Rate $14.00 15.00 13.50 14.00 14.50 Total Earnings Jan. 1-Mar. 15 $6,300.00 6,150.00 5,805.00 5,600.00 5,945.00 Social Security tax is withheld from the first $128,400 of earnings at the rate of 6.2%. Medicare tax is withheld at the rate of 1.45%, and city earnings tax at the rate of 1%, both applied to gross pay. Bacon and Leung have $15 withheld and Cole and Hicks have $10 withheld for health insurance. Bacon and Leung have $20 withheld to be invested in the travel agency's credit union. Cole has $38.75 withheld and Hicks has $18.75 withheld under a savings bond purchase plan. Mary's Luxury Travel's payroll is met by drawing checks on its regular bank account. The checks were issued in sequence, beginning with Check No. 423. Andrew Cole, employee number 62, is employed as a manager in the ticket sales department. He was born on May 8, 1986, and was hired on June 1 of last year. His Social Security number is 544- 67-1283. He lives at 28 Quarry Drive, Vernon, CT, 06066.

College Accounting (Book Only): A Career Approach

12th Edition

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cathy J. Scott

Chapter8: Employer Taxes, Payments, And Reports

Section: Chapter Questions

Problem 3E

Related questions

Question

Transcribed Image Text:Employee Earnings Record

Mary's Luxury Travel uses a weekly federal income tax withholding table. Refer to Figure 8-4 in the text. The payroll data for each employee for the week ended March 22, 20-, are given.

Employees are paid 1½ times the regular rate for working over 40 hours a week.

Name

Bacon, Andrea

Cole, Andrew

Hicks, Melvin

Leung, Cara

Melling, Melissa

No. of

Allowances

4

1

3

1

2

Marital Total Hours

Status Worked Mar. 16-22

44

40

M

S

M

S

M

44

36

40

Earnings

Rate

$14.00

15.00

13.50

14.00

14.50

Total Earnings

Jan. 1-Mar. 15

$6,300.00

6,150.00

5,805.00

5,600.00

5,945.00

<

Social Security tax is withheld from the first $128,400 of earnings at the rate of 6.2%. Medicare tax is withheld at the rate of 1.45%, and city earnings tax at the rate of 1%, both applied to gross

pay. Bacon and Leung have $15 withheld and Cole and Hicks have $10 withheld for health insurance. Bacon and Leung have $20 withheld to be invested in the travel agency's credit union. Cole has

$38.75 withheld and Hicks has $18.75 withheld under a savings bond purchase plan.

Mary's Luxury Travel's payroll is met by drawing checks on its regular bank account. The checks were issued in sequence, beginning with Check No. 423.

Andrew Cole, employee number 62, is employed as a manager in the ticket sales department. He was born on May 8, 1986, and was hired on June 1 of last year. His Social Security number is 544-

67-1283. He lives at 28 Quarry Drive, Vernon, CT, 06066.

Required:

For the week ended March 22, complete an employee earnings record for Andrew Cole. (Insert earnings data only for the week of March 22.)

Employee Earnings Record for Period Ended

Taxable Earnings

Deductions

March 22

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,