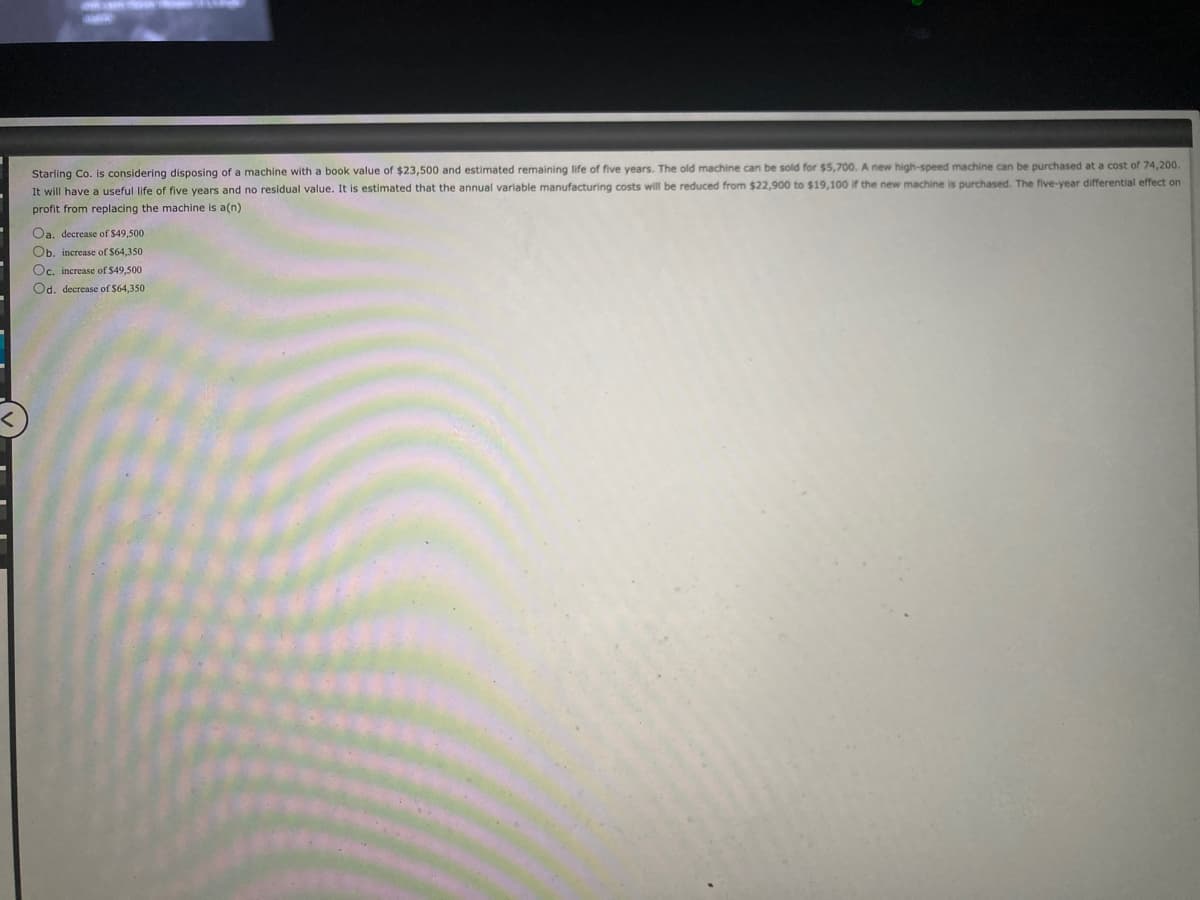

Starling Co. is considering disposing of a machine with a book value of $23,500 and estimated remaining life of five years. The old machine can be sold for $5,700. A new high-speed machine can be purchased at a cost of 74,200. It will have a useful life of five years and no residual value. It is estimated that the annual variable manufacturing costs will be reduced from $22,900 to $19,100 if the new machine is purchased. The five-year differential effect on profit from replacing the machine is a(n) Oa. decrease of $49,500 Ob. increase of $64,350 Oc. increase of $49,500 Od. decrease of $64,350

Q: A subsidiary corporation is liquidated under Section 332. Pursuant to its liquidation, the…

A: In section 332 no gain or loss is recognized by a parent corporation on the receipt of property…

Q: ent time one can enter five-year swaps that exchange LIBOR for 8%. An off-market swap would be…

A: Debts - The sum that the borrower owes the lender constitutes their debt, in its most basic form. A…

Q: What amount of research and development costs should be charged to Bennet’s 2021 statement of profit…

A: The amount of research and development costs charged to Hall's 2013 income statement should be…

Q: Elton Weiss and Reyna Herrera-Weiss are married and report the following income items: Elton's…

A: Adjusted gross income (AGI) is the gross income reduced by adjustments. These adjustments include…

Q: Five fishermen live in a village and have no other employment or income earning possibilities…

A: The question has asked to determine the figures to be filled in those blanks. We may compute…

Q: On January 1, 20X5, Pirate Company acquired all of the outstanding stock of Ship Incorporated, a…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: TB Problem 10-212 (Static) On January 3, 2024, Michelson... On January 3, 2024, Michelson & Sons…

A: Michelson & Sons acquired a land outside a city limit for agreed amount of $2.4 million. $400000…

Q: Presented below are data from the records of Metro Co.…

A: Statement of Cash Flow - Statement of Cash flow show the movement of cash during the financial year.…

Q: BE11-10 In its 2011 annual report, Campbell Soup Company reports beginning-of-the-year total assets…

A: Solution... Average total assets (total Assets at the beginning + total assets at the end) / 2…

Q: uired 1 Required 2 plete the following table showing the relation between sales and return on…

A: Lets understand the basics. Contribution margin is a margin generated on the sales. It is a sales…

Q: Prepare journal entries for the following transactions from Forest Furniture. Oct. 3 Sold 2 couches…

A: Date Particulars Debit ($) Credit ($) Oct 3 Accounts Receivable: Draw Plus ($4900-$171.5) 4,728.5…

Q: Tobias is a 50% partner in Solomon LLC, which does not invest in real estate. On January 1, Tobias's…

A: A capital loss that was incurred in the current or previous year but will not be eligible for…

Q: ents for the year ended December 31, 2020: Interest Due date rate Description National Bank- Long…

A: So there are basically many type of audit procedures that can be applied in order to get the all…

Q: At the beginning of the tax year, Barnaby's basis in the BBB Partnership was $182,600, including his…

A: The amount of cash plus the adjusted basis of any properties that were contributed makes up the…

Q: 1. Skysong Company's unadjusted trial balance at December 31, 2025, included the following accounts.…

A: The accounts receivable means the amount received by the company in the near future. The number of…

Q: Determine the amount to be paid in full settlement of the invoice assuming that credit for returns…

A: FINAL SETTLEMENT AMOUNT Final Settlement Amount is Computed by Deducting Value of Discount From…

Q: The following data were taken from the records of Larkspur Company for the fiscal year ended June…

A: Cost of goods manufactured - Cost of Goods Manufactured is the total cost incurred for manufactured…

Q: In 2022, Zach is single with no dependents. He is not claimed as a dependent on another's return.…

A: Tax credits are sums of money that taxpayers can immediately deduct from their tax liabilities. Tax…

Q: How do we end up with the Ending Inventory of $69112 on the budgeted balance sheet?

A: Budgeting - Budgeting is the method of estimating future sales and expenditures to keep control of…

Q: Suppose the risk-free return is 3.7% and the market portfolio has an expected return of 8.8% and a…

A: To assess market behaviour, one uses the Capital Asset Pricing Model (CAPM). The concept is based on…

Q: Consider the following 2019 data for Madison General Hospital (in millions of dollars): Revenues…

A: Variance is defined as the degree of variability; it is the difference between the actual and the…

Q: Emilia (43) contributed $225 per month to a self-only health savings account (HSA) through her…

A: Health saving accounts established in 2003.it allow to set pre tax income to cover health care cost.…

Q: Gunflint Adventures operates an airplane service that takes fishing parties to a remote lake resort…

A: The portion of a fixed asset that is considered to have been used up in the current period is…

Q: E10.5 (LO 1) (Depreciation Computations-Four Methods) Robert Parish Corporation purchased a new…

A: Since it is a question with multiple sub-parts, we will solve first three sub parts. If want…

Q: aterial is 60 KG iron, natural loss of iron 6%, damaged Pieces 2%, the standard price is $ 16/KG.…

A: Direct Material - Direct materials are the resources and materials used in the production of a…

Q: The Let's Read organization is a public charity under Internal Revenue Code IRS section 501(c)(3).…

A: Oganizations that are classified as public charities are those that:- Are churches, hospitals,…

Q: The Distance Plus partnership has the following capital balances at the beginning of the current…

A: The partnership comes to existence when two or more persons agree to do the business together. They…

Q: Prudential regulation is generally seen to deal with: a. Systematic risks in the financial sector.…

A: Prudential risks are those that can reduce the adequacy of a firm's financial resources, and as a…

Q: Blossom Company issued $900,000, 8-year bonds. It agreed to make annual deposits of $72,000 to a…

A: Bonds are issued by governments and corporations when they want to raise money. By buying a bond,…

Q: A tractor for over-the-road hauling is to be purchased by AgriGrow for $90,000. It is expected to be…

A: Net present value (NPV) is the difference between the present value of cash inflows and the present…

Q: he following data are taken from the records of Dove Company, a division of Oasis Corporation for…

A: Return on sales :— It is calculated by dividing net income by net sales. Asset Turnover :— It is…

Q: Upon receipt of the budget, the team manager, Damion Brownie, has now informed you that, in keeping…

A: A budget is a statement of expected or estimated revenues and expenses for a future period based on…

Q: White Lion Homebuilders is considering investing in a one-year project that new common stock and…

A: Rate of return represents the percentage of earnings the investor would get by investing money in a…

Q: The ABC Inc. operates several stores selling pine furniture. Selected financial ratios are as…

A: When analysing impact of change in one variable in the ratio analysis it is important to understand…

Q: sing the following selected items from the comparative balance sheet of Ivanhoe Company, illustrate…

A: Introduction:- Horizontal analysis interprets the change in financial statements over two or more…

Q: Rob is a quality inspector on the assembly line of a manufacturing company. He is paid P16 per hour…

A: Actual Hours Worked = 45 hours - 2 hours Idle Time = 43 Hours Idle Time = 2 Hours…

Q: Butrico Manufacturing Corporation uses a standard cost system, records materials price variances…

A: Note: As per our guidelines, we will solve the first three subparts for you. 1. Direct…

Q: I.In a wood toy production company, $500 wood, $20 glue and $10 nails was send to the production…

A: Disclaimer : "Since you have asked multiple questions, we will solve the first question for you.…

Q: what is the golden law of accounting?

A: Accounting - Accounting is art of recording transactions done in the financial year. Accounting…

Q: 3-Dec Mrs. Veena started business by introducing cash R$5000 and Rs 500000 as transfer from her…

A: In order to record a business transaction in the accounting records of the company, a journal entry…

Q: 4. The following data are accumulated by Geddes Company in evaluating the purchase of $150,000 of…

A:

Q: Proposed Regressive Plan (Regressive Tax) Calculate the tax for $95,000 . For example,…

A: Tax are to be paid by citizens of country to the government but rate of taxation depends on the…

Q: Bonita company has a factory machine with a book value of $152,000 and a remaining useful life of…

A: Given that there exists no salvage value of old machine and new Machine

Q: 2. An analysis and aging of Concord Corp. accounts receivable at December 31, 2025, disclosed the…

A: Net realizable value is the amount estimated to be collectable. Net realizable value is calculated…

Q: How does a firm evaluate if it has too many or too few current assets vs. its current liabilities?…

A: A firm evaluate if it has too many or too few current assets vs. its current liabilities by…

Q: Hudson Community College enrolls students in two departments, Liberal Arts and Sciences. The college…

A: Hudson Community college enrolls students in two departments liberal arts and sciences. The college…

Q: How do you determine the percentage breakdown for year 2? How is it determined that 86% (85,000…

A: LIFO Method is one of the methods used for measuring the cost of inventory. Under LIFO method, the…

Q: Growth Corporation acquired an 70% interest in Expanded Company on January 1, 2022 for P245,000. On…

A: When one organization acquires more than half of the interest in another organization it is known as…

Q: Material Handling and control: Chocolate Ltd. is Oman based manufacturing Company. Company needs to…

A: Identification of evidence that involved in the Transactions or events took place in the month of…

Q: (a) Determine the total costs that each operating segment would be accountable for if support costs…

A: Meaning of cost allocationAllocating the cost of support department into operating department…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- Dauten is offered a replacement machine which has a cost of 8,000, an estimated useful life of 6 years, and an estimated salvage value of 800. The replacement machine is eligible for 100% bonus depreciation at the time of purchase- The replacement machine would permit an output expansion, so sales would rise by 1,000 per year; even so, the new machines much greater efficiency would cause operating expenses to decline by 1,500 per year The new machine would require that inventories be increased by 2,000, but accounts payable would simultaneously increase by 500. Dautens marginal federal-plus-state tax rate is 25%, and its WACC is 11%. Should it replace the old machine?Although the Chen Company’s milling machine is old, it is still in relatively good working order and would last for another 10 years. It is inefficient compared to modern standards, though, and so the company is considering replacing it. The new milling machine, at a cost of $110,000 delivered and installed, would also last for 10 years and would produce after-tax cash flows (labor savings and depreciation tax savings) of $19,000 per year. It would have zero salvage value at the end of its life. The project cost of capital is 10%, and its marginal tax rate is 25%. Should Chen buy the new machine?Thaler Company bought 26,000 of raw materials a year ago in anticipation of producing 5,000 units of a deluxe version of its product to be priced at 75 each. Now the price of the deluxe version has dropped to 35 each, and Thaler is now deciding whether to produce 1,500 units of the deluxe version at a cost of 48,000 or to scrap the project. What is the opportunity cost of this decision? a. 175,000 b. 375,000 c. 48,000 d. 26,000

- Newmarge Products Inc. is evaluating a new design for one of its manufacturing processes. The new design will eliminate the production of a toxic solid residue. The initial cost of the system is estimated at 860,000 and includes computerized equipment, software, and installation. There is no expected salvage value. The new system has a useful life of 8 years and is projected to produce cash operating savings of 225,000 per year over the old system (reducing labor costs and costs of processing and disposing of toxic waste). The cost of capital is 16%. Required: 1. Compute the NPV of the new system. 2. One year after implementation, the internal audit staff noted the following about the new system: (1) the cost of acquiring the system was 60,000 more than expected due to higher installation costs, and (2) the annual cost savings were 20,000 less than expected because more labor cost was needed than anticipated. Using the changes in expected costs and benefits, compute the NPV as if this information had been available one year ago. Did the company make the right decision? 3. CONCEPTUAL CONNECTION Upon reporting the results mentioned in the postaudit, the marketing manager responded in a memo to the internal audit department indicating that cash inflows also had increased by a net of 60,000 per year because of increased purchases by environmentally sensitive customers. Describe the effect that this has on the analysis in Requirement 2. 4. CONCEPTUAL CONNECTION Why is a postaudit beneficial to a firm?Filkins Fabric Company is considering the replacement of its old, fully depreciated knitting machine. Two new models are available: Machine 190-3, which has a cost of $190,000, a 3-year expected life, and after-tax cash flows (labor savings and depreciation) of $87,000 per year; and Machine 360-6, which has a cost of $360,000, a 6-year life, and after-tax cash flows of $98,300 per year. Knitting machine prices are not expected to rise because inflation will be offset by cheaper components (microprocessors) used in the machines. Assume that Filkins’ cost of capital is 14%. Should the firm replace its old knitting machine? If so, which new machine should it use? By how much would the value of the company increase if it accepted the better machine? What is the equivalent annual annuity for each machine?Jonfran Company manufactures three different models of paper shredders including the waste container, which serves as the base. While the shredder heads are different for all three models, the waste container is the same. The number of waste containers that Jonfran will need during the following years is estimated as follows: The equipment used to manufacture the waste container must be replaced because it is broken and cannot be repaired. The new equipment would have a purchase price of 945,000 with terms of 2/10, n/30; the companys policy is to take all purchase discounts. The freight on the equipment would be 11,000, and installation costs would total 22,900. The equipment would be purchased in December 20x4 and placed into service on January 1, 20x5. It would have a five-year economic life and would be treated as three-year property under MACRS. This equipment is expected to have a salvage value of 12,000 at the end of its economic life in 20x9. The new equipment would be more efficient than the old equipment, resulting in a 25 percent reduction in both direct materials and variable overhead. The savings in direct materials would result in an additional one-time decrease in working capital requirements of 2,500, resulting from a reduction in direct material inventories. This working capital reduction would be recognized at the time of equipment acquisition. The old equipment is fully depreciated and is not included in the fixed overhead. The old equipment from the plant can be sold for a salvage amount of 1,500. Rather than replace the equipment, one of Jonfrans production managers has suggested that the waste containers be purchased. One supplier has quoted a price of 27 per container. This price is 8 less than Jonfrans current manufacturing cost, which is as follows: Jonfran uses a plantwide fixed overhead rate in its operations. If the waste containers are purchased outside, the salary and benefits of one supervisor, included in fixed overhead at 45,000, would be eliminated. There would be no other changes in the other cash and noncash items included in fixed overhead except depreciation on the new equipment. Jonfran is subject to a 40 percent tax rate. Management assumes that all cash flows occur at the end of the year and uses a 12 percent after-tax discount rate. Required: 1. Prepare a schedule of cash flows for the make alternative. Calculate the NPV of the make alternative. 2. Prepare a schedule of cash flows for the buy alternative. Calculate the NPV of the buy alternative. 3. Which should Jonfran domake or buy the containers? What qualitative factors should be considered? (CMA adapted)

- Friedman Company is considering installing a new IT system. The cost of the new system is estimated to be 2,250,000, but it would produce after-tax savings of 450,000 per year in labor costs. The estimated life of the new system is 10 years, with no salvage value expected. Intrigued by the possibility of saving 450,000 per year and having a more reliable information system, the president of Friedman has asked for an analysis of the projects economic viability. All capital projects are required to earn at least the firms cost of capital, which is 12 percent. Required: 1. Calculate the projects internal rate of return. Should the company acquire the new IT system? 2. Suppose that savings are less than claimed. Calculate the minimum annual cash savings that must be realized for the project to earn a rate equal to the firms cost of capital. Comment on the safety margin that exists, if any. 3. Suppose that the life of the IT system is overestimated by two years. Repeat Requirements 1 and 2 under this assumption. Comment on the usefulness of this information.Talbot Industries is considering launching a new product. The new manufacturing equipment will cost 17 million, and production and sales will require an initial 5 million investment in net operating working capital. The companys tax rate is 40%. a. What is the initial investment outlay? b. The company spent and expensed 150,000 on research related to the new product last year. Would this change your answer? Explain. c. Rather than build a new manufacturing facility, the company plans to install the equipment in a building it owns but is not now using. The building could be sold for 1.5 million after taxes and real estate commissions. How would this affect your answer?Caduceus Company is considering the purchase of a new piece of factory equipment that will cost $565,000 and will generate $135,000 per year for 5 years. Calculate the IRR for this piece of equipment. For further instructions on internal rate of return In Excel, see Appendix C.

- Mallette Manufacturing, Inc., produces washing machines, dryers, and dishwashers. Because of increasing competition, Mallette is considering investing in an automated manufacturing system. Since competition is most keen for dishwashers, the production process for this line has been selected for initial evaluation. The automated system for the dishwasher line would replace an existing system (purchased one year ago for 6 million). Although the existing system will be fully depreciated in nine years, it is expected to last another 10 years. The automated system would also have a useful life of 10 years. The existing system is capable of producing 100,000 dishwashers per year. Sales and production data using the existing system are provided by the Accounting Department: All cash expenses with the exception of depreciation, which is 6 per unit. The existing equipment is being depreciated using straight-line with no salvage value considered. The automated system will cost 34 million to purchase, plus an estimated 20 million in software and implementation. (Assume that all investment outlays occur at the beginning of the first year.) If the automated equipment is purchased, the old equipment can be sold for 3 million. The automated system will require fewer parts for production and will produce with less waste. Because of this, the direct material cost per unit will be reduced by 25 percent. Automation will also require fewer support activities, and as a consequence, volume-related overhead will be reduced by 4 per unit and direct fixed overhead (other than depreciation) by 17 per unit. Direct labor is reduced by 60 percent. Assume, for simplicity, that the new investment will be depreciated on a pure straight-line basis for tax purposes with no salvage value. Ignore the half-life convention. The firms cost of capital is 12 percent, but management chooses to use 20 percent as the required rate of return for evaluation of investments. The combined federal and state tax rate is 40 percent. Required: 1. Compute the net present value for the old system and the automated system. Which system would the company choose? 2. Repeat the net present value analysis of Requirement 1, using 12 percent as the discount rate. 3. Upon seeing the projected sales for the old system, the marketing manager commented: Sales of 100,000 units per year cannot be maintained in the current competitive environment for more than one year unless we buy the automated system. The automated system will allow us to compete on the basis of quality and lead time. If we keep the old system, our sales will drop by 10,000 units per year. Repeat the net present value analysis, using this new information and a 12 percent discount rate. 4. An industrial engineer for Mallette noticed that salvage value for the automated equipment had not been included in the analysis. He estimated that the equipment could be sold for 4 million at the end of 10 years. He also estimated that the equipment of the old system would have no salvage value at the end of 10 years. Repeat the net present value analysis using this information, the information in Requirement 3, and a 12 percent discount rate. 5. Given the outcomes of the previous four requirements, comment on the importance of providing accurate inputs for assessing investments in automated manufacturing systems.The Aubey Coffee Company is evaluating the within-plant distribution system for its new roasting, grinding, and packing plant. The two alternatives are (1) a conveyor system with a high initial cost but low annual operating costs and (2) several forklift trucks, which cost less but have considerably higher operating costs. The decision to construct the plant has already been made, and the choice here will have no effect on the overall revenues of the project. The cost of capital for the plant is 8%, and the projects’ expected net costs are listed in the following table: What is the IRR of each alternative? What is the present value of the costs of each alternative? Which method should be chosen?Flanders Manufacturing is considering purchasing a new machine that will reduce variable costs per part produced by $0.15. The machine will increase fixed costs by $18,250 per year. The information they will use to consider these changes is shown here.