Mary's Music Store reported net income of $147,000. Beginning balances in Accounts Receivable and Accounts Payable were $26,500 and $20,500, respectively. Ending balances in these accounts were $33,500 and $14,800, respectively. ASsuming that all relevant information has been presented, Mary's net cash flows from operating activities would be Multiple Choice $159,700. $148,300. $145,700. $134,300.

Mary's Music Store reported net income of $147,000. Beginning balances in Accounts Receivable and Accounts Payable were $26,500 and $20,500, respectively. Ending balances in these accounts were $33,500 and $14,800, respectively. ASsuming that all relevant information has been presented, Mary's net cash flows from operating activities would be Multiple Choice $159,700. $148,300. $145,700. $134,300.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter3: Accrual Accounting

Section: Chapter Questions

Problem 5MCQ: Dallas Company loaned to Ewing Company on December 1, 2019. Ewing will pay Dallas $720 of interest...

Related questions

Question

Please answer both. This is part A and B

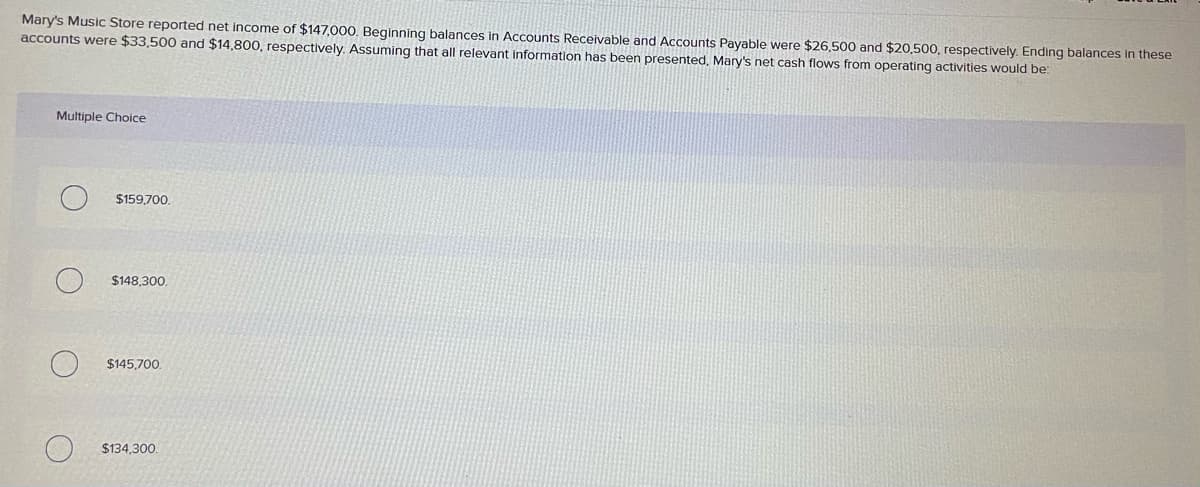

Transcribed Image Text:Mary's Music Store reported net income of $147,000. Beginning balances in Accounts Receivable and Accounts Payable were $26,500 and $20,500, respectively. Ending balances in these

accounts were $33,500 and $14,800, respectively. ASsuming that all relevant information has been presented, Mary's net cash flows from operating activities would be:

Multiple Choice

$159,700,

$148,300.

$145,700.

$134,300.

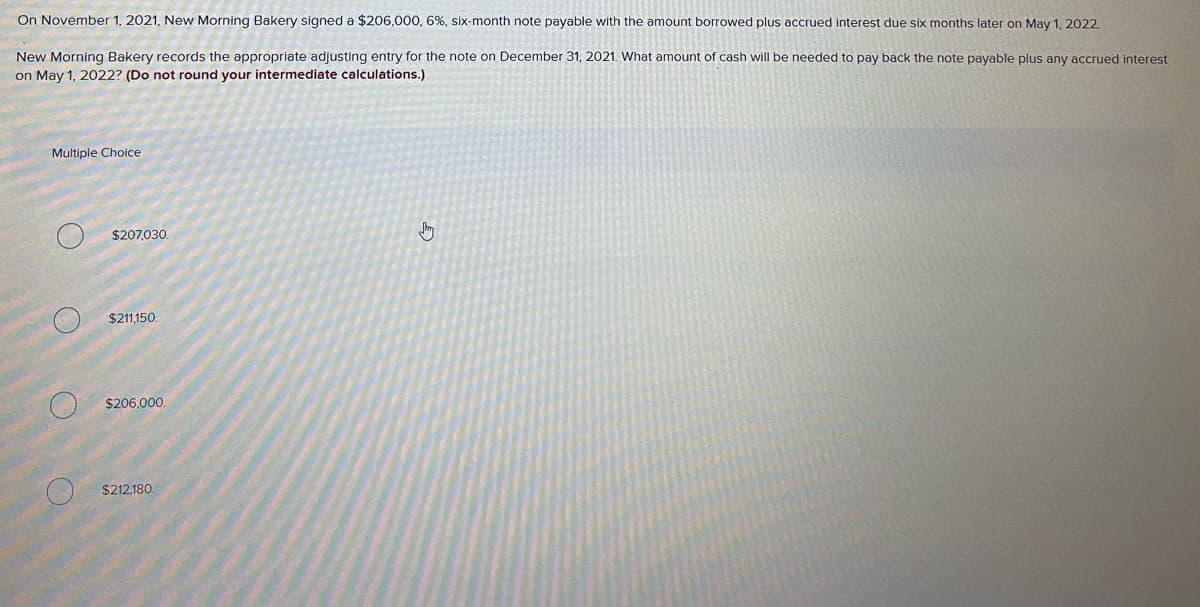

Transcribed Image Text:On November 1, 2021, New Morning Bakery signed a $206,000, 6%, six-month note payable with the amount borrowed plus accrued interest due six months later on May 1, 2022.

New Morning Bakery records the appropriate adjusting entry for the note on December 31, 2021. What amount of cash will be needed to pay back the note payable plus any accrued interest

on May 1, 2022? (Do not round your intermediate calculations.)

Multiple Choice

$207,030.

$211.150.

O $206,000.

$212.180.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT