Match each item on the left to the appropriate cash flow classification on the right. (You may use each classification r than once -- or not at all.) A company purchases a warehouse for $350,000 cash. A. Cash flow from operating activities. B. Cash flows from financing activities. C. No cash flow effect. ✓ A company uses $100,000 to pay dividends on common stock. D. Cash flow from investing activities. ✓ A company acquires equipment by signing a note payable for the purchase amount. A company collects $50,000 from a customer to provide services over the next year. ✓ A company pays interest of $50,000 on outstanding bonds payable

Match each item on the left to the appropriate cash flow classification on the right. (You may use each classification r than once -- or not at all.) A company purchases a warehouse for $350,000 cash. A. Cash flow from operating activities. B. Cash flows from financing activities. C. No cash flow effect. ✓ A company uses $100,000 to pay dividends on common stock. D. Cash flow from investing activities. ✓ A company acquires equipment by signing a note payable for the purchase amount. A company collects $50,000 from a customer to provide services over the next year. ✓ A company pays interest of $50,000 on outstanding bonds payable

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter13: Statement Of Cash Flows

Section: Chapter Questions

Problem 13.2EX: Effect of transactions on cash flows State the effect (cash receipt or cash payment and amount) of...

Related questions

Question

Question 8?

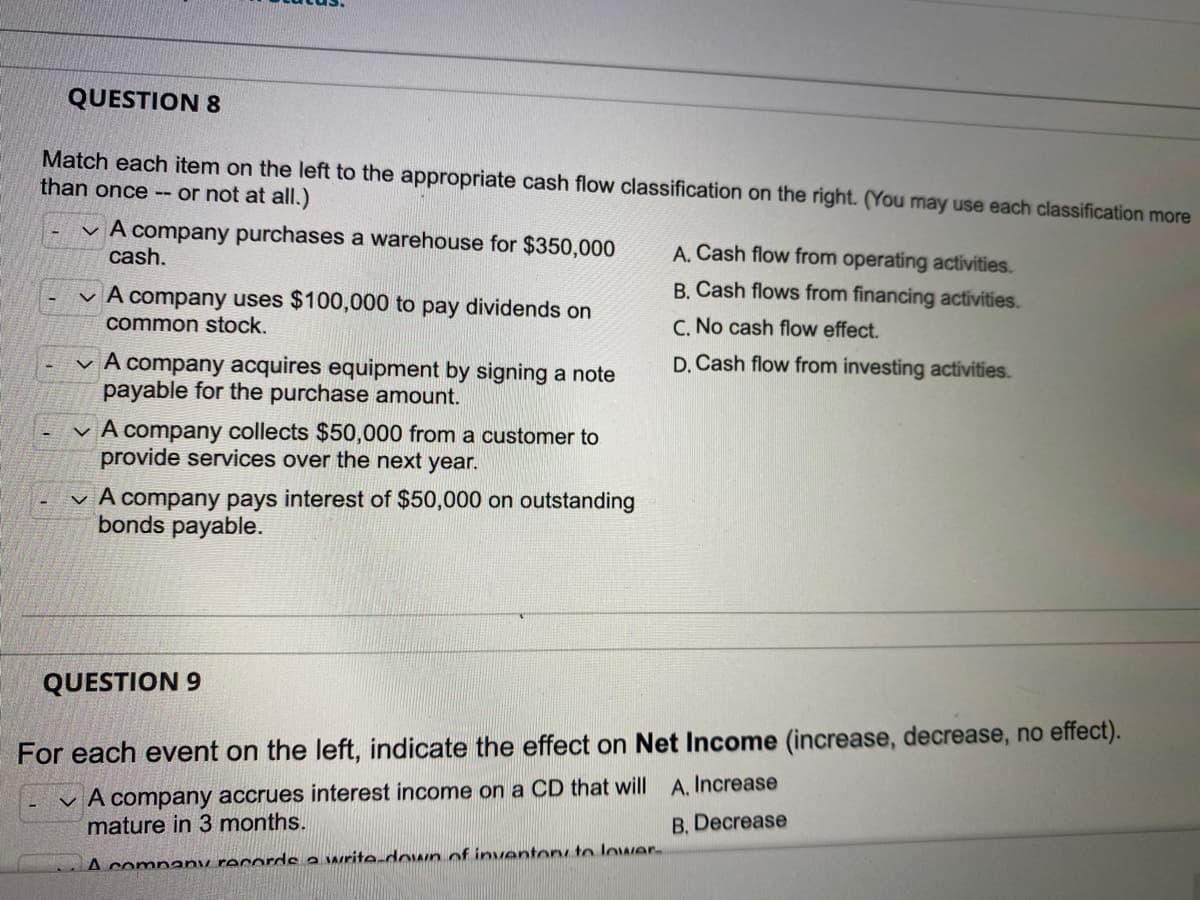

Transcribed Image Text:QUESTION 8

Match each item on the left to the appropriate cash flow classification on the right. (You may use each classification more

than once -- or not at all.)

A company purchases a warehouse for $350,000

cash.

A. Cash flow from operating activities.

B. Cash flows from financing activities.

A company uses $100,000 to pay dividends on

common stock.

C. No cash flow effect.

D. Cash flow from investing activities.

✓ A company acquires equipment by signing a note

payable for the purchase amount.

✓ A company collects $50,000 from a customer to

provide services over the next year.

✓ A company pays interest of $50,000 on outstanding

bonds payable.

QUESTION 9

For each event on the left, indicate the effect on Net Income (increase, decrease, no effect).

A company accrues interest income on a CD that will A. Increase

mature in 3 months.

B. Decrease

A company records a write-down of inventory to lower

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning