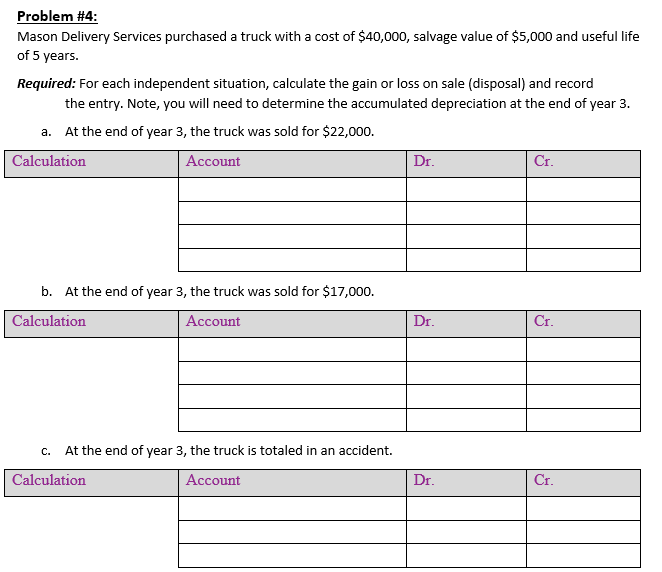

Mason Delivery Services purchased a truck with a cost of $40,000, salvage value of $5,000 and useful life of 5 years. Required: For each independent situation, calculate the gain or loss on sale (disposal) and record the entry. Note, you will need to determine the accumulated depreciation at the end of year 3. a. At the end of year 3, the truck was sold for $22,000. Calculation Account Dr. Cr. b. At the end of year 3, the truck was sold for $17,00o. Calculation Account Dr. Cr. c. At the end of year 3, the truck is totaled in an accident. Calculation Account Dr. Cr.

Mason Delivery Services purchased a truck with a cost of $40,000, salvage value of $5,000 and useful life of 5 years. Required: For each independent situation, calculate the gain or loss on sale (disposal) and record the entry. Note, you will need to determine the accumulated depreciation at the end of year 3. a. At the end of year 3, the truck was sold for $22,000. Calculation Account Dr. Cr. b. At the end of year 3, the truck was sold for $17,00o. Calculation Account Dr. Cr. c. At the end of year 3, the truck is totaled in an accident. Calculation Account Dr. Cr.

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 4EA: Montello Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and is...

Related questions

Question

How do I do this?

Transcribed Image Text:Problem #4:

Mason Delivery Services purchased a truck with a cost of $40,000, salvage value of $5,000 and useful life

of 5 years.

Required: For each independent situation, calculate the gain or loss on sale (disposal) and record

the entry. Note, you will need to determine the accumulated depreciation at the end of year 3.

a. At the end of year 3, the truck was sold for $22,000.

Calculation

Account

Dr.

Cr.

b. At the end of year 3, the truck was sold for $17,000.

Calculation

Account

Dr.

Cr.

C.

At the end of year 3, the truck is totaled in an accident.

Calculation

Account

Dr.

Cr.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning