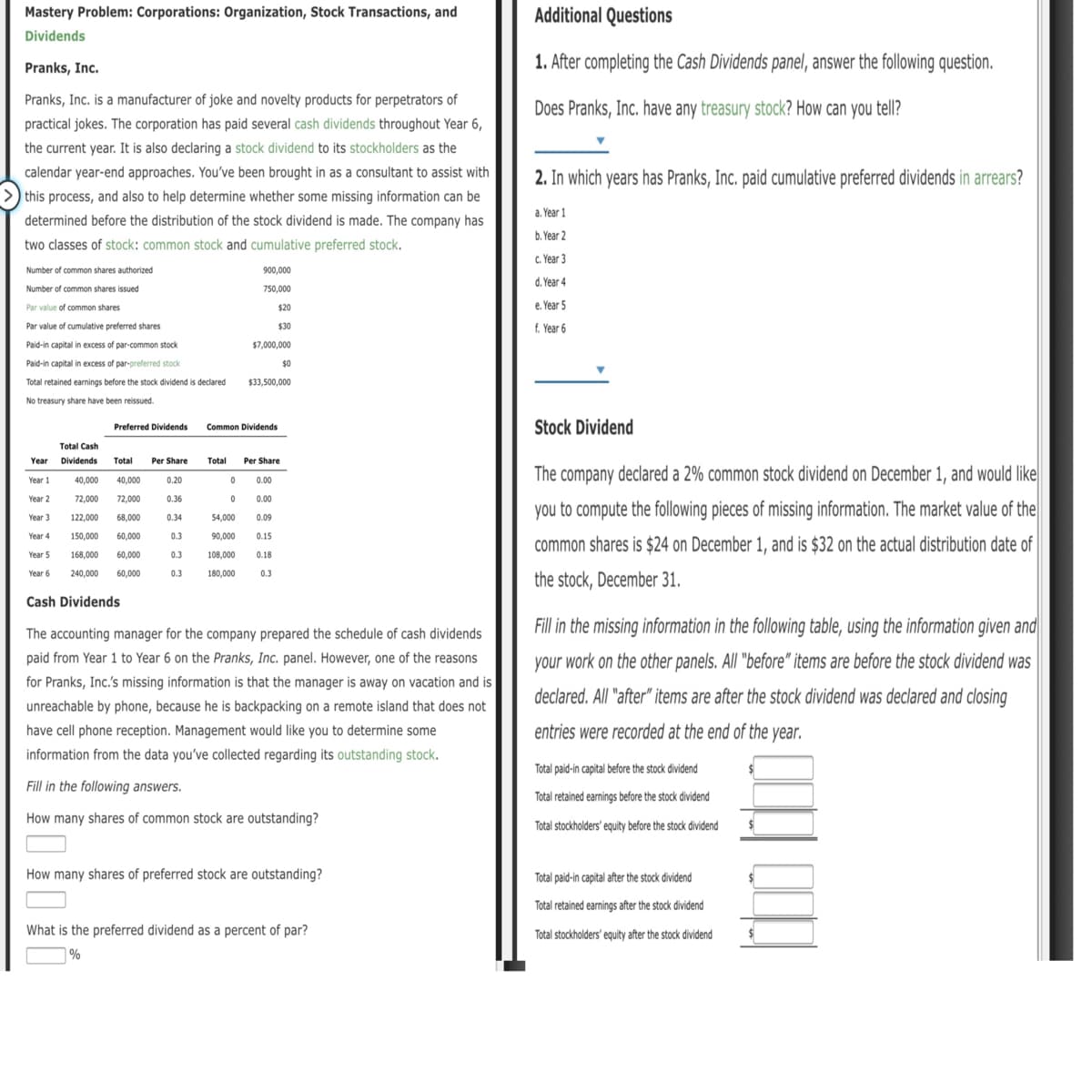

Mastery Problem: Corporations: Organization, Stock Transactions, and Additional Questions Dividends Pranks, Inc. 1. After completing the Cash Dividends panel, answer the following question. Pranks, Inc. is a manufacturer of joke and novelty products for perpetrators of Does Pranks, Inc. have any treasury stock? How can you tell? practical jokes. The corporation has paid several cash dividends throughout Year 6, the current year. It is also declaring a stock dividend to its stockholders as the calendar year-end approaches. You've been brought in as a consultant to assist with 2. In which years has Pranks, Inc. paid cumulative preferred dividends in arrears? this process, and also to help determine whether some missing information can be a. Year 1 determined before the distribution of the stock dividend is made. The company has b. Year 2 two classes of stock: common stock and cumulative preferred stock. C. Year 3 Number of common shares authorized 900,000 d. Year 4 Number of common shares issued 750,000 Par value of common shares $20 e. Year 5 Par value of cumulative preferred shares $30 f. Year 6 Paid-in capital in excess of par-common stock $7,000,000 Paid-in capital in excess of par-preferred stock $0 Total retained earnings before the stock dividend is declared $33,500,000 No treasury share have been reissued. Stock Dividend Preferred Dividends Common Dividends Total Cash Year Dividends Total Per Share Total Per Share The company declared a 2% common stock dividend on December 1, and would l Year 1 40,000 40,000 0.20 0.00 Year 2 72,000 72,000 0.36 0.00 you to compute the following pieces of missing information. The market value of t: Year 3 122,000 68,000 0.34 54,000 0.09 Year 4 150,000 60,000 0.3 90,000 0.15 common shares is $24 on December 1, and is $32 on the actual distribution date Year 5 168,000 60,000 0.3 108,000 0.18 Year 6 240,000 60,000 0.3 180,000 0.3 the stock, December 31. Cash Dividends Fill in the missing information in the following table, using the information given a The accounting manager for the company prepared the schedule of cash dividends paid from Year 1 to Year 6 on the Pranks, Inc. panel. However, one of the reasons your work on the other panels. All "before" items are before the stock dividend wa for Pranks, Inc.'s missing information is that the manager is away on vacation and is declared. All "after" items are after the stock dividend was declared and closing unreachable by phone, because he is backpacking on a remote island that does not have cell phone reception. Management would like you to determine some entries were recorded at the end of the year. information from the data you've collected regarding its outstanding stock. Total paid-in capital before the stock dividend Fill in the following answers. I retained earnings I e stock dividend How many shares of common stock are outstanding? Total stockholders' equity before the stock dividend How many shares of preferred stock are outstanding? Total paid-in capital after the stock dividend Total retained earnings after the stock dividend What is the preferred dividend as a percent of par? Total stockholders' equity after the stock dividend

Mastery Problem: Corporations: Organization, Stock Transactions, and Additional Questions Dividends Pranks, Inc. 1. After completing the Cash Dividends panel, answer the following question. Pranks, Inc. is a manufacturer of joke and novelty products for perpetrators of Does Pranks, Inc. have any treasury stock? How can you tell? practical jokes. The corporation has paid several cash dividends throughout Year 6, the current year. It is also declaring a stock dividend to its stockholders as the calendar year-end approaches. You've been brought in as a consultant to assist with 2. In which years has Pranks, Inc. paid cumulative preferred dividends in arrears? this process, and also to help determine whether some missing information can be a. Year 1 determined before the distribution of the stock dividend is made. The company has b. Year 2 two classes of stock: common stock and cumulative preferred stock. C. Year 3 Number of common shares authorized 900,000 d. Year 4 Number of common shares issued 750,000 Par value of common shares $20 e. Year 5 Par value of cumulative preferred shares $30 f. Year 6 Paid-in capital in excess of par-common stock $7,000,000 Paid-in capital in excess of par-preferred stock $0 Total retained earnings before the stock dividend is declared $33,500,000 No treasury share have been reissued. Stock Dividend Preferred Dividends Common Dividends Total Cash Year Dividends Total Per Share Total Per Share The company declared a 2% common stock dividend on December 1, and would l Year 1 40,000 40,000 0.20 0.00 Year 2 72,000 72,000 0.36 0.00 you to compute the following pieces of missing information. The market value of t: Year 3 122,000 68,000 0.34 54,000 0.09 Year 4 150,000 60,000 0.3 90,000 0.15 common shares is $24 on December 1, and is $32 on the actual distribution date Year 5 168,000 60,000 0.3 108,000 0.18 Year 6 240,000 60,000 0.3 180,000 0.3 the stock, December 31. Cash Dividends Fill in the missing information in the following table, using the information given a The accounting manager for the company prepared the schedule of cash dividends paid from Year 1 to Year 6 on the Pranks, Inc. panel. However, one of the reasons your work on the other panels. All "before" items are before the stock dividend wa for Pranks, Inc.'s missing information is that the manager is away on vacation and is declared. All "after" items are after the stock dividend was declared and closing unreachable by phone, because he is backpacking on a remote island that does not have cell phone reception. Management would like you to determine some entries were recorded at the end of the year. information from the data you've collected regarding its outstanding stock. Total paid-in capital before the stock dividend Fill in the following answers. I retained earnings I e stock dividend How many shares of common stock are outstanding? Total stockholders' equity before the stock dividend How many shares of preferred stock are outstanding? Total paid-in capital after the stock dividend Total retained earnings after the stock dividend What is the preferred dividend as a percent of par? Total stockholders' equity after the stock dividend

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter21: Corporations: Taxes, Earnings, Distributions, And The Statement Of Retained Earnings

Section: Chapter Questions

Problem 1MYW

Related questions

Question

Transcribed Image Text:Mastery Problem: Corporations: Organization, Stock Transactions, and

Additional Questions

Dividends

Pranks, Inc.

1. After completing the Cash Dividends panel, answer the following question.

Pranks, Inc. is a manufacturer of joke and novelty products for perpetrators of

Does Pranks, Inc. have any treasury stock? How can you tell?

practical jokes. The corporation has paid several cash dividends throughout Year 6,

the current year. It is also declaring a stock dividend to its stockholders as the

calendar year-end approaches. You've been brought in as a consultant to assist with

2. In which years has Pranks, Inc. paid cumulative preferred dividends in arrears?

>) this process, and also to help determine whether some missing information can be

a. Year 1

determined before the distribution of the stock dividend is made. The company has

b. Year 2

two classes of stock: common stock and cumulative preferred stock.

C. Year 3

Number of common shares authorized

900,000

d. Year 4

Number of common shares issued

750,000

Par value of common shares

$20

e. Year 5

Par value of cumulative preferred shares

$30

f. Year 6

Paid-in capital in excess of par-common stock

$7,000,000

Paid-in capital in excess of par-preferred stock

$0

Total retained earnings before the stock dividend is declared

$33,500,000

No treasury share have been reissued.

Stock Dividend

Preferred Dividends

Common Dividends

Total Cash

Year

Dividends

Total

Per Share

Total

Per Share

The company declared a 2% common stock dividend on December 1, and would like|

Year 1

40,000

40,000

0.20

0.00

Year 2

72,000

72,000

0.36

0.00

you to compute the following pieces of missing information. The market value of the

Year 3

122,000

68,000

0.34

54,000

0.09

150,000

60,000

0.3

90,000

0.15

common shares is $24 on December 1, and is $32 on the actual distribution date of

Year 5

168,000

60,000

0.3

108,000

0.18

Year 6

240,000

60,000

0.3

180,000

0.3

the stock, December 31.

Cash Dividends

Fill in the missing information in the following table, using the information given and

The accounting manager for the company prepared the schedule of cash dividends

paid from Year 1 to Year 6 on the Pranks, Inc. panel. However, one of the reasons

your work on the other panels. All "before" items are before the stock dividend was

for Pranks, Inc.'s missing information is that the manager is away on vacation and is

declared. All "after" items are after the stock dividend was declared and closing

unreachable by phone, because he is backpacking on a remote island that does not

have cell phone reception. Management would like you to determine some

entries were recorded at the end of the year.

information from the data you've collected regarding its outstanding stock.

Total paid-in capital before the stock dividend

%24

Fill in the following answers.

Total retained earnings before the stock dividend

How many shares of common stock are outstanding?

Total stockholders' equity before the stock dividend

How many shares of preferred stock are outstanding?

Total paid-in capital after the stock dividend

Total retained earnings after the stock dividend

What is the preferred dividend as a percent of par?

Total stockholders' equity after the stock dividend

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning