. the preference share stock is both cumulative and participating e. the preference share is participating only up to 15%

. the preference share stock is both cumulative and participating e. the preference share is participating only up to 15%

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter21: Corporations: Taxes, Earnings, Distributions, And The Statement Of Retained Earnings

Section: Chapter Questions

Problem 3SEA

Related questions

Question

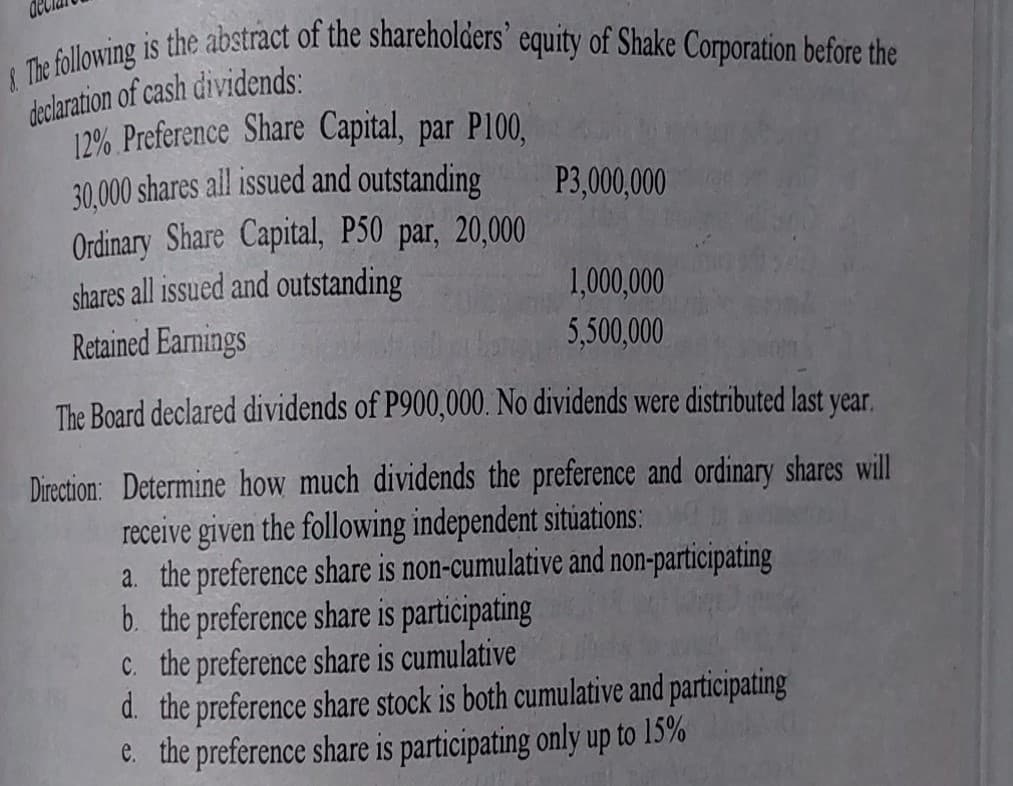

8. The following is the abstract of the shareholders’ equity of Shake Corporation before the declaration of cash dividends:(see attached image for the give. please answer it. thank you so much)The Board declared dividends of P900,000. No dividends were distributed last year.

(see attached image for the given. someone already answer letter a to c, so please answer letter d to e, please answer it based on your knowledge. thank you so much!)

Direction: Determine how much dividends the preference and ordinary shares will receive given the following independent situations:

d. the

e. the preference share is participating only up to 15%

Transcribed Image Text:I The following is the abstract of the shareholders' equity of Shake Corporation before the

declaration of cash dividends:

12% Preference Share Capital, par P100,

30,000 shares all issued and outstanding

Ordinary Share Capital, P50 par, 20,000

shares all issued and outstanding

Retained Earnings

P3,000,000

1,000,000

5,500,000

The Board declared dividends of P900,000. No dividends were distributed last year.

Direction: Determine how much dividends the preference and ordinary shares will

receive given the following independent situations:

a. the preference share is non-cumulative and non-participating

b. the preference share is participating

C. the preference share is cumulative

d. the preference share stock is both cumulative and participating

C. the preference share is participating only up to 15%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning