Match each of the following terms with its correct definition: v job-order costing system A. A single overhead rate calculated using all estimated overhead for a factory divided by the estimated activity level across the entire factory v Process-costing system B. A costing system that accumulates production costs by process or by department for a given period of v overapplied overhead time plantwide overhead rate

Match each of the following terms with its correct definition: v job-order costing system A. A single overhead rate calculated using all estimated overhead for a factory divided by the estimated activity level across the entire factory v Process-costing system B. A costing system that accumulates production costs by process or by department for a given period of v overapplied overhead time plantwide overhead rate

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter4: Job-order Costing And Overhead Application

Section: Chapter Questions

Problem 3MCQ: In a normal costing system, the cost of a job includes a. actual direct materials, actual direct...

Related questions

Question

Help plz

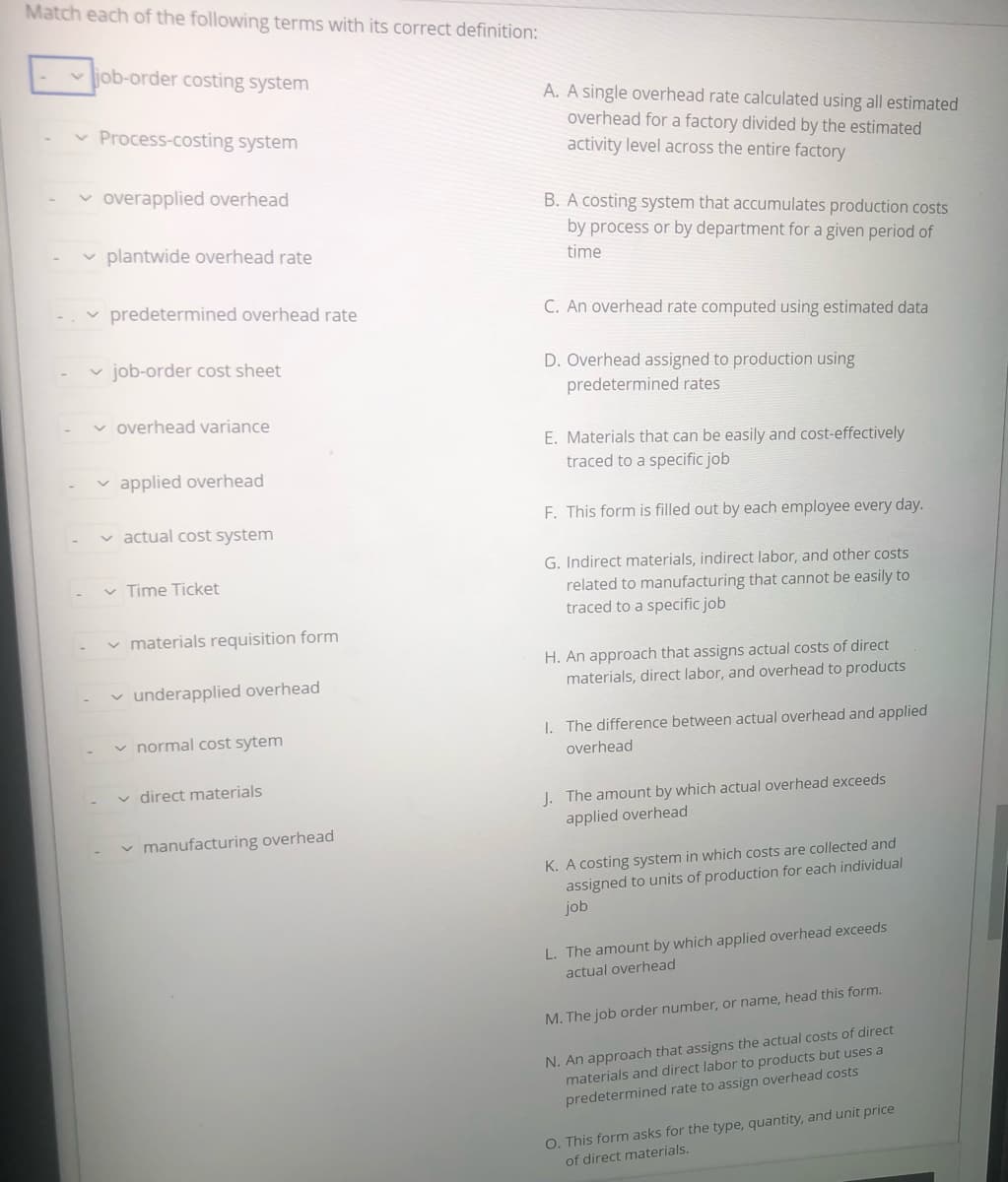

Transcribed Image Text:Match each of the following terms with its correct definition:

v job-order costing system

A. A single overhead rate calculated using all estimated

overhead for a factory divided by the estimated

v Process-costing system

activity level across the entire factory

v overapplied overhead

B. A costing system that accumulates production costs

by process or by department for a given period of

plantwide overhead rate

time

predetermined overhead rate

C. An overhead rate computed using estimated data

v job-order cost sheet

D. Overhead assigned to production using

predetermined rates

v overhead variance

E. Materials that can be easily and cost-effectively

traced to a specific job

v applied overhead

F. This form is filled out by each employee every day.

v actual cost system

G. Indirect materials, indirect labor, and other costs

related to manufacturing that cannot be easily to

traced to a specific job

v Time Ticket

v materials requisition form

H. An approach that assigns actual costs of direct

materials, direct labor, and overhead to products

v underapplied overhead

v normal cost sytem

I. The difference between actual overhead and applied

overhead

v direct materials

J. The amount by which actual overhead exceeds

applied overhead

v manufacturing overhead

K. A costing system in which costs are collected and

assigned to units of production for each individual

job

L. The amount by which applied overhead exceeds

actual overhead

M. The job order number, or name, head this form.

N. An approach that assigns the actual costs of direct

materials and direct labor to products but uses a

predetermined rate to assign overhead costs

O. This form asks for the type, quantity, and unit price

of direct materials.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning