Matrix Inc. borrowed $1,100,000 at 8% to finance the construction of a new building for its own use. Construction began on January 1, 2019, and was completed on October 31, 2019. Expenditures related to this building were: January 1 $258,000 (includes cost of purchasing land of $150,000) May 1 320,000 July 1 450,000 October 31 280. 000

Matrix Inc. borrowed $1,100,000 at 8% to finance the construction of a new building for its own use. Construction began on January 1, 2019, and was completed on October 31, 2019. Expenditures related to this building were: January 1 $258,000 (includes cost of purchasing land of $150,000) May 1 320,000 July 1 450,000 October 31 280. 000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter10: Property, Plant And Equipment: Acquisition And Subsequent Investments

Section: Chapter Questions

Problem 18E

Related questions

Question

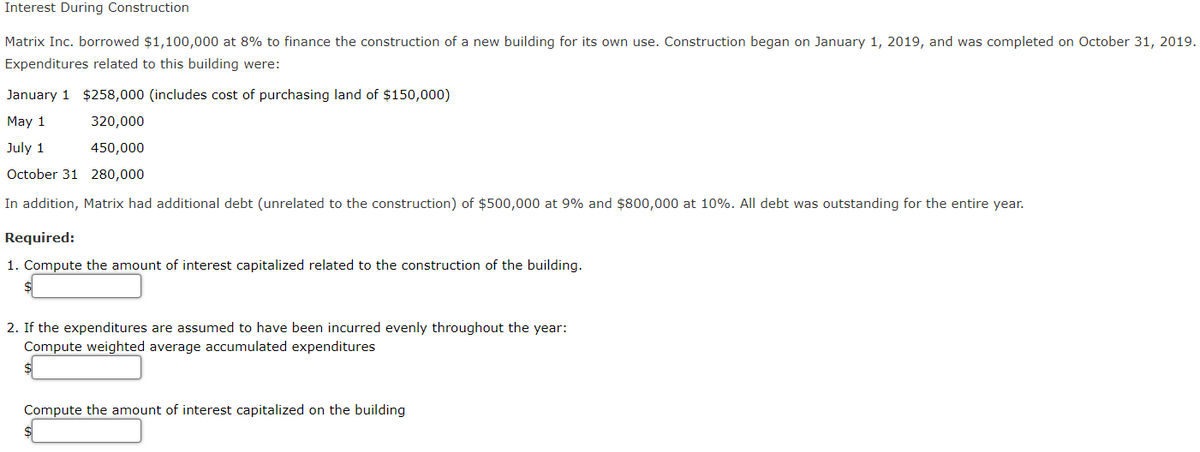

Transcribed Image Text:Interest During Construction

Matrix Inc. borrowed $1,100,000 at 8% to finance the construction of a new building for its own use. Construction began on January 1, 2019, and was completed on October 31, 2019.

Expenditures related to this building were:

January 1 $258,000 (includes cost of purchasing land of $150,000)

May 1

320,000

July 1

450,000

October 31 280,000

In addition, Matrix had additional debt (unrelated to the construction) of $500,000 at 9% and $800,000 at 10%. All debt was outstanding for the entire year.

Required:

1. Compute the amount of interest capitalized related to the construction of the building.

2. If the expenditures are assumed to have been incurred evenly throughout the year:

Compute weighted average accumulated expenditures

Compute the amount of interest capitalized on the building

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 6 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning