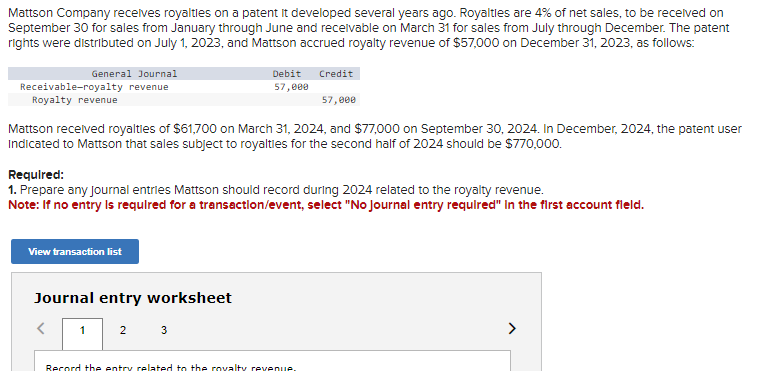

Mattson Company receives royalties on a patent it developed several years ago. Royaltles are 4% of net sales, to be received on September 30 for sales from January through June and receivable on March 31 for sales from July through December. The patent rights were distributed on July 1, 2023, and Mattson accrued royalty revenue of $57,000 on December 31, 2023, as follows: General Journal Receivable-royalty revenue Royalty revenue Credit 57,000 Mattson received royaltles of $61,700 on March 31, 2024, and $77,000 on September 30, 2024. In December, 2024, the patent user Indicated to Mattson that sales subject to royalties for the second half of 2024 should be $770,000. Debit 57,000 Required: 1. Prepare any journal entries Mattson should record during 2024 related to the royalty revenue. Note: If no entry is required for a transaction/event, select "No Journal entry required" In the first account field.

Mattson Company receives royalties on a patent it developed several years ago. Royaltles are 4% of net sales, to be received on September 30 for sales from January through June and receivable on March 31 for sales from July through December. The patent rights were distributed on July 1, 2023, and Mattson accrued royalty revenue of $57,000 on December 31, 2023, as follows: General Journal Receivable-royalty revenue Royalty revenue Credit 57,000 Mattson received royaltles of $61,700 on March 31, 2024, and $77,000 on September 30, 2024. In December, 2024, the patent user Indicated to Mattson that sales subject to royalties for the second half of 2024 should be $770,000. Debit 57,000 Required: 1. Prepare any journal entries Mattson should record during 2024 related to the royalty revenue. Note: If no entry is required for a transaction/event, select "No Journal entry required" In the first account field.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 13E

Related questions

Question

Transcribed Image Text:Mattson Company receives royalties on a patent It developed several years ago. Royalties are 4% of net sales, to be received on

September 30 for sales from January through June and receivable on March 31 for sales from July through December. The patent

rights were distributed on July 1, 2023, and Mattson accrued royalty revenue of $57,000 on December 31, 2023, as follows:

General Journal

Receivable-royalty revenue

Royalty revenue

57,000

Mattson received royalties of $61,700 on March 31, 2024, and $77,000 on September 30, 2024. In December, 2024, the patent user

Indicated to Mattson that sales subject to royalties for the second half of 2024 should be $770,000.

View transaction list

Required:

1. Prepare any Journal entries Mattson should record during 2024 related to the royalty revenue.

Note: If no entry is required for a transaction/event, select "No Journal entry required" in the first account field.

Journal entry worksheet

<

Debit

57,000

1

2 3

Credit

Record the entry related to the royalty revenue.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College