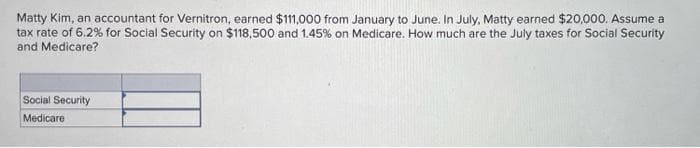

Matty Kim, an accountant for Vernitron, earned $111,000 from January to June. In July, Matty earned $20,000. Assume a tax rate of 6.2% for Social Security on $118,500 and 1.45% on Medicare. How much are the July taxes for Social Security and Medicare? Social Security Medicare

Matty Kim, an accountant for Vernitron, earned $111,000 from January to June. In July, Matty earned $20,000. Assume a tax rate of 6.2% for Social Security on $118,500 and 1.45% on Medicare. How much are the July taxes for Social Security and Medicare? Social Security Medicare

Algebra: Structure And Method, Book 1

(REV)00th Edition

ISBN:9780395977224

Author:Richard G. Brown, Mary P. Dolciani, Robert H. Sorgenfrey, William L. Cole

Publisher:Richard G. Brown, Mary P. Dolciani, Robert H. Sorgenfrey, William L. Cole

Chapter1: Introduction To Algebra

Section1.9: Opposites And Absolute Values

Problem 10MRE

Related questions

Question

Transcribed Image Text:Matty Kim, an accountant for Vernitron, earned $11,000 from January to June. In July, Matty earned $20,000. Assume a

tax rate of 6.2% for Social Security on $118,500 and 1.45% on Medicare. How much are the July taxes for Social Security

and Medicare?

Social Security

Medicare

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Algebra: Structure And Method, Book 1

Algebra

ISBN:

9780395977224

Author:

Richard G. Brown, Mary P. Dolciani, Robert H. Sorgenfrey, William L. Cole

Publisher:

McDougal Littell

Algebra: Structure And Method, Book 1

Algebra

ISBN:

9780395977224

Author:

Richard G. Brown, Mary P. Dolciani, Robert H. Sorgenfrey, William L. Cole

Publisher:

McDougal Littell