Max X s.t. Regular % constraint 0 X DeCaf % constraint 0 X Pounds of Regular 800 X Pounds of DeCaf 300 X What is the optimal solution and what is the contribution to profit (in $)? (Round your contribution to profit to two decimal places.) (BR, BD, CR, CD) = X Profit $2338.60

Max X s.t. Regular % constraint 0 X DeCaf % constraint 0 X Pounds of Regular 800 X Pounds of DeCaf 300 X What is the optimal solution and what is the contribution to profit (in $)? (Round your contribution to profit to two decimal places.) (BR, BD, CR, CD) = X Profit $2338.60

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter8: Evolutionary Solver: An Alternative Optimization Procedure

Section: Chapter Questions

Problem 22P

Related questions

Question

help please

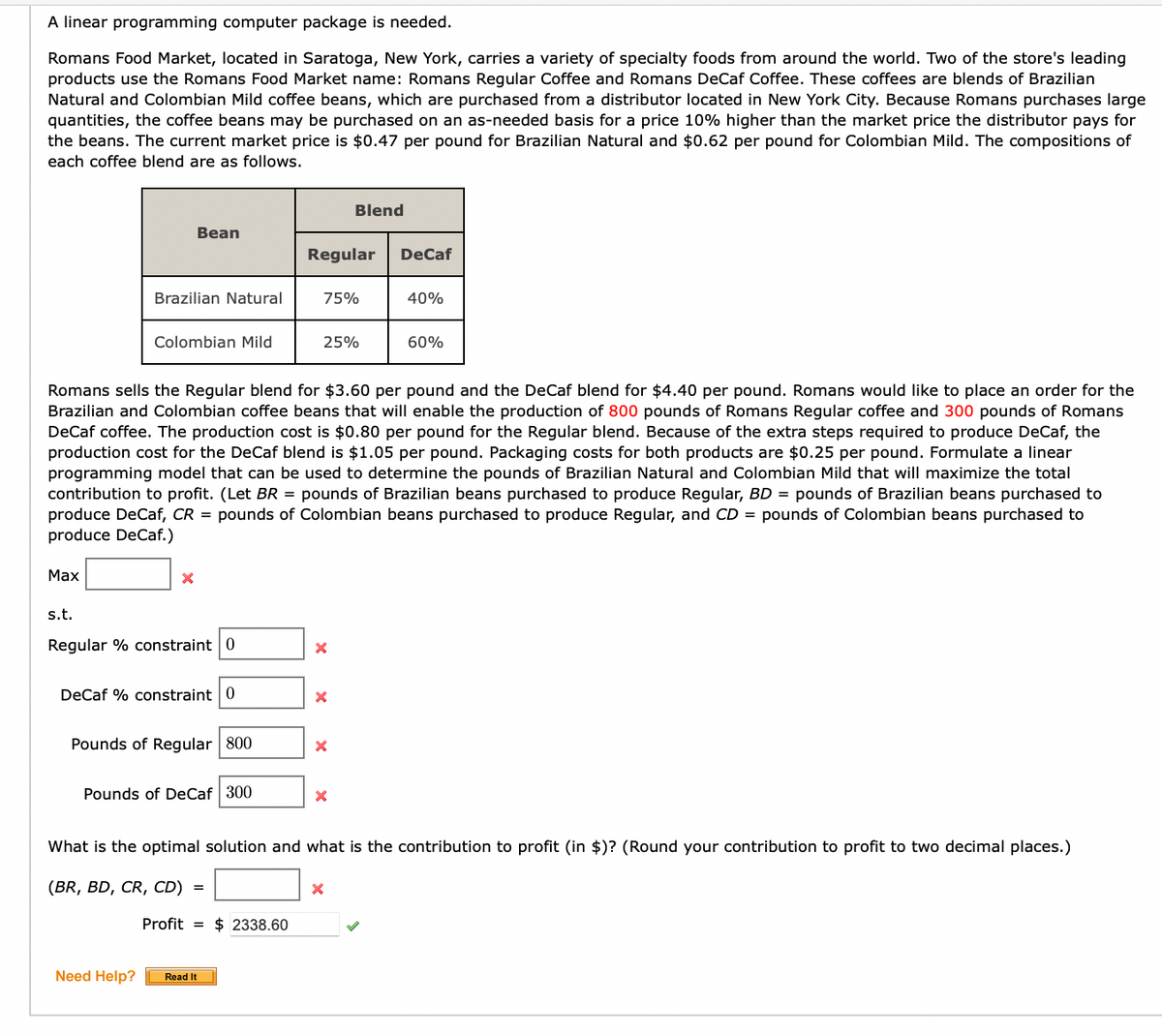

Transcribed Image Text:A linear programming computer package is needed.

Romans Food Market, located in Saratoga, New York, carries a variety of specialty foods from around the world. Two of the store's leading

products use the Romans Food Market name: Romans Regular Coffee and Romans DeCaf Coffee. These coffees are blends of Brazilian

Natural and Colombian Mild coffee beans, which are purchased from a distributor located in New York City. Because Romans purchases large

quantities, the coffee beans may be purchased on an as-needed basis for a price 10% higher than the market price the distributor pays for

the beans. The current market price is $0.47 per pound for Brazilian Natural and $0.62 per pound for Colombian Mild. The compositions of

each coffee blend are as follows.

Blend

Bean

Regular

DeCaf

Brazilian Natural

75%

40%

Colombian Mild

25%

60%

Romans sells the Regular blend for $3.60 per pound and the DeCaf blend for $4.40 per pound. Romans would like to place an order for the

Brazilian and Colombian coffee beans that will enable the production of 800 pounds of Romans Regular coffee and 300 pounds of Romans

DeCaf coffee. The production cost is $0.80 per pound for the Regular blend. Because of the extra steps required to produce DeCaf, the

production cost for the DeCaf blend is $1.05 per pound. Packaging costs for both products are $0.25 per pound. Formulate a linear

programming model that can be used to determine the pounds of Brazilian Natural and Colombian Mild that will maximize the total

contribution to profit. (Let BR = pounds of Brazilian beans purchased to produce Regular, BD = pounds of Brazilian beans purchased to

produce DeCaf, CR= pounds of Colombian beans purchased to produce Regular, and CD = pounds of Colombian beans purchased to

produce DeCaf.)

Max

X

s.t.

Regular % constraint 0

X

DeCaf % constraint 0

X

Pounds of Regular 800

X

Pounds of DeCaf 300

X

What is the optimal solution and what is the contribution to profit (in $)? (Round your contribution to profit to two decimal places.)

(BR, BD, CR, CD) =

X

Profit $2338.60

Need Help?

Read It

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 6 images

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,