May deposits PhP 20,000 into a fund at the beginning of nd of 15 years, she makes an additional deposit of X. nd of 20 years, May uses the accumulated balance in the fu te with annual payments of PhP 30,000 per year for 10 thereafter. is credited at an annual effective rate of 6%. Calculate X

May deposits PhP 20,000 into a fund at the beginning of nd of 15 years, she makes an additional deposit of X. nd of 20 years, May uses the accumulated balance in the fu te with annual payments of PhP 30,000 per year for 10 thereafter. is credited at an annual effective rate of 6%. Calculate X

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 26P

Related questions

Question

Find X, the deposit at the end of 15 years. Use the perpetuities for this question that is given on the second photo

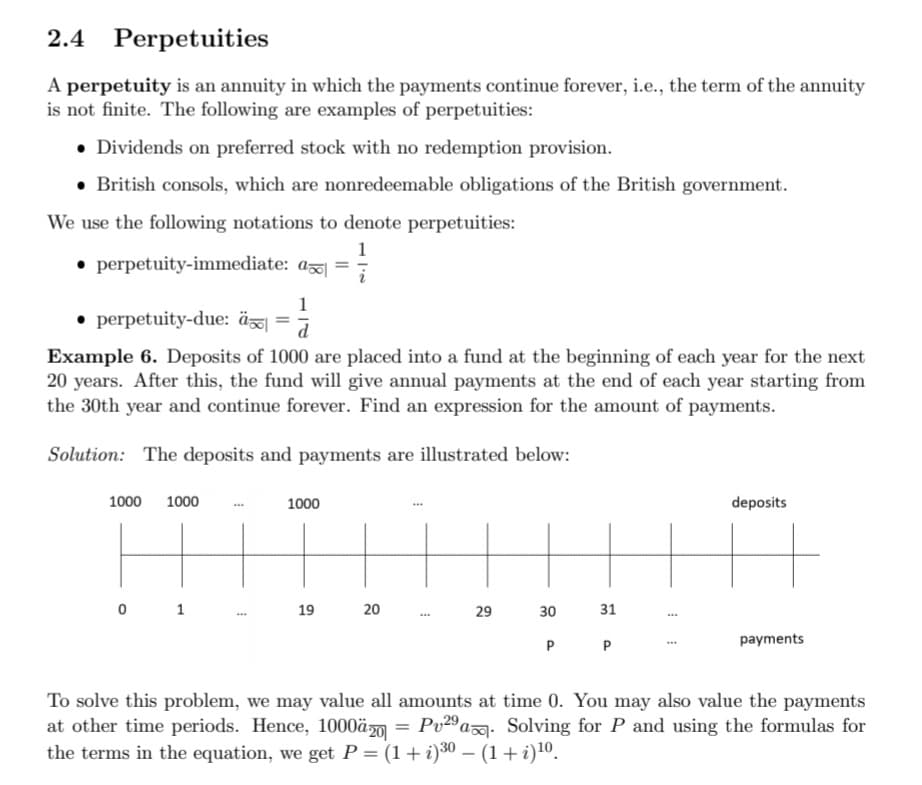

Transcribed Image Text:2.4 Perpetuities

A perpetuity is an annuity in which the payments continue forever, i.e., the term of the annuity

is not finite. The following are examples of perpetuities:

• Dividends on preferred stock with no redemption provision.

• British consols, which are nonredeemable obligations of the British government.

We use the following notations to denote perpetuities:

1

• perpetuity-immediate: a =

1

• perpetuity-due: äö|

d

Example 6. Deposits of 1000 are placed into a fund at the beginning of each year for the next

20 years. After this, the fund will give annual payments at the end of each year starting from

the 30th year and continue forever. Find an expression for the amount of payments.

Solution: The deposits and payments are illustrated below:

1000

1000

1000

deposits

0 1

19

20

29

30

31

...

P

payments

To solve this problem, we may value all amounts at time 0. You may also value the payments

at other time periods. Hence, 1000äm = Pv29 a. Solving for P and using the formulas for

the terms in the equation, we get P = (1+ i)30 – (1+i)10.

Transcribed Image Text:1

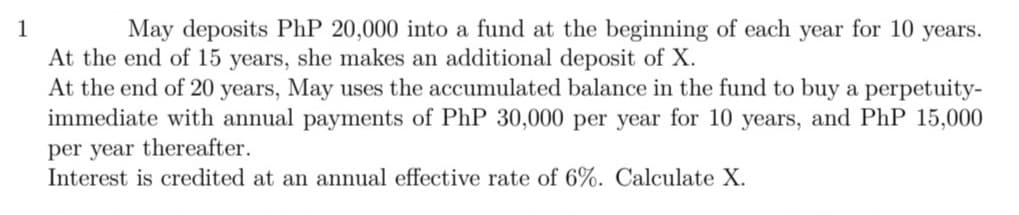

May deposits PhP 20,000 into a fund at the beginning of each year for 10

years.

At the end of 15 years, she makes an additional deposit of X.

At the end of 20 years, May uses the accumulated balance in the fund to buy a perpetuity-

immediate with annual payments of PhP 30,000 per year for 10 years, and PhP 15,000

per year thereafter.

Interest is credited at an annual effective rate of 6%. Calculate X.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning