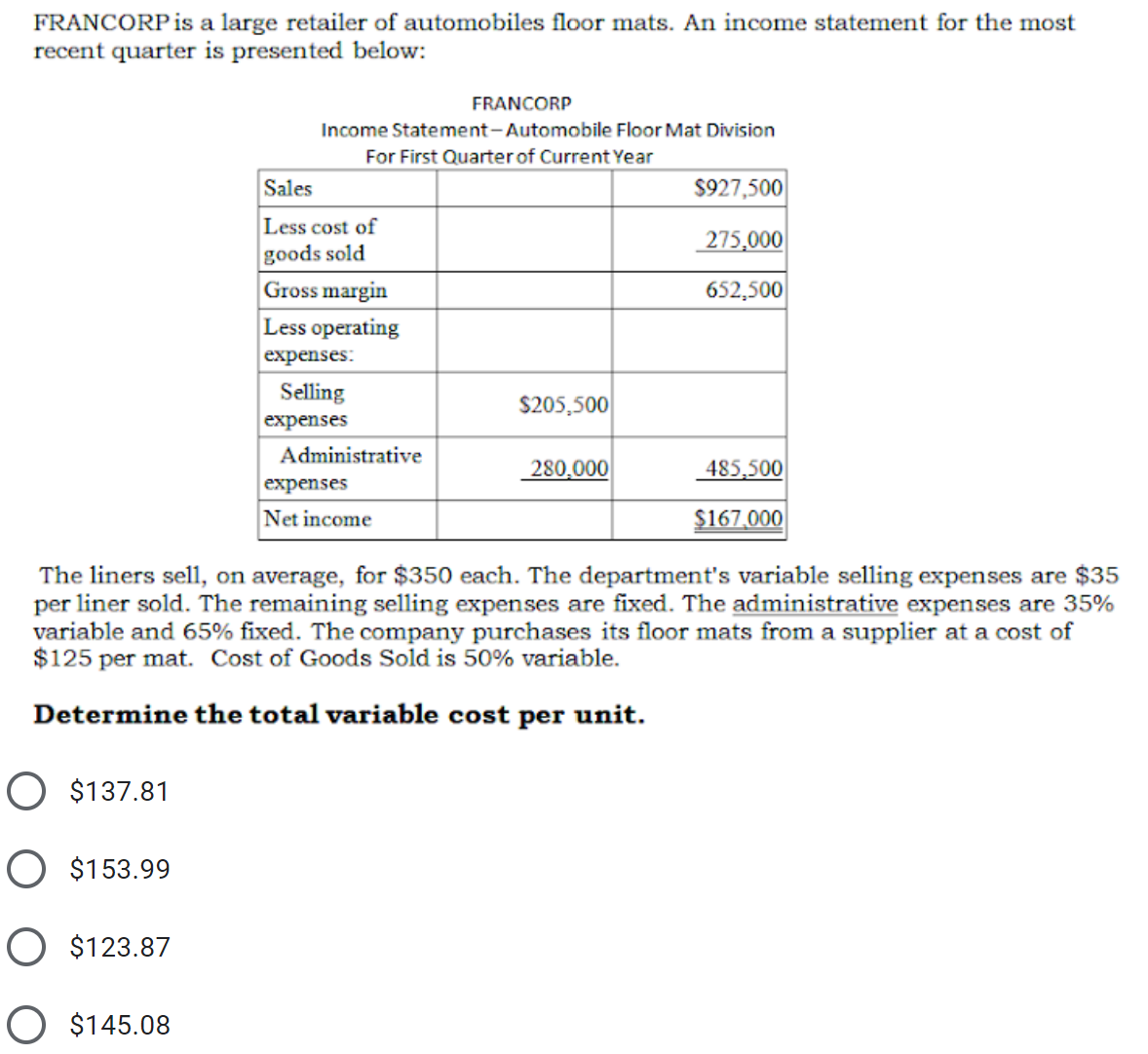

FRANCORPIS a large retailer of automobiles floor mats. An income statement for the most recent quarter is presented below: FRANCORP Income Statement-Automobile Floor Mat Division For First Quarter of Current Year Sales $927,500 Less cost of 275,000 goods sold Gross margin Less operating expenses: 652,500 Selling expenses $205,500 Administrative 280,000 485,500 expenses Net income $167,000 The liners sell, on average, for $350 each. The department's variable selling expenses are $35 per liner sold. The remaining selling expenses are fixed. The administrative expenses are 35% variable and 65% fixed. The company purchases its floor mats from a supplier at a cost of $125 per mat. Cost of Goods Sold is 50% variable. Determine the total variable cost per unit. O $137.81 O $153.99 O $123.87 O $145.08

FRANCORPIS a large retailer of automobiles floor mats. An income statement for the most recent quarter is presented below: FRANCORP Income Statement-Automobile Floor Mat Division For First Quarter of Current Year Sales $927,500 Less cost of 275,000 goods sold Gross margin Less operating expenses: 652,500 Selling expenses $205,500 Administrative 280,000 485,500 expenses Net income $167,000 The liners sell, on average, for $350 each. The department's variable selling expenses are $35 per liner sold. The remaining selling expenses are fixed. The administrative expenses are 35% variable and 65% fixed. The company purchases its floor mats from a supplier at a cost of $125 per mat. Cost of Goods Sold is 50% variable. Determine the total variable cost per unit. O $137.81 O $153.99 O $123.87 O $145.08

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter10: Cost Analysis For Management Decision Making

Section: Chapter Questions

Problem 18E

Related questions

Question

Transcribed Image Text:FRANCORP is a large retailer of automobiles floor mats. An income statement for the most

recent quarter is presented below:

FRANCORP

Income Statement-Automobile Floor Mat Division

For First Quarter of Current Year

Sales

$927,500

Less cost of

goods sold

Gross margin

Less operating

expenses:

275,000

652,500

Selling

expenses

$205,500

Administrative

280,000

485,500

expenses

Net income

$167,000

The liners sell, on average, for $350 each. The department's variable selling expenses are $35

per liner sold. The remaining selling expenses are fixed. The administrative expenses are 35%

variable and 65% fixed. The company purchases its floor mats from a supplier at a cost of

$125 per mat. Cost of Goods Sold is 50% variable.

Determine the total variable cost per unit.

O $137.81

O $153.99

O $123.87

O $145.08

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning