Mayfair Co. allows select customers to make purchases on credit. Its other customers can use either of two credit cards: Zisa or Access. Zisa deducts a 5.5% service charge for sales on its credit card. Access deducts a 4.5% service charge for sales on its card. Mayfair completes the following transactions in June. June 4 Sold $600 of merchandise on credit (that had cost $240) to Natara Morris. 5 Sold $7,100 of merchandise (that had cost $2,840) to customers who used their Zisa cards. 6 Sold $6,152 of merchandise (that had cost $2,461) to customers who used their Access cards. 8 Sold $4,300 of merchandise (that had cost $1,720) to customers who used their Access cards. 13 Wrote off the account of Abigail McKee against the Allowance for Doubtful Accounts. The $739 balance in McKee’s account stemmed from a credit sale in October of last year. 18 Received Morris’s check in full payment for the purchase of June 4. Required: Prepare journal entries to record the preceding transactions and events. (The company uses the perpetual inventory system.) (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 1 Sold $600 of merchandise on credit to Natara Morris. 2 Record cost of goods sold, $240 3 Sold $7,100 of merchandise to customers who used their Zisa cards. 4 Record cost of goods sold, $2,840. 5 Sold $6,152 of merchandise to customers who used their Access cards. 6 Record cost of goods sold, $2,461. 7 Sold $4,300 of merchandise to customers who used their Access cards. 8 Record cost of goods sold, $1,720. 9 Wrote off the account of Abigail McKee against the Allowance for Doubtful Accounts. The $739 balance in McKee’s account stemmed from a credit sale in October of last year. 10 Received Morris's check in full payment for the purchase of June 4.

Mayfair Co. allows select customers to make purchases on credit. Its other customers can use either of two credit cards: Zisa or Access. Zisa deducts a 5.5% service charge for sales on its credit card. Access deducts a 4.5% service charge for sales on its card. Mayfair completes the following transactions in June. June 4 Sold $600 of merchandise on credit (that had cost $240) to Natara Morris. 5 Sold $7,100 of merchandise (that had cost $2,840) to customers who used their Zisa cards. 6 Sold $6,152 of merchandise (that had cost $2,461) to customers who used their Access cards. 8 Sold $4,300 of merchandise (that had cost $1,720) to customers who used their Access cards. 13 Wrote off the account of Abigail McKee against the Allowance for Doubtful Accounts. The $739 balance in McKee’s account stemmed from a credit sale in October of last year. 18 Received Morris’s check in full payment for the purchase of June 4. Required: Prepare journal entries to record the preceding transactions and events. (The company uses the perpetual inventory system.) (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 1 Sold $600 of merchandise on credit to Natara Morris. 2 Record cost of goods sold, $240 3 Sold $7,100 of merchandise to customers who used their Zisa cards. 4 Record cost of goods sold, $2,840. 5 Sold $6,152 of merchandise to customers who used their Access cards. 6 Record cost of goods sold, $2,461. 7 Sold $4,300 of merchandise to customers who used their Access cards. 8 Record cost of goods sold, $1,720. 9 Wrote off the account of Abigail McKee against the Allowance for Doubtful Accounts. The $739 balance in McKee’s account stemmed from a credit sale in October of last year. 10 Received Morris's check in full payment for the purchase of June 4.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter9: Sales And Purchases

Section: Chapter Questions

Problem 3E: Record the following transactions in general journal form. a. Sold merchandise on account to A....

Related questions

Question

Mayfair Co. allows select customers to make purchases on credit. Its other customers can use either of two credit cards: Zisa or Access. Zisa deducts a 5.5% service charge for sales on its credit card. Access deducts a 4.5% service charge for sales on its card. Mayfair completes the following transactions in June.

| June | 4 | Sold $600 of merchandise on credit (that had cost $240) to Natara Morris. | ||

| 5 | Sold $7,100 of merchandise (that had cost $2,840) to customers who used their Zisa cards. | |||

| 6 | Sold $6,152 of merchandise (that had cost $2,461) to customers who used their Access cards. | |||

| 8 | Sold $4,300 of merchandise (that had cost $1,720) to customers who used their Access cards. | |||

| 13 | Wrote off the account of Abigail McKee against the Allowance for Doubtful Accounts. The $739 balance in McKee’s account stemmed from a credit sale in October of last year. | |||

| 18 | Received Morris’s check in full payment for the purchase of June 4. |

Required:

Prepare journal entries to record the preceding transactions and events. (The company uses the perpetual inventory system.) (If no entry is required for a transaction/event, select "No

-

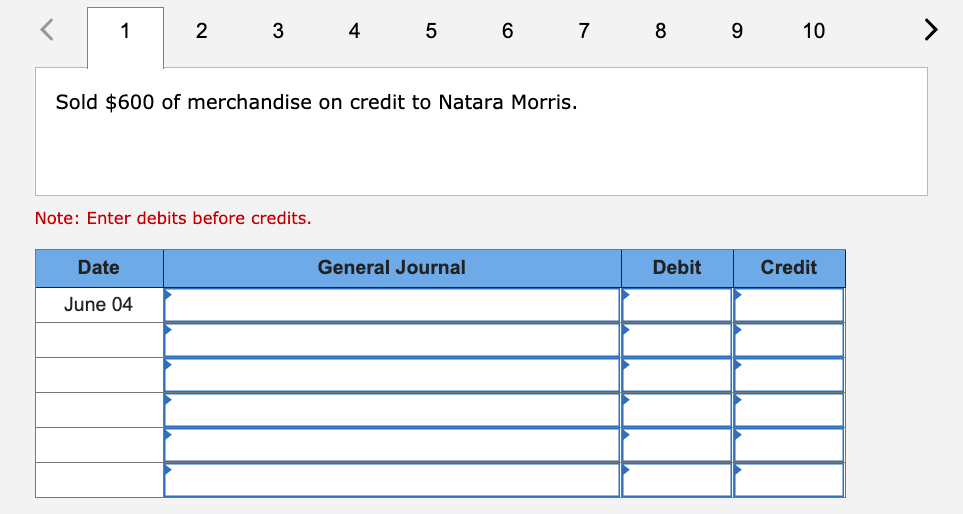

1Sold $600 of merchandise on credit to Natara Morris.

-

2Record cost of goods sold, $240

-

3Sold $7,100 of merchandise to customers who used their Zisa cards.

-

4Record cost of goods sold, $2,840.

-

5Sold $6,152 of merchandise to customers who used their Access cards.

-

6Record cost of goods sold, $2,461.

-

7Sold $4,300 of merchandise to customers who used their Access cards.

-

8Record cost of goods sold, $1,720.

-

9Wrote off the account of Abigail McKee against the Allowance for Doubtful Accounts. The $739 balance in McKee’s account stemmed from a credit sale in October of last year.

-

10Received Morris's check in full payment for the purchase of June 4.

Transcribed Image Text:1

2

4

5

6

7

8

9

10

>

Sold $600 of merchandise on credit to Natara Morris.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

June 04

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub