Mazin, Mansoor and Malik started a partnership fim on January 1, 2019. They contributed RO. 50,000, RO. 40,000 and RO. 30,000 respectively as their capitals and de profits in the ratio of 3:2:1. The partnership deed provided that Mazin is to be paid salary of RO. 12000 p.a. and Mansoor commission of RO. 2,500 every 6 months. It that interest on capital be allowed e 6% p.a. The drawings for the year were: Mazin RO. 6,000, Mansoar RO. 4,000 and Malik RO. 2,000. Interest an drawings was RO. RO.180 for Mansoor and RO. 90 for Malik. The net amount of profit as per the profit and loss account for the year ended 2019 was RO. 35,660. Question: Prepare the necessary accounting entries, the profit and loss appropriation account and the partners' capital accounts. Based on the above information ans tollowing '3 questions. (Do not upload any documents in the moodle)

Mazin, Mansoor and Malik started a partnership fim on January 1, 2019. They contributed RO. 50,000, RO. 40,000 and RO. 30,000 respectively as their capitals and de profits in the ratio of 3:2:1. The partnership deed provided that Mazin is to be paid salary of RO. 12000 p.a. and Mansoor commission of RO. 2,500 every 6 months. It that interest on capital be allowed e 6% p.a. The drawings for the year were: Mazin RO. 6,000, Mansoar RO. 4,000 and Malik RO. 2,000. Interest an drawings was RO. RO.180 for Mansoor and RO. 90 for Malik. The net amount of profit as per the profit and loss account for the year ended 2019 was RO. 35,660. Question: Prepare the necessary accounting entries, the profit and loss appropriation account and the partners' capital accounts. Based on the above information ans tollowing '3 questions. (Do not upload any documents in the moodle)

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter14: Partnerships And Limited Liability Entities

Section: Chapter Questions

Problem 2BD

Related questions

Question

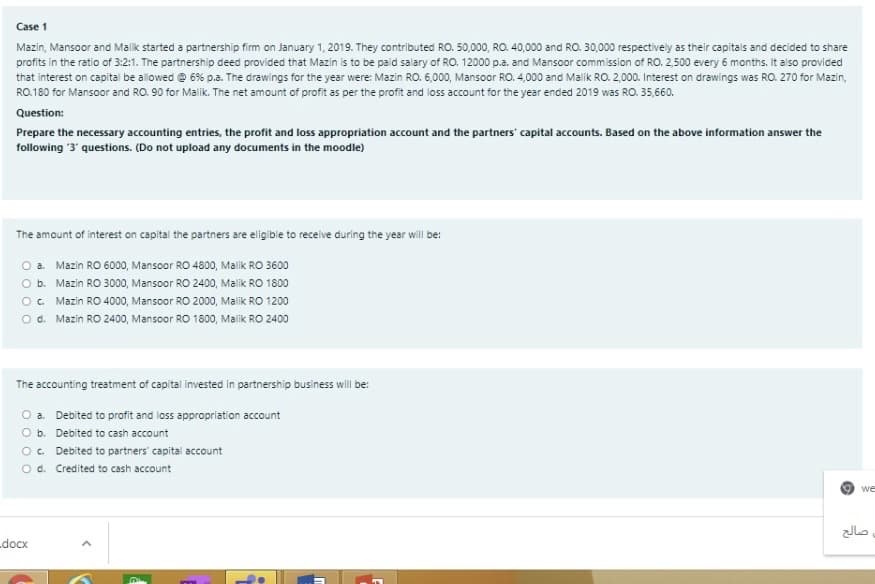

Transcribed Image Text:Case 1

Mazin, Mansoor and Malik started a partnership firm on January 1, 2019. They contributed RO. 50,000, RO. 40,000 and RO. 30,000 respectively as their capitals and decided to share

profits in the ratio of 3:2:1. The partnership deed provided that Mazin is to be paid salary of Ro. 12000 p.a. and Mansoor commission of RO. 2,500 every 6 months. It also provided

that interest on capital be allowed @ 6% p.a. The drawings for the year were: Mazin RO. 6,000, Mansoor RO. 4,000 and Malik RO. 2,000. Interest on drawings was RO. 270 for Mazin,

RO.180 for Mansoor and RO. 90 for Malik. The net amount of profit as per the profit and loss account for the year ended 2019 was RO. 35,660.

Question:

Prepare the necessary accounting entries, the profit and loss appropriation account and the partners' capital accounts. Based on the above information answer the

following 3' questions. (Do not upload any documents in the moodle)

The amount of interest on capital the partners are eligible to receive during the year will be:

O a. Mazin RO 6000, Mansoor RO 4800, Malik RO 3600

O b. Mazin RO 3000, Mansoor RO 2400, Malik RO 1800

O. Mazin RO 4000, Mansoor RO 2000, Malik RO 1200

O d. Mazin RO 2400, Mansoor RO 1800, Mailik RO 2400

The accounting treatment of capital invested in partnership business will be:

O a. Debited to profit and loss appropriation account

O b. Debited to cash account

O. Debited to partners' capital account

O d. Credited to cash account

we

docx

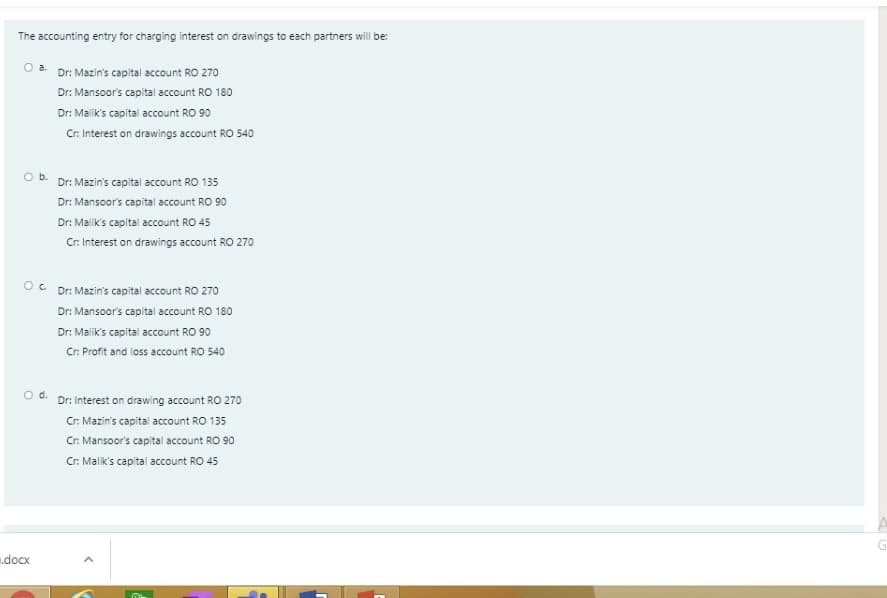

Transcribed Image Text:The accounting entry for charging interest on drawings to each partners will be:

Dr: Mazin's capital account RO 270

Dr: Mansoor's capital account RO 180

Dr: Malik's capital account RO 90

Cr. Interest on drawings account RO 540

O b. Dr: Mazin's capital account RO 135

Dr: Mansoor's capital account RO 90

Dr: Malik's capital account RO 45

Cr. Interest on drawings account RO 270

OC Dr: Mazin's capital account RO 270

Dr: Mansoor's capital account RO 180

Dr: Malik's capital account RO 90

Cr. Profit and loss account RO 540

d.

Dr: Interest on drawing account RO 270

Cr. Mazin's capital account RO 135

Cr. Mansoor's capital account RO 90

Cr. Malik's capital account RO 45

docx

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College