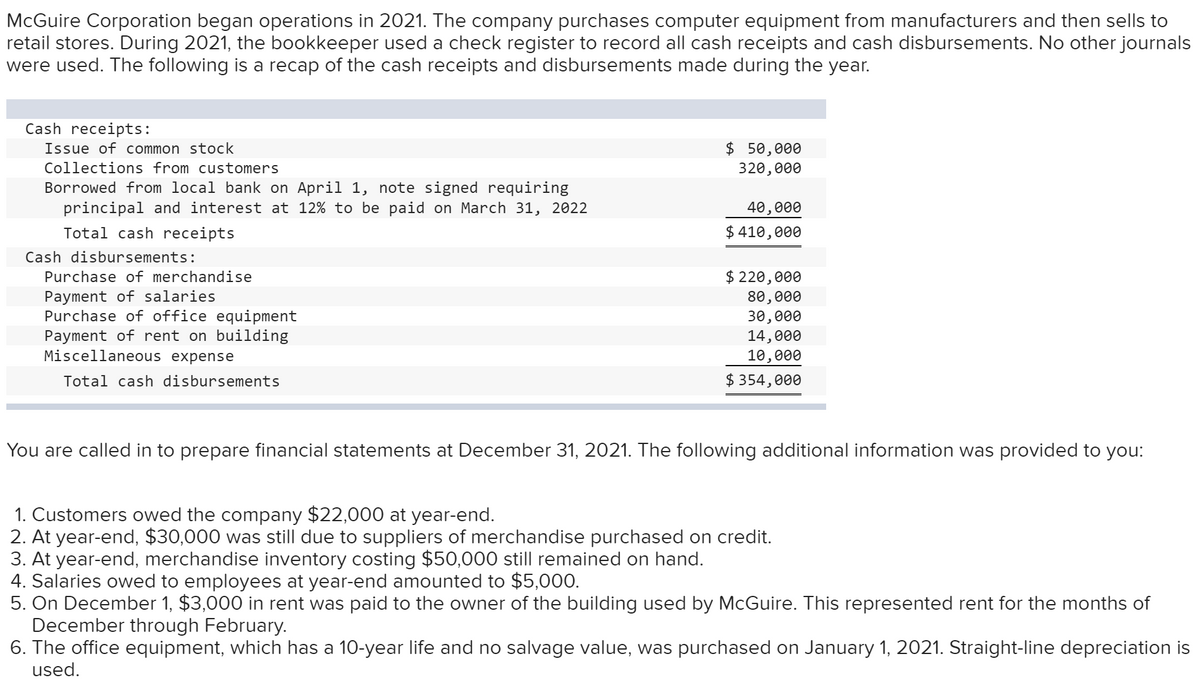

McGuire Corporation began operations in 2021. The company purchases computer equipment from manufacturers and then sells to retail stores. During 2021, the bookkeeper used a check register to record all cash receipts and cash disbursements. No other journals were used. The following is a recap of the cash receipts and disbursements made during the year. Cash receipts: Issue of common stock $ 50,000 320,000 Collections from customers Borrowed from local bank on April 1, note signed requiring principal and interest at 12% to be paid on March 31, 2022 40,000 $410,000 Total cash receipts Cash disbursements: $ 220,000 Purchase of merchandise Payment of salaries. 80,000 30,000 Purchase of office equipment Payment of rent on building Miscellaneous expense 14,000 10,000 Total cash disbursements $ 354,000 You are called in to prepare financial statements at December 31, 2021. The following additional information was provided to you: 1. Customers owed the company $22,000 at year-end. 2. At year-end, $30,000 was still due to suppliers of merchandise purchased on credit. 3. At year-end, merchandise inventory costing $50,000 still remained on hand. 4. Salaries owed to employees at year-end amounted to $5,000. 5. On December 1, $3,000 in rent was paid to the owner of the building used by McGuire. This represented rent for the months of December through February. 6. The office equipment, which has a 10-year life and no salvage value, was purchased on January 1, 2021. Straight-line depreciation is used.

McGuire Corporation began operations in 2021. The company purchases computer equipment from manufacturers and then sells to retail stores. During 2021, the bookkeeper used a check register to record all cash receipts and cash disbursements. No other journals were used. The following is a recap of the cash receipts and disbursements made during the year. Cash receipts: Issue of common stock $ 50,000 320,000 Collections from customers Borrowed from local bank on April 1, note signed requiring principal and interest at 12% to be paid on March 31, 2022 40,000 $410,000 Total cash receipts Cash disbursements: $ 220,000 Purchase of merchandise Payment of salaries. 80,000 30,000 Purchase of office equipment Payment of rent on building Miscellaneous expense 14,000 10,000 Total cash disbursements $ 354,000 You are called in to prepare financial statements at December 31, 2021. The following additional information was provided to you: 1. Customers owed the company $22,000 at year-end. 2. At year-end, $30,000 was still due to suppliers of merchandise purchased on credit. 3. At year-end, merchandise inventory costing $50,000 still remained on hand. 4. Salaries owed to employees at year-end amounted to $5,000. 5. On December 1, $3,000 in rent was paid to the owner of the building used by McGuire. This represented rent for the months of December through February. 6. The office equipment, which has a 10-year life and no salvage value, was purchased on January 1, 2021. Straight-line depreciation is used.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter6: Bank Accounts, Cash Funds, And Internal Controls

Section: Chapter Questions

Problem 2PB

Related questions

Question

Transcribed Image Text:McGuire Corporation began operations in 2021. The company purchases computer equipment from manufacturers and then sells to

retail stores. During 2021, the bookkeeper used a check register to record all cash receipts and cash disbursements. No other journals

were used. The following is a recap of the cash receipts and disbursements made during the year.

Cash receipts:

Issue of common stock

$ 50,000

320,000

Collections from customers

Borrowed from local bank on April 1, note signed requiring

principal and interest at 12% to be paid on March 31, 2022

40,000

Total cash receipts

$ 410,000

Cash disbursements:

$ 220,000

Purchase of merchandise

Payment of salaries

80,000

Purchase of office equipment

30,000

14,000

Payment of rent on building

Miscellaneous expense

10,000

Total cash disbursements

$ 354,000

You are called in to prepare financial statements at December 31, 2021. The following additional information was provided to you:

1. Customers owed the company $22,000 at year-end.

2. At year-end, $30,000 was still due to suppliers of merchandise purchased on credit.

3. At year-end, merchandise inventory costing $50,000 still remained on hand.

4. Salaries owed to employees at year-end amounted to $5,000.

5. On December 1, $3,000 in rent was paid to the owner of the building used by McGuire. This represented rent for the months of

December through February.

6. The office equipment, which has a 10-year life and no salvage value, was purchased on January 1, 2021. Straight-line depreciation is

used.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College