"be balance sheet of the Omar Paolo and Ouek partnershin on November 1 2016 (bet

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter12: Accounting For Partnerships And Limited Liability Companies

Section: Chapter Questions

Problem 12.1BPR

Related questions

Question

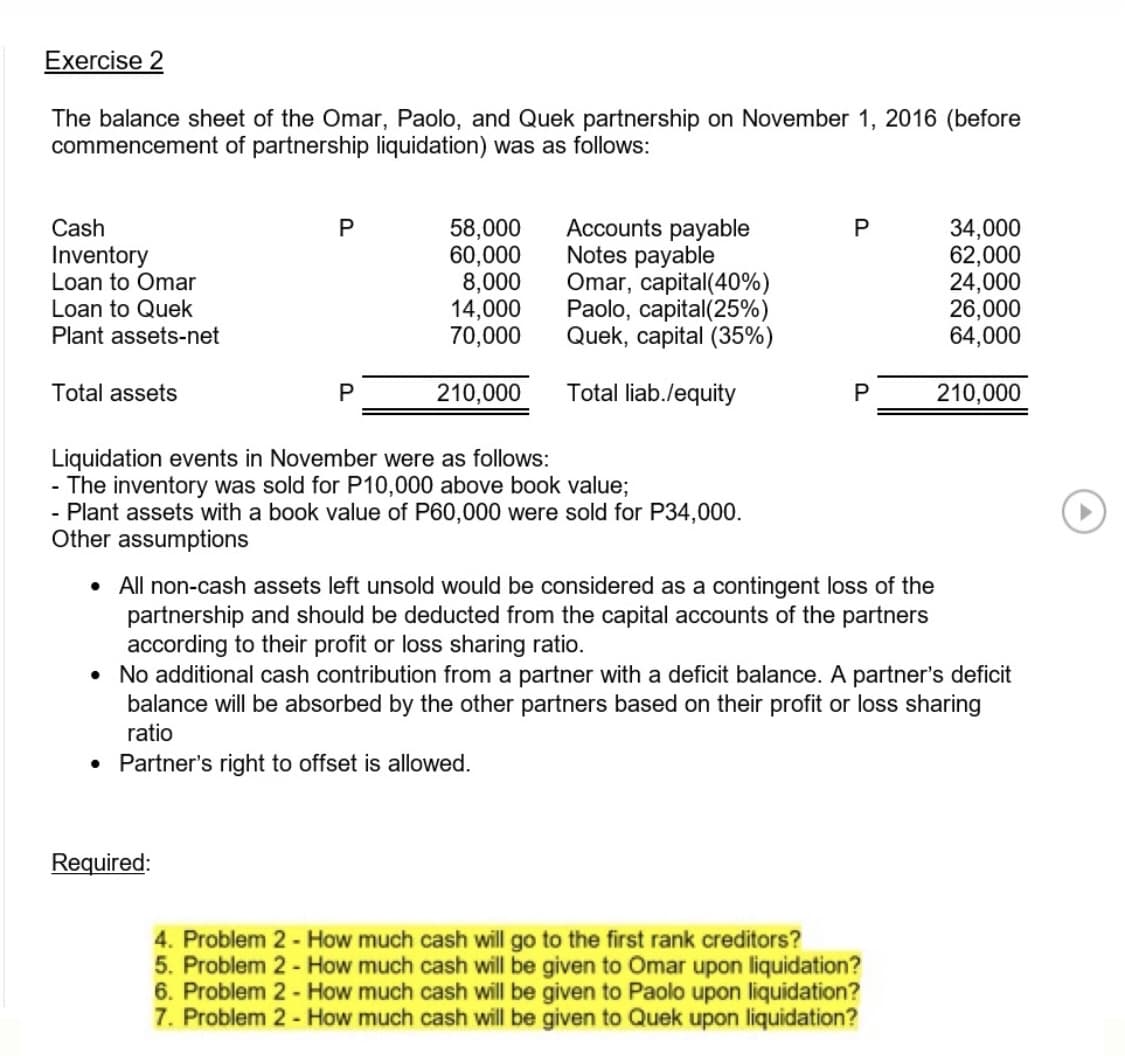

Transcribed Image Text:Exercise 2

The balance sheet of the Omar, Paolo, and Quek partnership on November 1, 2016 (before

commencement of partnership liquidation) was as follows:

58,000

60,000

8,000

14,000

70,000

Accounts payable

Notes payable

Omar, capital(40%)

Paolo, capital(25%)

Quek, capital (35%)

34,000

62,000

24,000

26,000

64,000

Cash

P

Inventory

Loan to Omar

Loan to Quek

Plant assets-net

Total assets

210,000

Total liab./equity

210,000

Liquidation events in November were as follows:

- The inventory was sold for P10,000 above book value;

- Plant assets with a book value of P60,000 were sold for P34,000.

Other assumptions

• All non-cash assets left unsold would be considered as a contingent loss of the

partnership and should be deducted from the capital accounts of the partners

according to their profit or loss sharing ratio.

• No additional cash contribution from a partner with a deficit balance. A partner's deficit

balance will be absorbed by the other partners based on their profit or loss sharing

ratio

• Partner's right to offset is allowed.

Required:

4. Problem 2 - How much cash will go to the first rank creditors?

5. Problem 2 - How much cash will be given to Omar upon liquidation?

6. Problem 2 - How much cash will be given to Paolo upon liquidation?

7. Problem 2 - How much cash will be given to Quek upon liquidation?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning