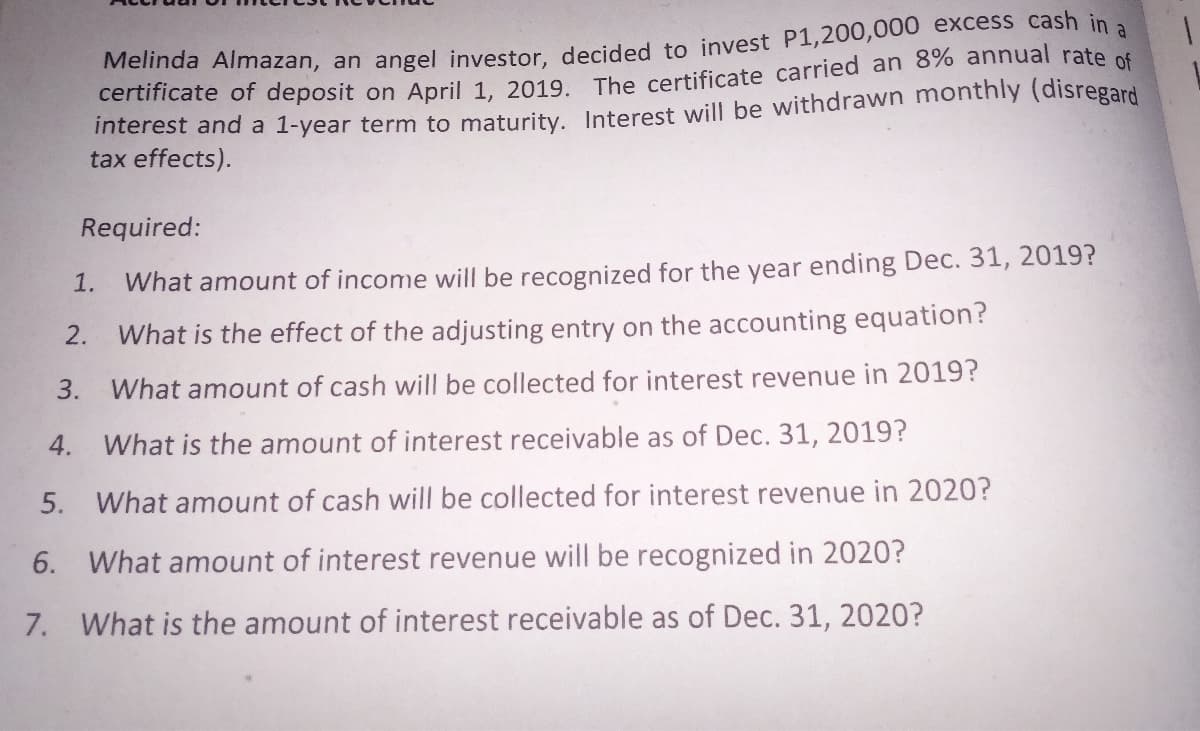

Melinda Almazan, an angel investor. decided to invest P1,200,00 certificate of deposit on April 1. 2019, The certificate carried an 8% annual rate of interest and a 1-year term to maturity, Interest will be withdrawn monthly (disregard tax effects). al Required: 1. What amount of income will be recognized for the year ending Dec. 31, 2019? 2. What is the effect of the adjusting entry on the accounting equation? 3. What amount of cash will be collected for interest revenue in 2019?

Melinda Almazan, an angel investor. decided to invest P1,200,00 certificate of deposit on April 1. 2019, The certificate carried an 8% annual rate of interest and a 1-year term to maturity, Interest will be withdrawn monthly (disregard tax effects). al Required: 1. What amount of income will be recognized for the year ending Dec. 31, 2019? 2. What is the effect of the adjusting entry on the accounting equation? 3. What amount of cash will be collected for interest revenue in 2019?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter3: Accrual Accounting

Section: Chapter Questions

Problem 5MCQ: Dallas Company loaned to Ewing Company on December 1, 2019. Ewing will pay Dallas $720 of interest...

Related questions

Question

100%

Transcribed Image Text:Melinda Almazan, an angel investor decided to invest P1,200,000 excess cash in

certificate of deposit on April 1. 2019 The certificate carried an 8% annual rate of

interest and a 1-year term to maturity, Interest will be withdrawn monthly (disregard

tax effects).

a

Required:

1.

What amount of income will be recognized for the year ending Dec. 31, 2019?

2.

What is the effect of the adjusting entry on the accounting equation?

3. What amount of cash will be collected for interest revenue in 2019?

4. What is the amount of interest receivable as of Dec. 31, 2019?

5.

What amount of cash will be collected for interest revenue in 2020?

6. What amount of interest revenue will be recognized in 2020?

7. What is the amount of interest receivable as of Dec. 31, 2020?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT