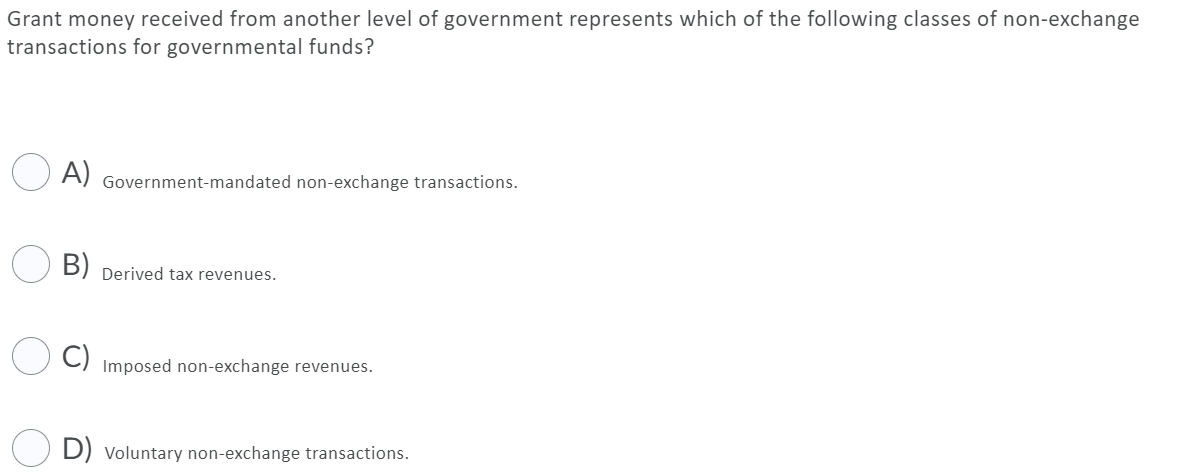

ment-mandated non-exchange transactions.

Q: Explain the differences between upstream and downstream intra-entity transfers, as well as how each…

A: Intra-entity transfer refers to transfer of goods or products among the entities. More often, such…

Q: What qualifies as a like-kind exchange?

A: Definition: Property, plant, and equipment: These assets are long lived economic resources which are…

Q: Describe the exchanges in nonmonetary asset.

A: A non-monetary transaction refers to a commercial or business transaction that happens without the…

Q: Describe any differences in segment disclosure requirements between U.S. GAAP and IFRS.

A: International Financial Reporting Standards IFRS is a set of global accounting standards issued by…

Q: What is the basis for distinguishing between operating and nonoperating items?

A:

Q: On the level of exchange allocate the following types of a transfer: А External B Internal C…

A: The question is related to on the level of exchange the types of transfer allocation.

Q: What follows is a very explicit discussion of like-kind exchanges under IRC provisions?

A: Section 1031 of IRS refer to the exchange of one financial property for another that allows…

Q: What is over-the-counter (OTC) trade?

A: It is an electronic communications network which permits the investors to sell and buy the stocks.…

Q: What is the relationship between future exchange and clearinghouse?

A: Future exchange and clearing house are two different parts of future markets.

Q: Define inter vivos trust.

A: Inter vivos Trust: An inter vivos trust is a kind of trust which is made in the lifetime of grantor.…

Q: xplain the general similarities AND differences between GAAP and IFRS.

A: Discussion of general similarity and difference between GAAP and IFRS are as follows

Q: Describe the concept of “over-trading” using numeric example if appropriate.’

A: In the world of finance over trading is an important concept for businesses.

Q: State the key differences between IFRS and U.S. GAAP.

A: IFRS stands for International Financial Reporting Standards. These are accounting standards issued…

Q: What is AB Share Mechanism and what is this mechanism used for?Provide Example

A: An organization's total capital is bifurcated into many units. Each unit represents ownership in the…

Q: Harmonization and convergence are closely aligned. – Explain.

A: Convergence is described as a process which focuses to eliminate the differences and developing a…

Q: state the importance of Balance of International Payment

A: The Balance of International Payment (or simply the Balance of Payment or BoP) is that statement…

Q: What is nonoperating assets?

A: Non-operating assets are the assets that are not required or in use for normal business activity.…

Q: ne

A: Negotiable Instruments are written contracts whose benefit could be passed on from its original…

Q: Define the following relative to like-kind exchanges: Boot Postponed gain or loss Gain or loss…

A: The like kind exchange is defined as the transaction of tax deferred which allows for asset disposal…

Q: reciprocal method

A: Direct Method Particulars Basis of Apportionment Bricks Bars Information Systems Personnel…

Q: How are non controlling intrerests (NCI) affected by intragroup transactions?

A: Non-controlling interests are the ownership is defined where the shareholder holds less than 50% of…

Q: 1.) Discuss the Reciprocity Rule

A: The answer is given below: Note: Answering the first question as there are multiple…

Q: es RTN hold any importan

A: In online transactions are done based on codes and codes are given for the name of bank and area of…

Q: Differentiate between spot and forward exchange rates

A: Introduction: The spot rate is the rate at which the actual deal or sale is to take place…

Q: Which organization initiated the convergence process between GAAP and IFRS and why?

A: GAAP -: GAAP is a mixture of definitive standards (established by policy boards) and the normally…

Q: nstrument is used by the exporter and nporter to fulfill their short term nancial requirement?

A: Banks provide credit to the business for import and export.

Q: Distinguish between the Customs Act, Customs Tariff Act, an EIPA Further, what is the purpose of…

A: Customs Act: Customs Act deals with the administration part of the customs transactions and general…

Q: Differentiate between primary and secondary markets.

A: Primary market is a market where shares and securities are created and sold for the first time.…

Q: Mutual agency is defined

A: In a partnership, two or more parties agree to operate and manage a business and share the profits…

Q: Do equivalence calculations require a common time basis for comparison?

A: Answer: The calculation of equivalence method is used where duration of the projects is not equal.…

Q: difference between IFRS standardization and harmonization

A: Financial Reporting (IFRS) are a set of accounting principles for financial reporting published by…

Q: al entries for elimination of intragroup sales?

A: In this example S ltd is partially owned subsidiary company and S ltd sold goods to its parent…

Q: What is the importance of a Form 8-K? What is the importance of a proxy statement?

A: Importance of a Form 8-K: Form 8-K is issued by a company when there is something unique or…

Q: Discuss the features that differetiateorganised exchanges from the over-the-counter market

A: the question is based on the concept of stock exchange trading mechanism and over the counter…

Q: Differentiate between IFRS vs. U.S. GAAP.

A: International Financial Reporting Standards (IFRS): IFRS are a set of international accounting…

Q: What is negotiated deals (security offerings)?

A: Negotiated deals are usually referred to in the context of fixed-income securities. The parties…

Q: Which of the following is not an assertion relating to classes of transactions? Accuracy, Adequacy,…

A: Classes of transaction includes the transactions of the company which are grouped together for…

Q: Distinguish between participating or nonparticipating?

A:

Q: Explain how to account for the impairment of a held-tomaturitydebt security.

A: Debt securities: Debt security is money borrowed at a specific rate of interest which must be repaid…

Q: Is there are any relation between the CFPS, EPS, and DPS?

A: The financial statements of a firm is used and analysed by determining various types of financial…

Q: Has the IASB-FASB convergence process been successful?

A: Financial accounting standards board (FASB): This is the organization which creates, develops, and…

Step by step

Solved in 2 steps

- Governments often provide goods and services to citizens or other governmental units at a fee. These activities are accounted for in: a. the general fund b. governmental funds c. proprietary funds d. special revenue funds39. The receipt of which of the following may not give rise to the revenue by a government entity? Notice of Cash Allocation Tax Remittance Advice Subsidy from another Government entity Inter-agency fund transferWhich governmental fund includes resources that are legally restricted so that the governmental entity must maintain the principal and can use only the earnings from the fund's resources to benefit the government's programs for all of its citizens? Group of answer choices a.) Capital projects fund b.) Permanent fund c.) Agency fund

- What is the purpose of the capital projects fund, debt service fund, and permanent fund. Please describe the difference between government-wide financial statements and fund-basis financial statements. Why is it necessary for the federal government accounting standards to differ from state and local governments' accounting standards?What is the primary difference between revenue grants and capital grants in accounting for government grants? A. Revenue grants are recognized in the income statement immediately, while capital grants are recognized as deferred income. B. Revenue grants are used for long-term asset acquisition, while capital grants support day-to-day operating activities. C. Both revenue and capital grants are recognized in the income statement immediately. D. Capital grants are not accounted for in financial statements.Which of the following funds provides goods and services only to other departments or agencies of the government on a cost-reimbursement basis? Group of answer choices a.) Internal service funds b.) Enterprise funds c.) Special revenue funds

- Discuss the purpose of the capital projects fund, debt service fund, and permanent fund. Describe the difference between government-wide financial statements and fund-basis financial statements. Why is it necessary for the federal government accounting standards to differ from state and local governments accounting standards?Which of the following statement is true regarding the net approach of presentinggovernment grants?A. Government grant related to income has a deferred income from governmentgrant account.B. Government grant related to asset has a deferred income from government grantaccount.C. For grants related to asset, depreciation expense is higher as compared togross approach (unearned income from government grant approach).D. Government grant related to asset has to recognize an income from governmentgrant. From the below statements, which of them is a false statement regarding FSRSC?A. The chairman should be a senior practitioner of any scope of the accountancyprofession.B. FSRSC members serve without compensation for a term of three years, which canbe renewed for another three years.C. Not all members of FSRSC should be CPAs.D. FSRSC is the current standard setting-body in the Philippines. Its currentpronouncements are PASs. Which of the following statements is correct concerning the…Governmental funds are identical to governmental activities, proprietary funds are identical to business-type activities, and fiduciary funds are identical to fiduciary activities of a government. True or False

- Which of the following is not a category of program revenue reported on the statement of activities at the government wide level? a. General program revenue b. Charge for services c. Operating grants and contribution d. Capital grants and contributionAccording to PAS 20 Accounting for Government Grants and Disclosure of Government Assistance, which of the following is a government grant? a. Tax benefits Free technical or marketing advice Public improvements that benefit the entire community Provision of guarantees Noninterest-bearing loan from the government According to PAS 20 Accounting for Government Grants and Disclosure of Government Assistance, which of the following is not a government grant? Aid from the government to compensate for casualty losses already incurred. Cash received from the government to be used to acquire land. Government procurement policy that is responsible for a portion of the entity’s sales. Aid from the government to defray expenses which are yet to be incurred.Which of the following is an example of an interactivity transaction? Money is transferred from the general fund to the debt service fund. Money is transferred from the capital projects fund to the general fund. Money is transferred from the special revenue fund to the debt service fund. Money is transferred from the general fund to the enterprise fund.