mer and Knox began a partnership by investing $72,000 and $102,000, respectively. The partners agreed to share net income and ss by giving annual salary allowances of $56,000 to Ramer and $44,800 to Knox, 10% interest allowances on their investments, and y remaining balance shared equally. (Enter all allowances as positive values. Enter losses as negative values.) equired: Determine each partner's share given a first-year net income of $110,800. Determine each partner's share given a first-year net loss of $28,800. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine each partner's share given a first-year net loss of $28,800. Allocation of Partnership Income Ramer Knox Total $ (28,800) et Income (loss) alary allowances 0 alance of income (loss) nterest allowances 0 alance of income (loss) Balance allocated equally alance of income (loss) Shares of the partners 0

mer and Knox began a partnership by investing $72,000 and $102,000, respectively. The partners agreed to share net income and ss by giving annual salary allowances of $56,000 to Ramer and $44,800 to Knox, 10% interest allowances on their investments, and y remaining balance shared equally. (Enter all allowances as positive values. Enter losses as negative values.) equired: Determine each partner's share given a first-year net income of $110,800. Determine each partner's share given a first-year net loss of $28,800. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine each partner's share given a first-year net loss of $28,800. Allocation of Partnership Income Ramer Knox Total $ (28,800) et Income (loss) alary allowances 0 alance of income (loss) nterest allowances 0 alance of income (loss) Balance allocated equally alance of income (loss) Shares of the partners 0

Chapter21: Partnerships

Section: Chapter Questions

Problem 57P

Related questions

Question

Transcribed Image Text:Ramer and Knox began a partnership by investing $72,000 and $102,000, respectively. The partners agreed to share net income and

loss by giving annual salary allowances of $56,000 to Ramer and $44,800 to Knox, 10% interest allowances on their investments, and

any remaining balance shared equally. (Enter all allowances as positive values. Enter losses as negative values.)

Required:

1. Determine each partner's share given a first-year net income of $110,800.

2. Determine each partner's share given a first-year net loss of $28,800.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

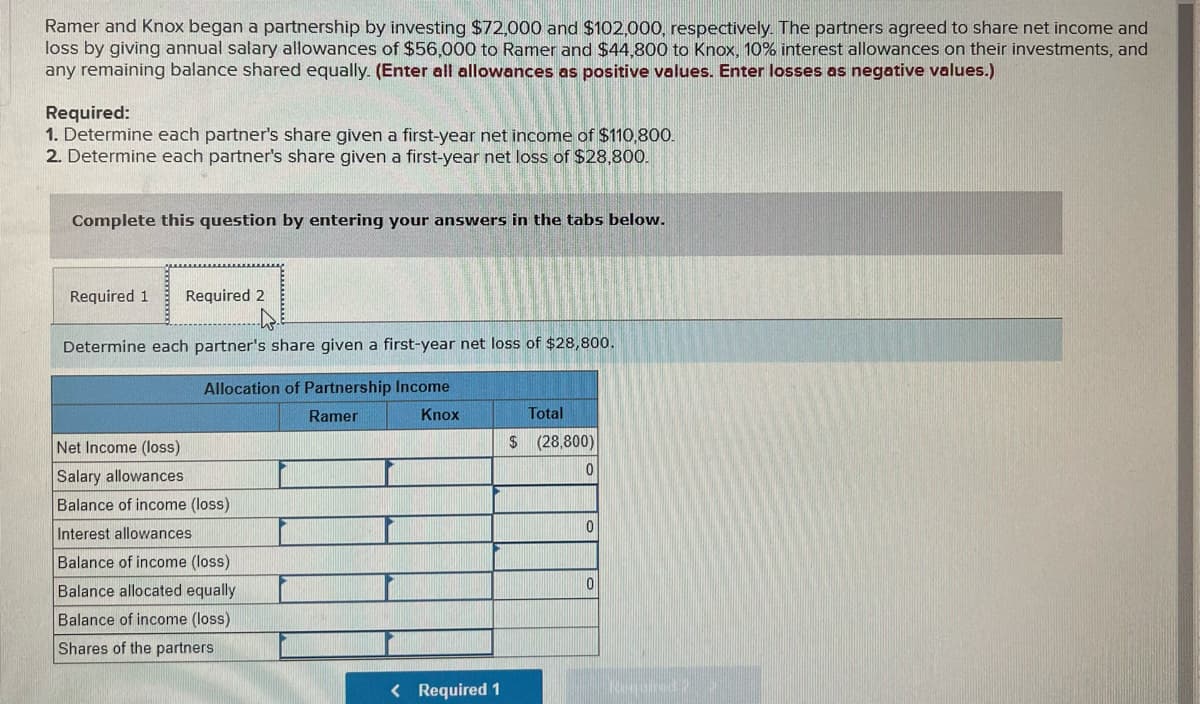

Determine each partner's share given a first-year net loss of $28,800.

Allocation of Partnership Income

Ramer

Knox

Total

$ (28,800)

Net Income (loss)

Salary allowances

0

Balance of income (loss)

Interest allowances

Balance of income (loss)

Balance allocated equally

Balance of income (loss)

Shares of the partners

< Required 1

0

0

RASTI?

Transcribed Image Text:Ramer and Knox began a partnership by investing $72,000 and $102,000, respectively. The partners agreed to share net income and

loss by giving annual salary allowances of $56,000 to Ramer and $44,800 to Knox, 10% interest allowances on their investments, and

any remaining balance shared equally. (Enter all allowances as positive values. Enter losses as negative values.)

Required:

1. Determine each partner's share given a first-year net income of $110,800.

2. Determine each partner's share given a first-year net loss of $28,800.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

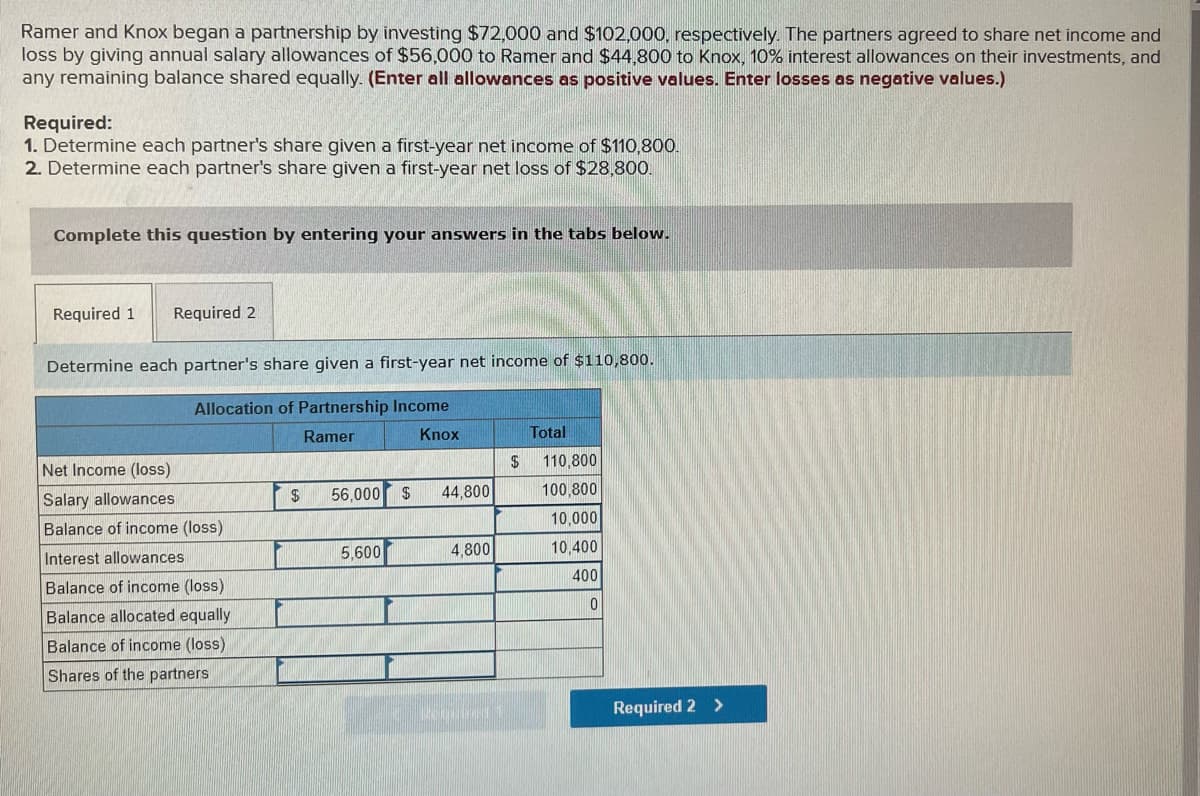

Determine each partner's share given a first-year net income of $110,800.

Allocation of Partnership Income

Ramer

Knox

Total

Net Income (loss)

Salary allowances

Balance of income (loss)

Interest allowances

Balance of income (loss)

Balance allocated equally

Balance of income (loss)

Shares of the partners

$

56,000 $

5,600

44,800

4,800

WIT

$

110,800

100,800

10,000

10,400

400

0

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT