Merchandise is sold for cash. The selling price of the merchandise is $2,000 and the sale is subject to a 7% state sales tax. credit to O a. Sales for $1,860 Ob. Cash for $2,000 Oc. Sales Tax Payable for $140 Od. Sales for $2,140

Merchandise is sold for cash. The selling price of the merchandise is $2,000 and the sale is subject to a 7% state sales tax. credit to O a. Sales for $1,860 Ob. Cash for $2,000 Oc. Sales Tax Payable for $140 Od. Sales for $2,140

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 25CE: Sales Tax Cobb Baseball Bats sold 45 bats for $50 each, plus an additional state sales tax of 6%....

Related questions

Question

Transcribed Image Text:Tess3false

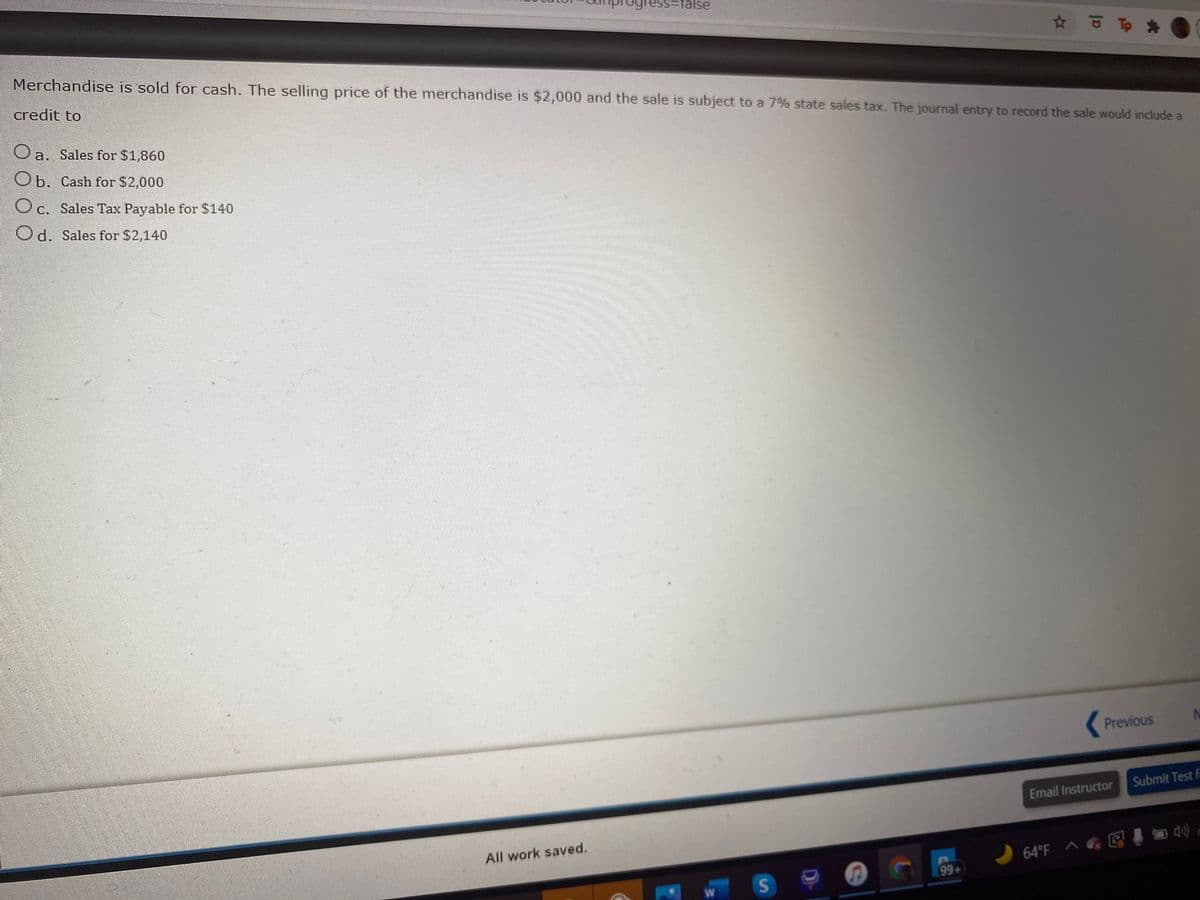

Merchandise is sold for cash. The selling price of the merchandise is $2,000 and the sale is subject to a 7% state sales tax. The journal entry to record the sale would include a

credit to

Oa. Sales for $1,860

Ob. Cash for $2,000

O c. Sales Tax Payable for $140

Od. Sales for $2,140

Previous

Submit Test f

Email Instructor

All work saved.

64°F ^ E I

99+

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning