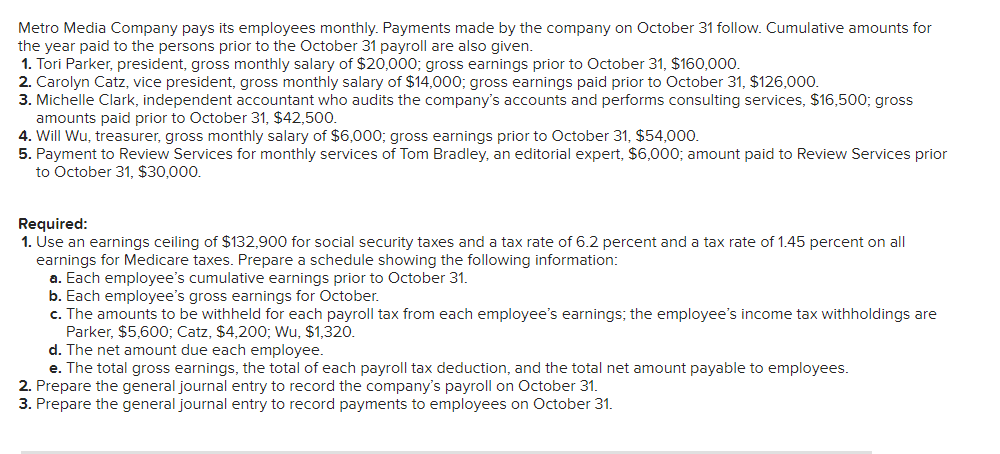

Metro Media Company pays its employees monthly. Payments made by the company on October 31 follow. Cumulative amounts for the year paid to the persons prior to the October 31 payroll are also given. 1. Tori Parker, president, gross monthly salary of $20,000; gross earnings prior to October 31, $160,000. 2. Carolyn Catz, vice president, gross monthly salary of $14,000; gross earnings paid prior to October 31, $126,000. 3. Michelle Clark, independent accountant who audits the company's accounts and performs consulting services, $16,500; gross amounts paid prior to October 31, $42,500. 4. Will Wu, treasurer, gross monthly salary of $6,000; gross earnings prior to October 31, $54,000. 5. Payment to Review Services for monthly services of Tom Bradley, an editorial expert, $6,000; amount paid to Review Services prior to October 31, $30,000. Required: 1. Use an earnings ceiling of $132,900 for social security taxes and a tax rate of 6.2 percent and a tax rate of 1.45 percent on all earnings for Medicare taxes. Prepare a schedule showing the following information: a. Each employee's cumulative earnings prior to October 31. b. Each employee's gross earnings for October. c. The amounts to be withheld for each payroll tax from each employee's earnings; the employee's income tax withholdings are Parker, $5,600; Catz, $4,200; Wu, $1,320. d. The net amount due each employee. e. The total gross earnings, the total of each payroll tax deduction, and the total net amount payable to employees. 2. Prepare the general journal entry to record the company's payroll on October 31. 3. Prepare the general journal entry to record payments to employees on October 31.

Metro Media Company pays its employees monthly. Payments made by the company on October 31 follow. Cumulative amounts for the year paid to the persons prior to the October 31 payroll are also given. 1. Tori Parker, president, gross monthly salary of $20,000; gross earnings prior to October 31, $160,000. 2. Carolyn Catz, vice president, gross monthly salary of $14,000; gross earnings paid prior to October 31, $126,000. 3. Michelle Clark, independent accountant who audits the company's accounts and performs consulting services, $16,500; gross amounts paid prior to October 31, $42,500. 4. Will Wu, treasurer, gross monthly salary of $6,000; gross earnings prior to October 31, $54,000. 5. Payment to Review Services for monthly services of Tom Bradley, an editorial expert, $6,000; amount paid to Review Services prior to October 31, $30,000. Required: 1. Use an earnings ceiling of $132,900 for social security taxes and a tax rate of 6.2 percent and a tax rate of 1.45 percent on all earnings for Medicare taxes. Prepare a schedule showing the following information: a. Each employee's cumulative earnings prior to October 31. b. Each employee's gross earnings for October. c. The amounts to be withheld for each payroll tax from each employee's earnings; the employee's income tax withholdings are Parker, $5,600; Catz, $4,200; Wu, $1,320. d. The net amount due each employee. e. The total gross earnings, the total of each payroll tax deduction, and the total net amount payable to employees. 2. Prepare the general journal entry to record the company's payroll on October 31. 3. Prepare the general journal entry to record payments to employees on October 31.

Chapter3: Social Security Taxes

Section: Chapter Questions

Problem 17PB

Related questions

Question

Transcribed Image Text:Metro Media Company pays its employees monthly. Payments made by the company on October 31 follow. Cumulative amounts for

the year paid to the persons prior to the October 31 payroll are also given.

1. Tori Parker, president, gross monthly salary of $20,000; gross earnings prior to October 31, $160,000.

2. Carolyn Catz, vice president, gross monthly salary of $14,000; gross earnings paid prior to October 31, $126,000.

3. Michelle Clark, independent accountant who audits the company's accounts and performs consulting services, $16,500; gross

amounts paid prior to October 31, $42,500.

4. Will Wu, treasurer, gross monthly salary of $6,000; gross earnings prior to October 31, $54,000.

5. Payment to Review Services for monthly services of Tom Bradley, an editorial expert, $6,000; amount paid to Review Services prior

to October 31, $30,000.

Required:

1. Use an earnings ceiling of $132,900 for social security taxes and a tax rate of 6.2 percent and a tax rate of 1.45 percent on allI

earnings for Medicare taxes. Prepare a schedule showing the following information:

a. Each employee's cumulative earnings prior to October 31.

b. Each employee's gross earnings for October.

c. The amounts to be withheld for each payroll tax from each employee's earnings; the employee's income tax withholdings are

Parker, $5,600; Catz, $4,200; Wu, $1,320.

d. The net amount due each employee.

e. The total gross earnings, the total of each payroll tax deduction, and the total net amount payable to employees.

2. Prepare the general journal entry to record the company's payroll on October 31.

3. Prepare the general journal entry to record payments to employees on October 31.

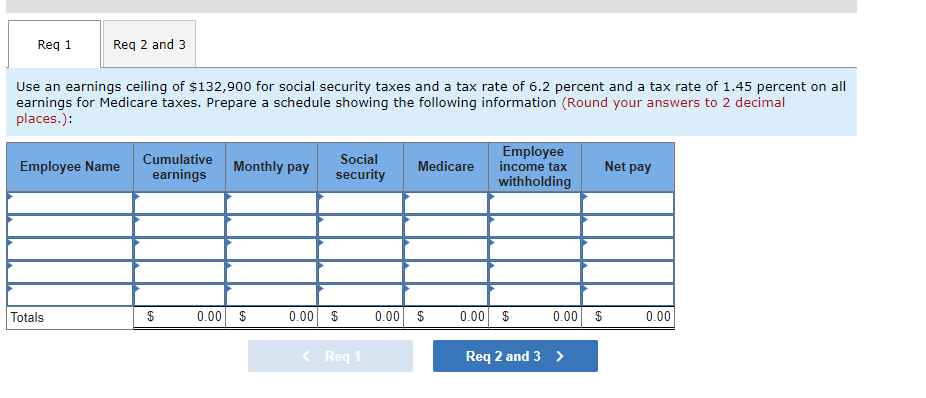

Transcribed Image Text:Req 1

Req 2 and 3

Use an earnings ceiling of $132,900 for social security taxes and a tax rate of 6.2 percent and a tax rate of 1.45 percent on all

earnings for Medicare taxes. Prepare a schedule showing the following information (Round your answers to 2 decimal

places.):

Employee

income tax

withholding

Cumulative

Social

Employee Name

Monthly pay

Medicare

Net pay

earnings

security

Totals

$

0.00 $

0.00 $

0.00 $

0.00 $

0.00 $

0.00

< Req 1

Req 2 and 3 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage