Vladimir Marsh has been employed by the Ace Distributing Company for the past three years. During the following amounts were credited to Ms. Marsh's payroll account, for the year 2021: Salary of $60,500 as per her employment contract. • Reimbursement of employment related travel costs as per invoices supplied by Ms. Marsh ● totalling $4,250. • Fees of $1,200 for serving as the employee's representative on the Company's board of directors. • Reimbursement of $1,100 in tuition fees for a work related course. • A $1,560 dividend on Ace Distributing Company shares acquired through the employee purchase program. • Fees of $1,200 for serving as the employee's representative on the Company's board of directors. Mr. Marsh also purchased shares from the company ABC Inc. All purchases were made in the year 2021. November 1st Purchase of 3000 shares for 8,75$ November 10th Purchase of 2500 shares for 8,90$ November 15th Purchase of 1250 shares at 9,25$

Vladimir Marsh has been employed by the Ace Distributing Company for the past three years. During the following amounts were credited to Ms. Marsh's payroll account, for the year 2021: Salary of $60,500 as per her employment contract. • Reimbursement of employment related travel costs as per invoices supplied by Ms. Marsh ● totalling $4,250. • Fees of $1,200 for serving as the employee's representative on the Company's board of directors. • Reimbursement of $1,100 in tuition fees for a work related course. • A $1,560 dividend on Ace Distributing Company shares acquired through the employee purchase program. • Fees of $1,200 for serving as the employee's representative on the Company's board of directors. Mr. Marsh also purchased shares from the company ABC Inc. All purchases were made in the year 2021. November 1st Purchase of 3000 shares for 8,75$ November 10th Purchase of 2500 shares for 8,90$ November 15th Purchase of 1250 shares at 9,25$

Chapter4: Income Tax Withholding

Section: Chapter Questions

Problem 5PB

Related questions

Question

Transcribed Image Text:2)

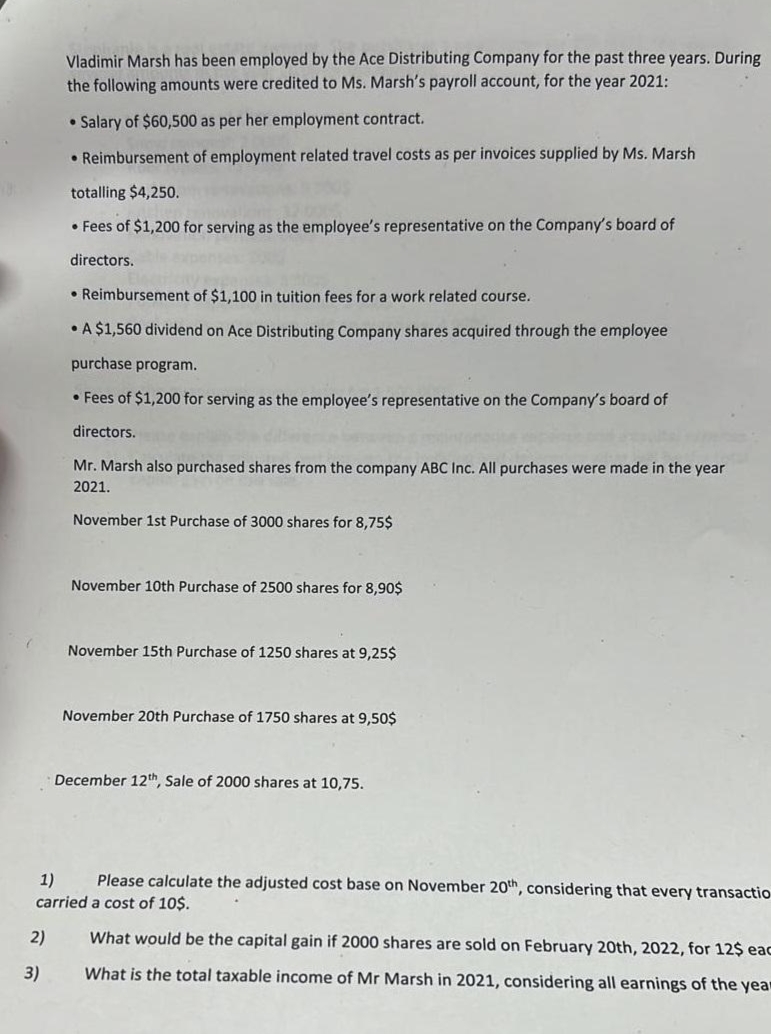

Vladimir Marsh has been employed by the Ace Distributing Company for the past three years. During

the following amounts were credited to Ms. Marsh's payroll account, for the year 2021:

• Salary of $60,500 as per her employment contract.

• Reimbursement of employment related travel costs as per invoices supplied by Ms. Marsh

totalling $4,250.

• Fees of $1,200 for serving as the employee's representative on the Company's board of

directors.

3)

• Reimbursement of $1,100 in tuition fees for a work related course.

• A $1,560 dividend on Ace Distributing Company shares acquired through the employee

purchase program.

• Fees of $1,200 for serving as the employee's representative on the Company's board of

directors.

Mr. Marsh also purchased shares from the company ABC Inc. All purchases were made in the year

2021.

November 1st Purchase of 3000 shares for 8,75$

November 10th Purchase of 2500 shares for 8,90$

November 15th Purchase of 1250 shares at 9,25$

November 20th Purchase of 1750 shares at 9,50$

1) Please calculate the adjusted cost base on November 20th, considering that every transactio

carried a cost of 10$.

What would be the capital gain if 2000 shares are sold on February 20th, 2022, for 12$ eac

What is the total taxable income of Mr Marsh in 2021, considering all earnings of the year

December 12th, Sale of 2000 shares at 10,75.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub