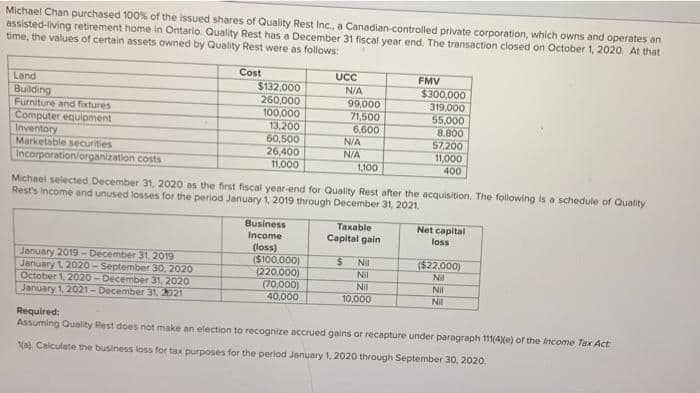

Michael Chan purchased 100% of the issued shares of Quality Rest Inc., a Canadian-controlled private corporation, which owns and operates an assisted-living retirement home in Ontario. Quality Rest has a December 31 fiscal year end. The transaction closed on October 1, 2020. At that time, the values of certain assets owned by Quality Rest were as follows: Cost Land Building Furniture and fixtures Computer equipment Inventory Marketable securities Incorporation/organization $132,000 260,000 100,000 January 2019-December 31, 2019 January 1, 2020-September 30, 2020 October 1, 2020-December 31, 2020 January 1, 2021-December 31, 2021 13,200 60,500 26,400 11,000 UCC N/A 99,000 71,500 6,600 Business Income (loss) ($100,000) (220.000) (70,000) 40,000 N/A N/A costs Michael selected December 31, 2020 as the first fiscal year-end for Quality Rest after the acquisition. The following is a schedule of Quality Rest's income and unused losses for the period January 1, 2019 through December 31, 2021. 1,100 Taxable Capital gain FMV $300,000 319,000 55,000 8,800 57,200 11,000 400 $ Nil Nil Nil 10,000 Net capital loss ($22,000) Nil Nil Nil Required: Assuming Quality Rest does not make an election to recognize accrued gains or recapture under paragraph 111(4)(e) of the Income Tax Act 1(a). Calculate the business loss for tax purposes for the period January 1, 2020 through September 30, 2020.

Michael Chan purchased 100% of the issued shares of Quality Rest Inc., a Canadian-controlled private corporation, which owns and operates an assisted-living retirement home in Ontario. Quality Rest has a December 31 fiscal year end. The transaction closed on October 1, 2020. At that time, the values of certain assets owned by Quality Rest were as follows: Cost Land Building Furniture and fixtures Computer equipment Inventory Marketable securities Incorporation/organization $132,000 260,000 100,000 January 2019-December 31, 2019 January 1, 2020-September 30, 2020 October 1, 2020-December 31, 2020 January 1, 2021-December 31, 2021 13,200 60,500 26,400 11,000 UCC N/A 99,000 71,500 6,600 Business Income (loss) ($100,000) (220.000) (70,000) 40,000 N/A N/A costs Michael selected December 31, 2020 as the first fiscal year-end for Quality Rest after the acquisition. The following is a schedule of Quality Rest's income and unused losses for the period January 1, 2019 through December 31, 2021. 1,100 Taxable Capital gain FMV $300,000 319,000 55,000 8,800 57,200 11,000 400 $ Nil Nil Nil 10,000 Net capital loss ($22,000) Nil Nil Nil Required: Assuming Quality Rest does not make an election to recognize accrued gains or recapture under paragraph 111(4)(e) of the Income Tax Act 1(a). Calculate the business loss for tax purposes for the period January 1, 2020 through September 30, 2020.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 8MC

Related questions

Question

Transcribed Image Text:Michael Chan purchased 100% of the issued shares of Quality Rest Inc., a Canadian-controlled private corporation, which owns and operates an

assisted-living retirement home in Ontario. Quality Rest has a December 31 fiscal year end. The transaction closed on October 1, 2020. At that

time, the values of certain assets owned by Quality Rest were as follows:

Cost

Land

Building

Furniture and fixtures

Computer equipment

Inventory

Marketable securities

Incorporation/organization

$132,000

260,000

100,000

January 2019-December 31, 2019

January 1, 2020-September 30, 2020

October 1, 2020-December 31, 2020

January 1, 2021-December 31, 2021

13,200

60,500

26,400

11,000

Business

Income

UCC

N/A

(loss)

($100,000)

(220,000)

(70,000)

40,000

99,000

71,500

6,600

costs

Michael selected December 31, 2020 as the first fiscal year-end for Quality Rest after the acquisition. The following is a schedule of Quality

Rest's income and unused losses for the period January 1, 2019 through December 31, 2021.

N/A

N/A

1,100

Taxable

Capital gain

$

FMV

$300,000

319,000

55,000

8,800

57,200

11,000

400

Nil

Nil

Nil

10,000

Net capital

loss

($22,000)

N

Nil

Nil

Required:

Assuming Quality Rest does not make an election to recognize accrued gains or recapture under paragraph 111(4)(e) of the Income Tax Act

1(a). Calculate the business loss for tax purposes for the period January 1, 2020 through September 30, 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning