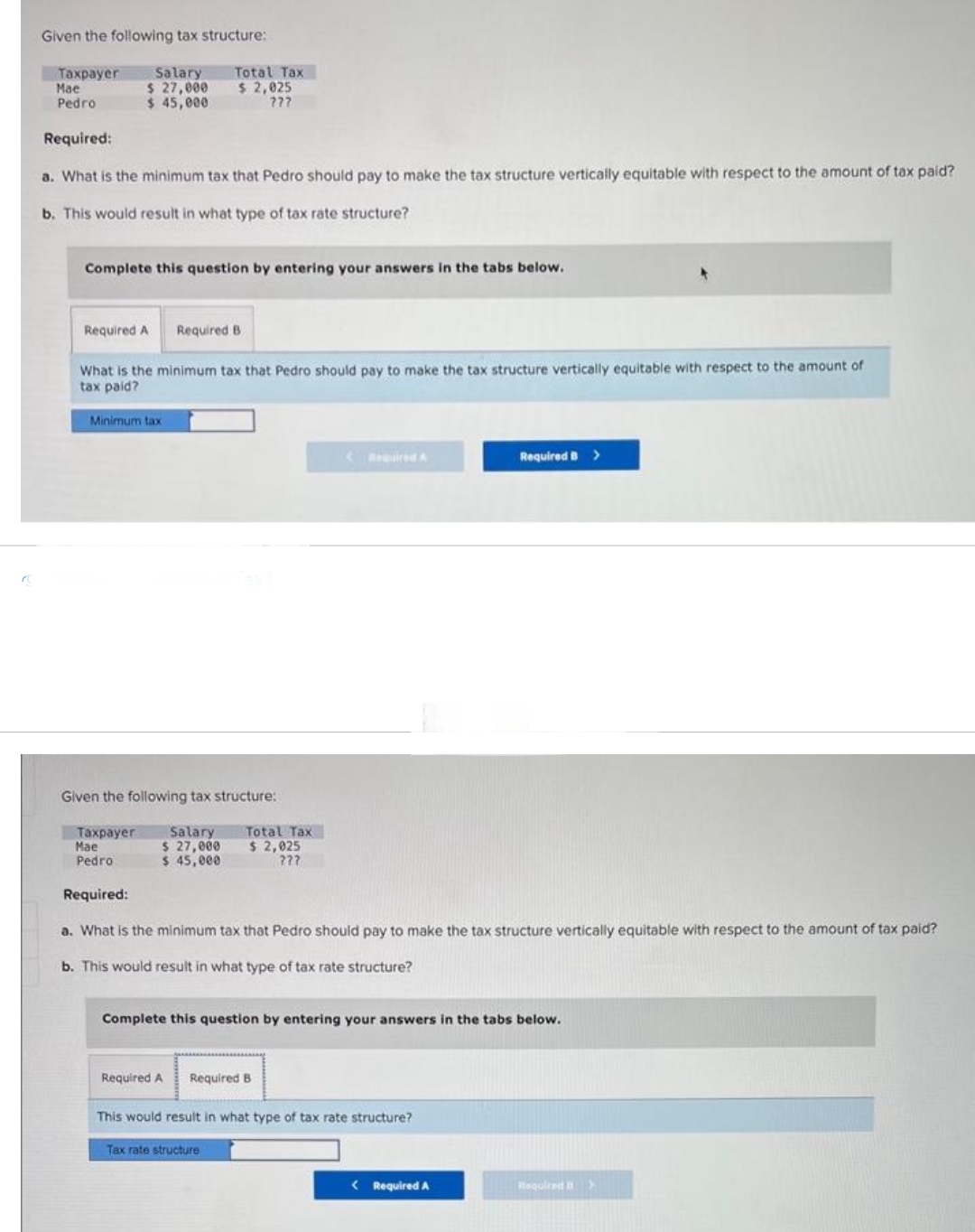

Given the following tax structure: Salary $ 27,000 $ 45,000 Taxpayer Mae Pedro Required: a. What is the minimum tax that Pedro should pay to make the tax structure vertically equitable with respect to the amount of tax paid? b. This would result in what type of tax rate structure? Complete this question by entering your answers in the tabs below. Required A Total Tax $ 2,025 777 Minimum tax Required B What is the minimum tax that Pedro should pay to make the tax structure vertically equitable with respect to the amount of tax paid? Given the following tax structure: Taxpayer Salary Mae $ 27,000 Pedro $ 45,000 Total Tax $ 2,025 ??? < Required A Required: a. What is the minimum tax that Pedro should pay to make the tax structure vertically equitable with respect to the amount of tax paid? b. This would result in what type of tax rate structure? Required A Required B Tax rate structure Complete this question by entering your answers in the tabs below. This would result in what type of tax rate structure? Required B >

Given the following tax structure: Salary $ 27,000 $ 45,000 Taxpayer Mae Pedro Required: a. What is the minimum tax that Pedro should pay to make the tax structure vertically equitable with respect to the amount of tax paid? b. This would result in what type of tax rate structure? Complete this question by entering your answers in the tabs below. Required A Total Tax $ 2,025 777 Minimum tax Required B What is the minimum tax that Pedro should pay to make the tax structure vertically equitable with respect to the amount of tax paid? Given the following tax structure: Taxpayer Salary Mae $ 27,000 Pedro $ 45,000 Total Tax $ 2,025 ??? < Required A Required: a. What is the minimum tax that Pedro should pay to make the tax structure vertically equitable with respect to the amount of tax paid? b. This would result in what type of tax rate structure? Required A Required B Tax rate structure Complete this question by entering your answers in the tabs below. This would result in what type of tax rate structure? Required B >

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter4: Gross Income

Section: Chapter Questions

Problem 14P

Related questions

Question

Ef.5.

Transcribed Image Text:Given the following tax structure:

Taxpayer

Mae

Salary

$ 27,000

Pedro

$ 45,000

Required:

a. What is the minimum tax that Pedro should pay to make the tax structure vertically equitable with respect to the amount of tax paid?

b. This would result in what type of tax rate structure?

Complete this question by entering your answers in the tabs below.

Required A

Total Tax

$ 2,025

???

Minimum tax

Required B

What is the minimum tax that Pedro should pay to make the tax structure vertically equitable with respect to the amount of

tax paid?

Given the following tax structure:

Taxpayer Salary

Mae

$ 27,000

Pedro

$ 45,000

Total Tax

$ 2,025

???

Required:

a. What is the minimum tax that Pedro should pay to make the tax structure vertically equitable with respect to the amount of tax paid?

b. This would result in what type of tax rate structure?

Complete this question by entering your answers in the tabs below.

Required A Required B

Tax rate structure

This would result in what type of tax rate structure?

Required B

< Required A

>

Required >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning