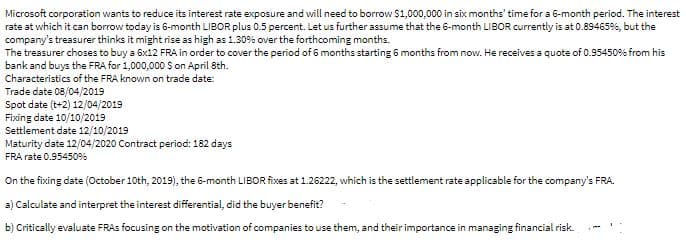

Microsoft corporation wants to reduce its interest rate exposure and will need to borrow $1,000,000 in six months' time for a 6-month period. The interest rate at which it can borrow today is 6-month LIBOR plus 0.5 percent. Let us further assume that the 6-month LIBOR currently is at 0.89465%, but the company's treasurer thinks it might rise as high as 1.30% over the forthcoming months. The treasurer choses to buy a 6x12 FRA in order to cover the period of 6 months starting 6 months from now. He receives a quote of 0.954509% from his bank and buys the FRA for 1,000,000 S on April 8th. Characteristics of the FRA known on trade date: Trade date 08/04/2019 Spot date (t+2) 12/04/2019 Fixing date 10/10/2019 Settlement date 12/10/2019 Maturity date 12/04/2020 Contract period: 182 days FRA rate 0.95450% On the fixing date (October 10th, 2019), the 6-month LIBOR fixes at 1.26222, which is the settlement rate applicable for the company's FRA. a) Calculate and interpret the interest differential, did the buyer benefit? b) Critically evaluate FRAS focusing on the motivation of companies to use them, and their importance in managing financial risk.

Microsoft corporation wants to reduce its interest rate exposure and will need to borrow $1,000,000 in six months' time for a 6-month period. The interest rate at which it can borrow today is 6-month LIBOR plus 0.5 percent. Let us further assume that the 6-month LIBOR currently is at 0.89465%, but the company's treasurer thinks it might rise as high as 1.30% over the forthcoming months. The treasurer choses to buy a 6x12 FRA in order to cover the period of 6 months starting 6 months from now. He receives a quote of 0.954509% from his bank and buys the FRA for 1,000,000 S on April 8th. Characteristics of the FRA known on trade date: Trade date 08/04/2019 Spot date (t+2) 12/04/2019 Fixing date 10/10/2019 Settlement date 12/10/2019 Maturity date 12/04/2020 Contract period: 182 days FRA rate 0.95450% On the fixing date (October 10th, 2019), the 6-month LIBOR fixes at 1.26222, which is the settlement rate applicable for the company's FRA. a) Calculate and interpret the interest differential, did the buyer benefit? b) Critically evaluate FRAS focusing on the motivation of companies to use them, and their importance in managing financial risk.

Chapter16: Working Capital Policy And Short-term Financing

Section: Chapter Questions

Problem 24P

Related questions

Question

Transcribed Image Text:Microsoft corporation wants to reduce its interest rate exposure and will need to borrow $1,000,000 in six months' time for a 6-month period. The interest

rate at which it can borrow today is 6-month LIBOR plus 0.5 percent. Let us further assume that the 6-month LIBOR currently is at 0.89465%, but the

company's treasurer thinks it might rise as high as 1.30% over the forthcoming months.

The treasurer choses to buy a 6x12 FRA in order to cover the period of 6 months starting 6 months from now. He receives a quote of 0.954509% from his

bank and buys the FRA for 1,000,000 S on April 8th.

Characteristics of the FRA known on trade date:

Trade date 08/04/2019

Spot date (t+2) 12/04/2019

Fixing date 10/10/2019

Settlement date 12/10/2019

Maturity date 12/04/2020 Contract period: 182 days

FRA rate 0.95450%

On the fixing date (October 10th, 2019), the 6-month LIBOR fixes at 1.26222, which is the settlement rate applicable for the company's FRA.

a) Calculate and interpret the interest differential, did the buyer benefit?

b) Critically evaluate FRAS focusing on the motivation of companies to use them, and their importance in managing financial risk.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning