MLX has annual sales of $320 million per year and has calculated the collection float to be 12 days. If MLX is currently paying 9.35% on its line of credit, what amount of interest expense could be saved if the collection float is reduced by 3 days? (Assume 365 days per year.)

Q: Zycad has sales of $110 million a year. If Zycad reduces their processing float by 3 days, what is…

A: The computation of increase in firm’s average cash balance is as follows:

Q: The firm's average accounts receivable balance is P2.5 million, and they are financed by a bank loan…

A: In the given question, the annual savings in interest cost will be compared with the annual cost of…

Q: If $4,000 is invested at 7% compounded annually. How long will it take for it to grow to $6,000,…

A: To solve the question, we need to use the concept of time value of money. According to the concept…

Q: Parramore Corp has $12 million of sales, $1 million of inventories, $4 million of receivables, and…

A: The cash conversion cycle is a measure of estimating the time period for a corporation in which the…

Q: A firm has annual operating outlays of P1,800,000 and a cash conversion cycle of 60 days. If the…

A: Cash Conversion Cycle: The cash conversion cycle (CCC) is a statistic that represents the amount of…

Q: Calculate the cash conversion cycle. Round your answer to the nearest whole number. days…

A: Information Provided: COGS = $144,000 (60% of sales) Inventory Turnover = 30x Accounts Receivable =…

Q: Harrelson Inc. currently has $750,000 in accounts receivable, and its days sales outstanding (DSO)…

A: In finance, the term sales represent gross earnings generated before deducting any expense by a…

Q: 4. Sovereign-Tea Company projected to make even monthly cash payments of P150,000 during the year.…

A: Total relevant cost = Holding cost +Transaction cost Formula for Holding cost= k(C/2) and formula…

Q: Dome Metals has credit sales of $288,000 yearly with credit terms of net 120 days, which is also the…

A: The net income is the income that is received after deducting all the cost and expense from the…

Q: Beautinator Cosmetics borrowed $152,300 from a bank for three years. If the quoted rate (APR) is…

A: Answer: Calculation of the effective annual rate (EAR): Formula of effective annual rate: EAR = (1+…

Q: s, which were 1% on the old sakes, would amount to 2% only on incremental sales. Variable Cost is…

A: Given data, Sales =P2,000,000 Days sales outstanding = 2 weeks New sales =50% increase Bad debts =2%…

Q: ACE Design has daily sales of $52,000. The financial management team has determined that a lockbox…

A: By reducing collection time by 2.9 days, the cash balance will be increased by = daily sales x…

Q: Sexy Inc. makes use of the lockbox system, what would be the net benefit to the company? Use 365…

A: Given, Fixed Fee = P 50,000 Interest Rate = 6%

Q: Twelve years ago, the Archer Corporation borrowed $6,850,000. Since then, cumulative inflation has…

A: Inflation reduces the purchasing power of the money. Dollar today will be less than one dollar after…

Q: If real gets a cash infusion of P1 million each time it needs cash, what are the total costs per…

A: As per Bartleby guidelines, in case of multi-part questions, we are only allowed to answer the first…

Q: Fourteen years ago, the U.S. Aluminum Corporation borrowed $6.5 million. Since then, cumulative…

A: a) Computation of effective purchasing power:

Q: Sparkling Water Ltd, expects to sell 8 million bottles of drinking water each year in perpetuity.…

A: Worth of a company refers to the value of the business. To assess the worth of a company, different…

Q: With a margin of 120 million of a base year that grows at 10%, some commissions collected of 205…

A: Calculate the margin in the following year (Margin T+1) by multiplying the margin in the base year…

Q: orp. currently has sales P2,000,000, and its days sales outstanding is 2 weeks. The financial…

A: Given data, Sales =P2,000,000 Days sales outstanding = 2 weeks New sales =50% increase Bad debts =2%…

Q: Dome Metals has credit sales of $450,000 yearly with credit terms of net 45 days, which is also the…

A: Decrease in accounts receivable = Average accounts receivable without discount- Average accounts…

Q: Enticement Co currently expects sales of $50,000 a month. Variable costs of sales are $40,000 a…

A: In the purview of the question, we are required to compute the increase in accounts receivable,…

Q: Parramore Corp has $17 million of sales, $3 million of inventories, $2.25 million of receivables,…

A: Step 1: “Since you have posted a question with multiple sub-parts, we will solve first three…

Q: Pedro Corp. currently has sales of P2,000,000, and its days sales outstanding is 2 week. The…

A: Given data, Sales =P2,000,000 Days sales outstanding = 2 weeks New sales =50% increase Bad debts…

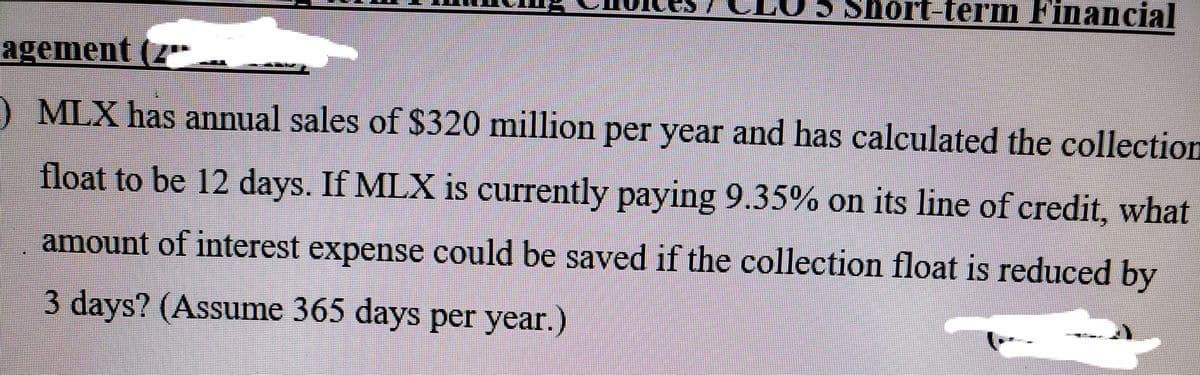

Q: MLX has annual sales of $320 million per year and has calculated the collection float to be 12 days.…

A: INTEREST EXPENSE SAVED : = (ANNUAL SALES / 365 DAYS) X REDUCED DAYS X RATE ANNUAL SALES =…

Q: angel co. has P500,000 in receivable that carries a 30-day credit term, 2% factor’s fee, 5% holdback…

A: Factoring is a system or arrangement in which the company sells its accounts receivables to a…

Q: Parramore Corp has $18 million of sales, $2 million of inventories, $3.5 million of receivables, and…

A: Since you have asked a question with multiple parts, we will solve the first 3 parts as per policy.…

Q: What is the maximum level of accounts receivable that ALei can carry and have a 35-day average…

A: Answer a: Average collection period = Accounts receivableAnnual credit…

Q: Every 15 days a company receives P10,000 worth of raw materials from its suppliers. The credit terms…

A: It is given that Price of Raw material – P 10,000 Frequency – every 15 days Discount – 2%, if paid…

Q: The management of XYZ Co has annual credit sales of $20 million and accounts receivable of $4…

A: Answer: Collection Period = Accounts Receivable/Credit Sales × 365 days Put the values in the…

Q: Eaglet Company has a 12 percent opportunity cost of funds and currently sells on terms of net/10,…

A: Total amount to be received from the customer after 60 days on term net/10 is as follows: Resultant…

Q: A corporation has $344 million in sales,$232 million in COGS, $53 million in inventory, $128 million…

A: Cash conversion cycle = [Average inventoryCost of goods sold + Average receivablesNet sales-Average…

Q: Berry Manufacturing turns over its inventory 8 times each year, has an Average Payment Period of 35…

A: Cash conversion cycle is defined as the metric, which helps in expressing the time when they used to…

Q: Dome Metals has credit sales of $450,000 yearly with credit terms of net 45 days, which is also the…

A: Credit management is considered to be important part. Discount are offered in order to receive…

Q: Harrelson Inc. currently has $750,000 in accounts receivable, and its days sales outstanding (DSO)…

A: Given the following information: Accounts receivable: $750,000 Days sales outstanding (DSO): 55…

Q: A firm has daily cash receipts of P100,000. A bank has offered to reduce the collection time on the…

A: Daily cash receipts = P 100000 Reduction in collection time (n) = 3 days Monthly fee = P 500 r = 5%

Q: Sol Manoloto Company has a sales of P110 million a year. If Sol Manoloto Company reduces its…

A: We’ll answer the first question since the exact one wasn’t specified. Please submit a new question…

Q: The company has sales of $ 10 million per year, all of which are from credit terms that require…

A: The average number of days that is taken by the company to recover its sales payment or its accounts…

Q: Dome Metals has credit sales of $162,000 yearly with credit terms of net 30 days, which is also the…

A: Firm often make strategies to collect account receivables outstanding balance at an early point of…

Q: Parramore Corp has $10 million of sales, $2 million of inventories, $4 million of receivables, and…

A: Ratio analysis: This is the quantitative analysis of financial statements of a business enterprise.…

Q: Every 15 days a company receives P10,000 worth of raw materials from its suppliers. The credit terms…

A: Number of raw materials worth P 10000 received in a year = 360/15 = 24 2/15, net 30 credit terms…

Q: A product has sales of $7M this year, but sales are expected to decline at 10% per year until it is…

A: The present value is the value of the sum received at time 0 or the current period. It is the value…

Q: TEME is a manufacturer of toy construction equipment. If it pays out all of its earnings as…

A: Value of the company=Earnings Expected rate of return

Q: MLX has annual sales of $320 million per year and has calculated the collect float to be 12 days. If…

A: Collection float means that the amount deposited by customer but that is not available for use. So…

Q: Amed Corp has annual sales of $400,000 and an average collection period of 38 days. • A factoring…

A: A Factoring Loan: A factoring loan is a loan in which accounts receivable are used as security or…

Q: If a firm has sales of $21,764,000 a year, and the average collection period for the industry is 55…

A: Average collection period basically tells us about the average number of days between the day credit…

Step by step

Solved in 2 steps

- Effective Cost of Short-Term Credit Yonge Corporation must arrange financing for its working capital requirements for the coming year. Yonge can: (a) borrow from its bank on a simple interest basis (interest payable at the end of the loan) for 1 year at a 12% nominal rate; (b) borrow on a 3-month, but renewable on rate with 12 end-of-month payments; or (d) obtain the needed funds by no longer taking discounts and thus increasing its accounts payable. Yonge buys on terms of 1/15, net 60. What is the effective annual cost (not the nominal cost) of the least expensive type of credit, assuming 360 days per year?Strickler Technology is considering changes in its working capital policies to improve its cash flow cycle. Stricklers sales last year were 3,250,000 (all on credit), and its net profit margin was 7%. Its inventory turnover was 6.0 times during the year, and its DSO was 41 days. Its annual cost of goods sold was 1,800,000. The firm had fixed assets totaling 535,000. Stricklers payables deferral period is 45 days. a. Calculate Stricklers cash conversion cycle. b. Assuming Strickler holds negligible amounts of cash and marketable securities, calculate its total assets turnover and ROA. c. Suppose Stricklers managers believe the annual inventory turnover can be raised to 9 times without affecting sale or profit margins. What would Stricklers cash conversion cycle, total assets turnover, and ROA have been if the inventory turnover had been 9 for the year?Relaxing Collection Efforts The Boyd Corporation has annual credit sales of 1.6 million. Current expenses for the collection department are 35,000, bad-debt losses are 1.5%, and the days sales outstanding is 30 days. The firm is considering easing its collection efforts such that collection expenses will be reduced to 22,000 per year. The change is expected to increase bad-debt losses to 2.5% and to increase the days sales outstanding to 45 days. In addition, sales are expected to increase to 1,625,000 per year. Should the firm relax collection efforts if the opportunity cost of funds is 16%, the variable cost ratio is 75%, and taxes are 40%?

- MLX has annual sales of $320 million per year and has calculated the collection float to be 12 days. If MLX is currently paying 9.35% on its line of credit, what amount of interest expense could be saved if the collection float is reduced by 3 days? (Assume 365 days per year.)Wontaby Ltd. is extending its credit terms from 45 to 60 days. Sales are expected to increase from $4.75 million to $5.85 million as a result. Wontaby finances short - term assets at the bank at a cost of 12 percent annually. Calculate the additional annual financing cost of this change in credit terms. (Use 365 days in a year. Do not round intermediate calculations. Round the final answer to the nearest whole dollar. Enter answer in whole dollar not in million.) Annual financing costNProblem A DEF has total forecasted gross purchases of P4,500,000 relating to a major supplier for the coming year. The supplier is offering a credit term of 3/15, n/45. How much is the simple annual effective cost of paying on the 45th day? Problem B ABC can take a 45-day loan with a 15% interest deducted in advance, to be reapplied each time. How much is the simple annual cost of the loan? Problem C ABC’s bank offered a loan with conditions of a P5,000,000 face amount, 6-month term, 4% interest deducted in advance and bank charge of P30,000. How much is the compounded annual effective cost of the bank loan?

- Income from sales of certain hardened steel connectors was P400,000 in the first quarter, P410,000 in the second, and amounts increasing by 10,000 per quarter through year 4. What is the equivalent uniform amount per quarter if the interest rate is 12% per year compounded quarterly? Please show the solution. Solutions in excel are acceptable.Kirk Development buys on terms of 2/15, net 60 days. It does not take discounts, and it typically pays on time, 60 days after the invoice date. Net purchases amount to $750,000 per year. On average, what is the dollar amount of total trade credit (costly + free) the firm receives during the year, i.e., what are its average accounts payable? (Assume a 365-day year, and note that purchases are net of discounts.)Effective Cost of Trade Credit The D.J. Masson Corporation needs to raise $600,000 for 1 year to supply working capital to a new store. Masson buys from its suppliers on terms of 2/10, net 70, and it currently pays on the 10th day and takes discounts. However, it could forgo the discounts, pay on the 70th day, and thereby obtain the needed $600,000 in the form of costly trade credit. What is the effective annual interest rate of this trade credit? Assume a 365-day year. Do not round intermediate calculations. Round your answer to two decimal places. Cost of Bank loan Mary Jones recently obtained an equipment loan from a local bank. The loan is for $22,000 with a nominal interest rate of 14%. However, this is an installment loan, so the bank also charges add-on interest. Mary must make monthly payments on the loan, and the loan is to be repaid in 1 year. What is the effective annual rate on the loan (assuming a 365-day year)? Do not round intermediate calculations. Round your answer…

- Effective Cost of Trade Credit The D.J. Masson Corporation needs to raise $800,000 for 1 year to supply working capital to a new store. Masson buys from its suppliers on terms of 3/10, net 85, and it currently pays on the 10th day and takes discounts. However, it could forgo the discounts, pay on the 85th day, and thereby obtain the needed $800,000 in the form of costly trade credit. What is the effective annual interest rate of this trade credit? Assume a 365-day year. Do not round intermediate calculations. Round your answer to two decimal places. %A. DEF has total forecasted gross purchases of P4,500,000 relating to a major supplier for the coming year. The supplier is offering a credit term of 3/15, n/45. How much is the simple annual effective cost of paying on the 45th day? B. ABC can take a 45-day loan with a 15% interest deducted in advance, to be reapplied each time. How much is the simple annual cost of the loan? C. ABC’s bank offered a loan with conditions of a P5,000,000 face amount, 6-month term, 4% interest deducted in advance and bank charge of P30,000. How much is the compounded annual effective cost of the bank loan?HAPPY Company makes credit sales of P1,800,000 annually. The average age of accounts receivable is 30 days. Management consider shortening credit terms to 20 days. Cost of money is 12%. How much will the company save from financing charges? Use 360-day year MY ANSWER IS 6,000 AND 12,000. WHAT IS THE CORRECT ANSWER?