Miguel and his wife are married and file taxes jointly. Together, they make $96,300 annually. What is their effective tax rate? 8.3% 15.8% 11.5% 22%

Miguel and his wife are married and file taxes jointly. Together, they make $96,300 annually. What is their effective tax rate? 8.3% 15.8% 11.5% 22%

Chapter9: Deductions: Employee And Self-employed-related Expenses

Section: Chapter Questions

Problem 1DQ

Related questions

Question

Sh6

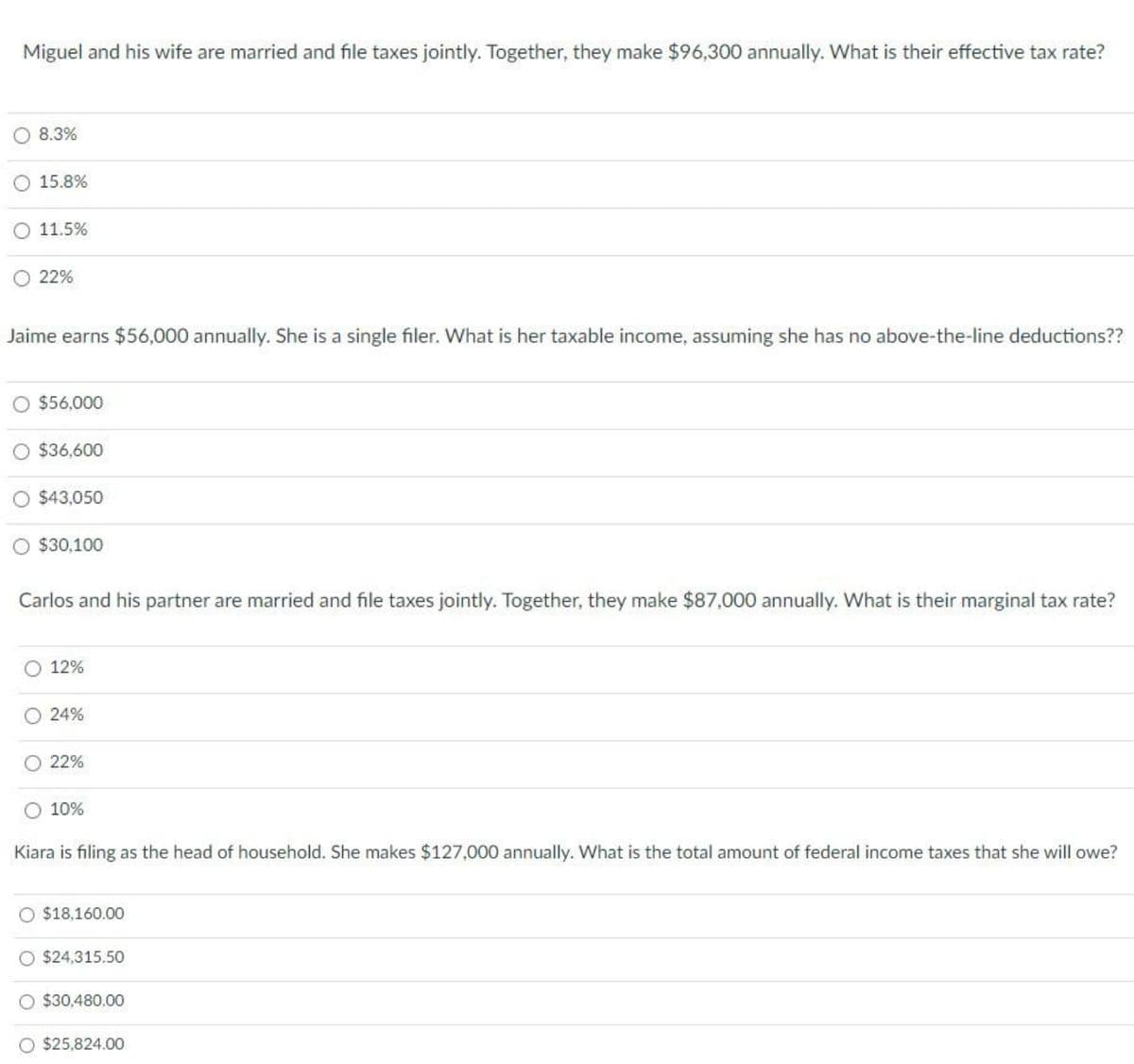

Transcribed Image Text:Miguel and his wife are married and file taxes jointly. Together, they make $96,300 annually. What is their effective tax rate?

O 8.3%

15.8%

11.5%

22%

Jaime earns $56,000 annually. She is a single filer. What is her taxable income, assuming she has no above-the-line deductions??

$56,000

$36,600

$43,050

$30,100

Carlos and his partner are married and file taxes jointly. Together, they make $87,000 annually. What is their marginal tax rate?

12%

24%

O 22%

10%

Kiara is filing as the head of household. She makes $127,000 annually. What is the total amount of federal income taxes that she will owe?

O $18,160.00

O $24,315.50

O $30,480.00

O $25,824.00

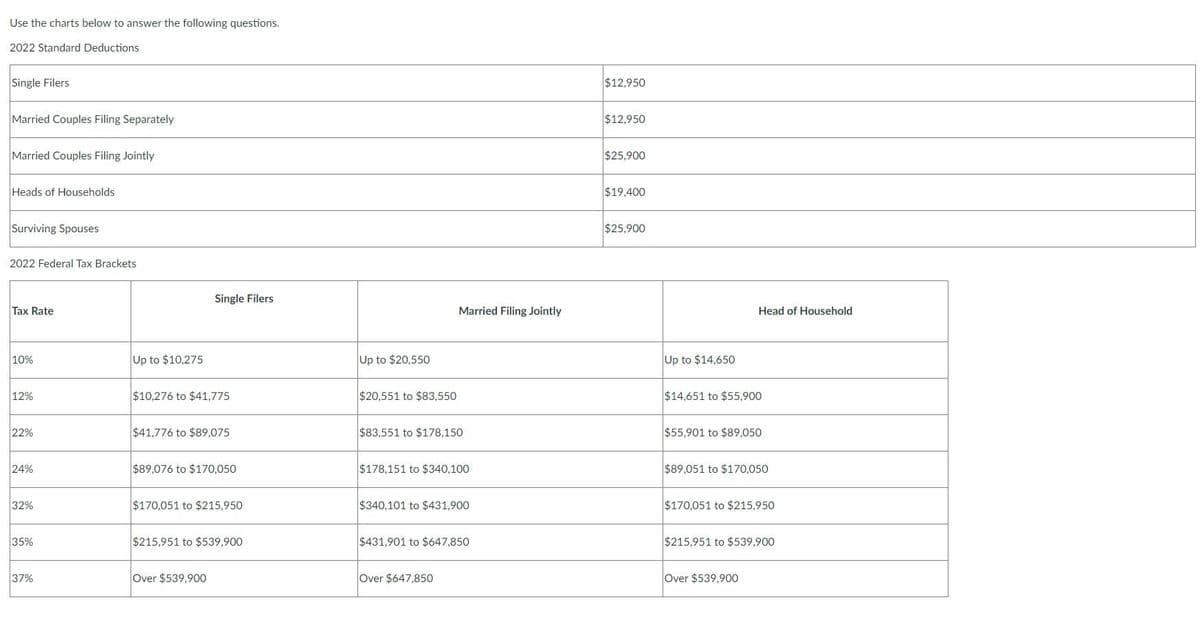

Transcribed Image Text:Use the charts below to answer the following questions.

2022

Single Filers

Married Couples Filing Separately

Married Couples Filing Jointly

Heads of Households

Surviving Spouses

2022 Federal Tax Brackets

Standard Deductions

Tax Rate

10%

12%

22%

24%

32%

35%

37%

Up to $10,275

Single Filers

$10,276 to $41,775

$41,776 to $89,075

$89,076 to $170,050

$170,051 to $215,950

$215,951 to $539,900

Over $539,900

Up to $20,550

$20,551 to $83,550

Married Filing Jointly

$83,551 to $178,150

$178,151 to $340,100

$340,101 to $431,900

$431,901 to $647,850

Over $647,850

$12,950

$12,950

$25,900

$19,400

$25,900

Up to $14,650

Head of Household

$14,651 to $55,900

$55,901 to $89,050

$89,051 to $170,050

$170,051 to $215,950

$215,951 to $539,900

Over $539,900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning