Miguel Company reported a retained earnings balance of P4,000,000 at January 1, 2021. In August 2021, Miguel Company determine that insurance premiums of P900,000 for the three-year period beginning January 1, 2020, had been paid and fully expensed in 2019. The income tax rate is 30%. What should be reported as corrected retained earnings on January 1, 2021?

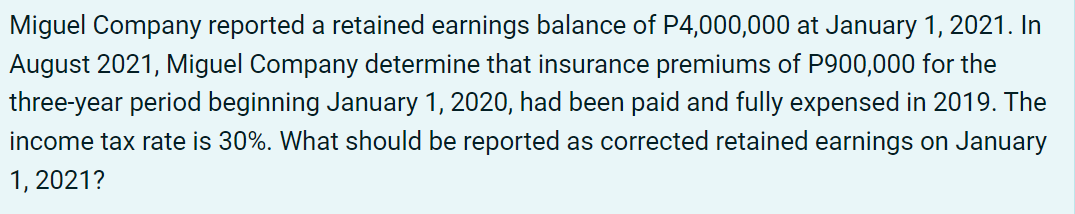

Miguel Company reported a retained earnings balance of P4,000,000 at January 1, 2021. In August 2021, Miguel Company determine that insurance premiums of P900,000 for the three-year period beginning January 1, 2020, had been paid and fully expensed in 2019. The income tax rate is 30%. What should be reported as corrected retained earnings on January 1, 2021?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 9MC: Brooks Company reported a prior period adjustment of 512,000 in pretax financial "income" and...

Related questions

Question

Pls give solutions for both questions thank you so much

Transcribed Image Text:Miguel Company reported a retained earnings balance of P4,000,000 at January 1, 2021. In

August 2021, Miguel Company determine that insurance premiums of P900,000 for the

three-year period beginning January 1, 2020, had been paid and fully expensed in 2019. The

income tax rate is 30%. What should be reported as corrected retained earnings on January

1, 2021?

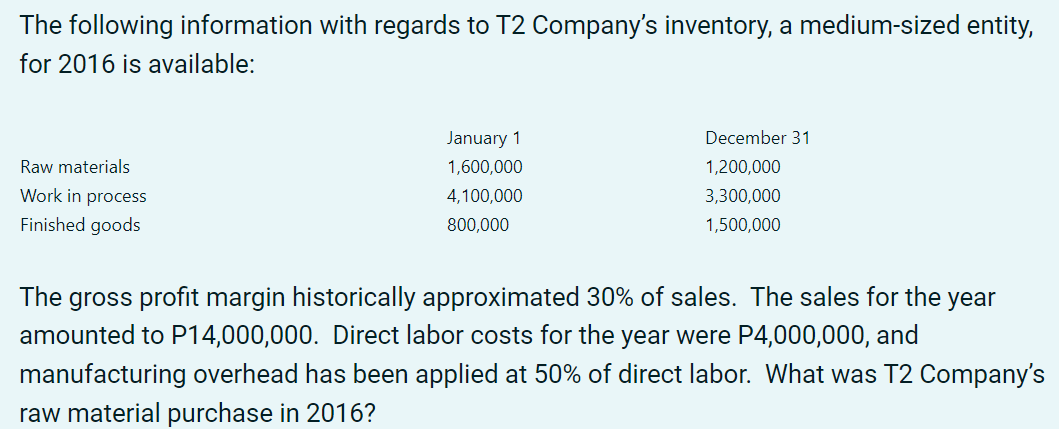

Transcribed Image Text:The following information with regards to T2 Company's inventory, a medium-sized entity,

for 2016 is available:

January 1

December 31

Raw materials

1,600,000

1,200,000

Work in process

4,100,000

3,300,000

Finished goods

800,000

1,500,000

The gross profit margin historically approximated 30% of sales. The sales for the year

amounted to P14,000,000. Direct labor costs for the year were P4,000,000, and

manufacturing overhead has been applied at 50% of direct labor. What was T2 Company's

raw material purchase in 2016?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT