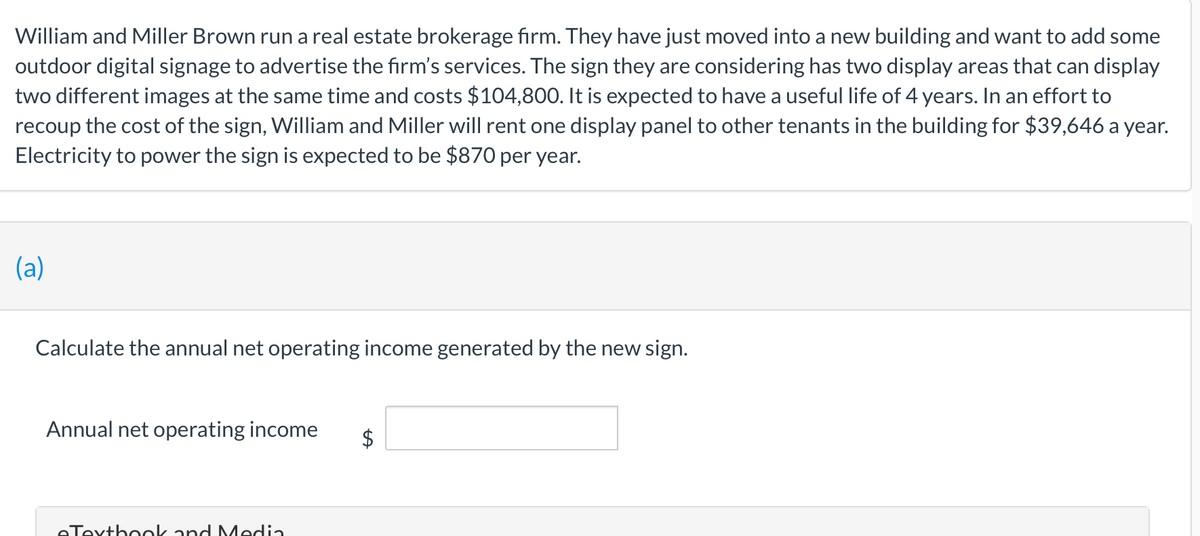

William and Miller Brown run a real estate brokerage firm. They have just moved into a new building and want to add some outdoor digital signage to advertise the firm's services. The sign they are considering has two display areas that can display two different images at the same time and costs $104,800. It is expected to have a useful life of 4 years. In an effort to recoup the cost of the sign, William and Miller will rent one display panel to other tenants in the building for $39,646 a year. Electricity to power the sign is expected to be $870 per year.

William and Miller Brown run a real estate brokerage firm. They have just moved into a new building and want to add some outdoor digital signage to advertise the firm's services. The sign they are considering has two display areas that can display two different images at the same time and costs $104,800. It is expected to have a useful life of 4 years. In an effort to recoup the cost of the sign, William and Miller will rent one display panel to other tenants in the building for $39,646 a year. Electricity to power the sign is expected to be $870 per year.

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter26: Capital Budgeting (capbud)

Section: Chapter Questions

Problem 5R

Related questions

Question

Transcribed Image Text:William and Miller Brown run a real estate brokerage firm. They have just moved into a new building and want to add some

outdoor digital signage to advertise the firm's services. The sign they are considering has two display areas that can display

two different images at the same time and costs $104,800. It is expected to have a useful life of 4 years. In an effort to

recoup the cost of the sign, William and Miller will rent one display panel to other tenants in the building for $39,646 a year.

Electricity to power the sign is expected to be $870 per year.

(a)

Calculate the annual net operating income generated by the new sign.

Annual net operating income

2$

eTextbook and Media

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College