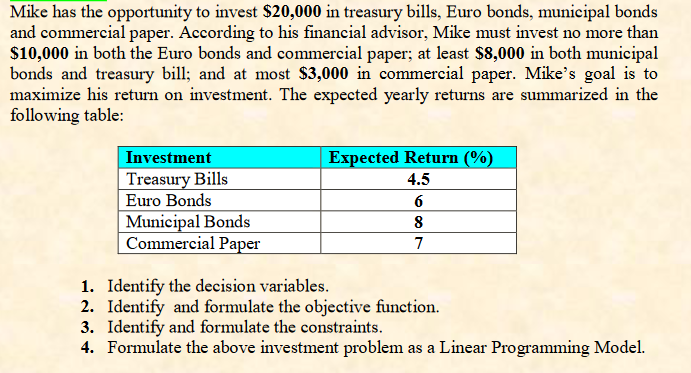

Mike has the opportunity to invest $20,000 in treasury bills, Euro bonds, municipal bonds and commercial paper. According to his financial advisor, Mike must invest no more than $10,000 in both the Euro bonds and commercial paper; at least $8,000 in both municipal bonds and treasury bill; and at most $3,000 in commercial paper. Mike's goal is to maximize his return on investment. The expected yearly returns are summarized in the following table: Investment Treasury Bills Euro Bonds Municipal Bonds Commercial Paper Expected Return (%) 4.5 6 8 7 1. Identify the decision variables. 2. Identify and formulate the objective function. 3. Identify and formulate the constraints. 4. Formulate the above investment problem as a Linear Programming Model.

Mike has the opportunity to invest $20,000 in treasury bills, Euro bonds, municipal bonds and commercial paper. According to his financial advisor, Mike must invest no more than $10,000 in both the Euro bonds and commercial paper; at least $8,000 in both municipal bonds and treasury bill; and at most $3,000 in commercial paper. Mike's goal is to maximize his return on investment. The expected yearly returns are summarized in the following table: Investment Treasury Bills Euro Bonds Municipal Bonds Commercial Paper Expected Return (%) 4.5 6 8 7 1. Identify the decision variables. 2. Identify and formulate the objective function. 3. Identify and formulate the constraints. 4. Formulate the above investment problem as a Linear Programming Model.

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter11: Simulation Models

Section11.4: Marketing Models

Problem 30P: Seas Beginning sells clothing by mail order. An important question is when to strike a customer from...

Related questions

Question

Transcribed Image Text:Mike has the opportunity to invest $20,000 in treasury bills, Euro bonds, municipal bonds

and commercial paper. According to his financial advisor, Mike must invest no more than

$10,000 in both the Euro bonds and commercial paper; at least $8,000 in both municipal

bonds and treasury bill; and at most $3,000 in commercial paper. Mike's goal is to

maximize his return on investment. The expected yearly returns are summarized in the

following table:

Investment

Treasury Bills

Euro Bonds

Municipal Bonds

Commercial Paper

Expected Return (%)

4.5

6

8

7

1.

Identify the decision variables.

2. Identify and formulate the objective function.

3. Identify and formulate the constraints.

4. Formulate the above investment problem as a Linear Programming Model.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 6 images

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,